Immediate bankruptcy prevention but potential decline in debt stability and creditworthiness

Investment restrictions and impaired asset soundness may hinder economic recovery

Bleak outlook for corporate defaults... S&P "Long-term increase in failing companies possible"

[Asia Economy Reporter Jeong Hyunjin] The increase in 'zombie' companies raises concerns because it structurally hinders the recovery of the economy, which has been stagnant due to the COVID-19 pandemic. Although it may seem that corporate bankruptcies are not significantly increasing at the moment, in the long term, it can deteriorate the stability of debt and creditworthiness, thereby worsening the asset soundness of financial markets.

Companies already burdened with heavy debt at the economic trough cannot embark on new investments, and if the economy worsens further, problems caused by debt may also emerge. Ultimately, in a declining economic curve, scenarios such as an L-shaped recovery or further decline are likely to carry more weight than a V-shaped rebound.

Zombie companies also make it difficult to distinguish the wheat from the chaff among businesses. Zombies are neither alive nor dead, meaning the boundary between corporate survival and failure has become ambiguous. According to Bloomberg on the 16th, Claudio Borio, Head of the Monetary and Economic Department at the Bank for International Settlements (BIS), said, "The real problem is that in a situation of increased uncertainty, it is not easy to distinguish between companies that can survive independently and those that cannot," adding, "Ultra-loose monetary and fiscal policies help prevent liquidity shortages for companies but entail bearing long-term risks."

The problem is that investment activities by companies that could aid economic recovery are being constrained. Generally, when the economy enters a recovery phase, companies tend to increase debt to expand investments, but this formula has collapsed due to the COVID-19 crisis. Companies increased debt to an unsustainable level to survive during the economic downturn. This has already resulted in a state of 'Debt overhang.' In such a situation, increasing debt further for investment only adds to the burden.

Monica Ericsson, head of investment-grade corporate teams at DoubleLine Capital, evaluated, "To earn returns, one must endure too long a period or credit risk," calling it "a very unsatisfactory market for investment."

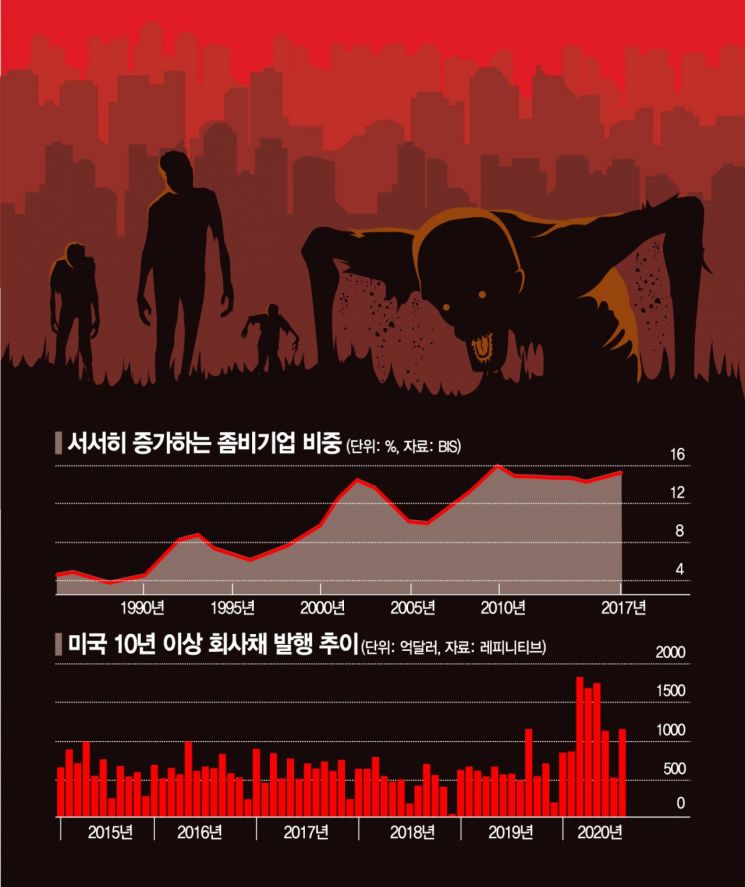

In addition to new bonds issued by zombie companies, cases of refinancing by extending maturities without repaying existing debt are also increasing. According to Refinitiv, the amount of bonds issued for refinancing purposes in the U.S. bond market this year has already exceeded $250 billion (approximately 295.1 trillion KRW), doubling compared to the same period last year. Many of these bonds have maturities of 20 to 30 years, with some extending up to 40 years. Although ultra-low interest rates are expected to continue for several years, meaning immediate debt costs will not increase, it implies that companies are increasingly operating with borrowed funds over longer periods.

Another concern is that once zombie companies are created, recovery is difficult. According to a recent BIS report analyzing economic data from 14 advanced economies including the U.S., Japan, and China, the proportion of zombie companies, which was about 4% of all companies in the 1980s, increased to 15% by 2017. Among zombie companies, 60% recovered to become normal companies again, but most showed poor performance and were highly likely to revert to zombie status.

There are growing forecasts that corporate defaults will sharply increase starting next year. Credit rating agency S&P projected that the speculative-grade default rate will rise from 5.4% in June this year to 12.5% by June next year. Under the worst-case scenario, assuming the reimplementation of social distancing measures due to a resurgence of COVID-19, this rate could rise to 15.5%. S&P explained, "Additional monetary and fiscal policies may reduce defaults in the short term, but as corporate revenues decline and debt burdens increase, more defaults could be generated over the long term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.