Scheduled Interest Rate Cut Implemented as Low Interest Rates Worsen Profitability

[Asia Economy Reporter Oh Hyung-gil] Major life insurance companies are forecasting premium increases next month, leading to the emergence of 'sell-out marketing' that halts sales at the business sites.

Although this is due to deteriorating profitability amid historically low base interest rates, there are concerns that it could lead to poor performance in a household economy weakened by the impact of the novel coronavirus infection (COVID-19).

According to the insurance industry on the 14th, starting with Samsung Life Insurance, some life insurers plan to lower the assumed interest rates for interest rate-linked products from next month. Samsung Life announced in a conference call last month that it would reduce the assumed interest rate by about 0.25 percentage points for some interest rate-linked products starting next month. This is an additional measure following the 0.25 percentage point cut in the assumed interest rate for whole life insurance products in April.

Kyobo Life Insurance also announced that the assumed interest rate will change from 2.25% to 2% starting next month. Hanwha Life Insurance has also lowered the assumed interest rate once again in July following the change in April.

As the 'Big 3' life insurers implement assumed interest rate cuts, small and medium-sized insurers are also expected to follow suit. Mirae Asset Life Insurance is reportedly planning to lower the assumed interest rate for some whole life insurance products from 2.4% to 2.25%, a 0.15 percentage point reduction, starting next month.

The assumed interest rate refers to the expected rate of return that an insurer can earn from managing the premiums received from customers until the payment of insurance benefits and refunds.

It serves as the basis for calculating the premiums customers must pay. When the expected rate of return decreases, insurers raise premiums for products with the same coverage conditions. Typically, a 0.25 percentage point decrease in the assumed interest rate results in a premium increase of about 5 to 10%.

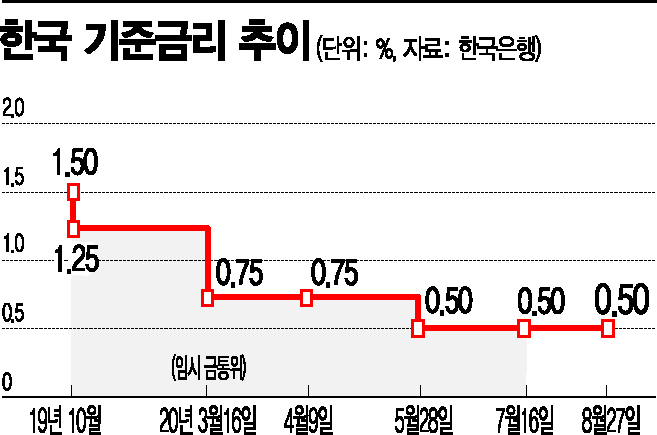

The reason life insurers have lowered the assumed interest rate twice this year can be found in the prolonged low interest rate environment.

Although loss ratios have improved due to the impact of COVID-19, the profitability of insurers, which mainly invest in bonds under low interest rates, is worsening. According to the Life Insurance Association, the return on assets for life insurers, which was 4% in 2015, has fallen to 3.47% in the first half of this year.

In particular, with the suspension of sales of non-surrender whole life insurance approaching, there are concerns that sell-out marketing for life insurance products will intensify this month. Starting next month, an amendment to the Insurance Business Supervisory Regulations will be implemented, requiring the surrender value of non-surrender or low-surrender refund-type insurance to be lowered to within the refund rate of standard insurance.

The financial authorities plan to continuously monitor sell-out marketing before the implementation of the Insurance Business Supervisory Regulations and actively respond to signs of incomplete sales or excessive competition. A life insurance company official advised, "Considering the prolonged low interest rate trend, we have no choice but to respond inevitably through lowering the assumed interest rate," adding, "When purchasing insurance, one should carefully decide based on their own purpose of subscription rather than whether sales are halted."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.