Financial Sector on Edge Over High Interest Rates and Benefits

30,000 New Sign-ups in First Month Then Stagnation

3% Promotion Also Ended

[Asia Economy Reporter Kim Min-young] “Big tech companies like Naver and Kakao, which possess data on tens of millions of users and have fully established internet platforms, entering the financial industry could pose a crisis unlike anything we've seen before.” (Chairman of Financial Group A)

“Even though fair competition is not enough, there are issues of fairness due to discriminatory regulations between the financial sector and big tech. It will be a battle against giant platforms, and there is a lot of concern about how to respond.” (President of Bank B)

The rumors were frightening. On June 8, when Naver officially entered the financial market, the financial sector feared that all customers would be taken away by the giant platform. Considering the power of large platforms used multiple times daily by the majority of the population, there was a judgment that the financial market landscape could change instantly. Also, unlike large financial companies bound by various regulations, big tech companies have largely avoided these regulations, which further heightened the sense of crisis. But was it just a noisy start? As Naver Bank Account marks its 100th day since launch on the 15th, its performance appears to be weaker than expected. Even major financial group chairmen were tense about the first financial sector penetration by the ‘dinosaur’ Naver, but it is now being evaluated as a ‘storm in a teacup.’

Naver Bank Account Expected to Reach 700,000 Subscribers by Year-End

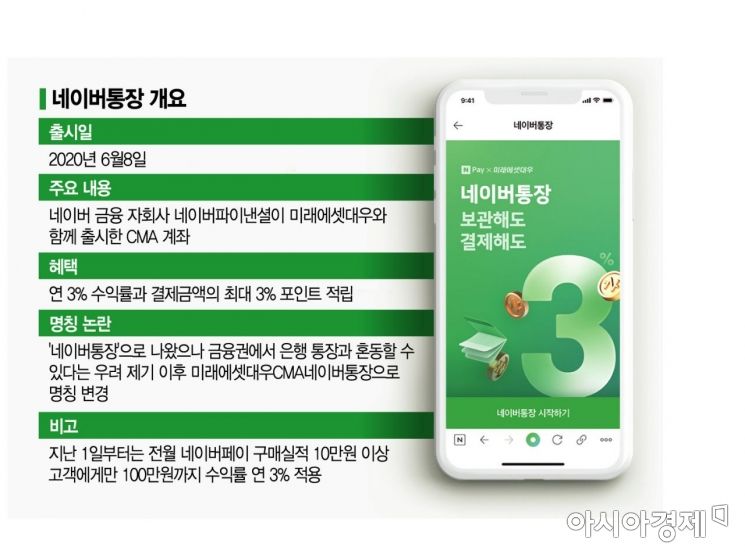

According to the financial sector on the 9th, Naver Financial, Naver’s financial subsidiary, partnered with Mirae Asset Daewoo to launch the ‘Naver Bank Account,’ which has about 400,000 accounts opened in the first two months. In the first month (June 8 to July 3), 270,000 accounts were acquired, but in the second month of July, only about 130,000 additional accounts were added. The promotion offering 3% interest without conditions ended this month, so the increase in subscribers is expected to decline further. The financial sector forecasts that the number of Naver Bank Account subscribers will reach 700,000 by the end of this year.

The Naver Bank Account is a comprehensive asset management account (CMA) product jointly offered by Naver Financial and Mirae Asset Daewoo. It attracted attention by offering an annual 3% yield and up to 9 percentage points in rewards linked to Naver’s shopping and Pay services. Due to its integration with the Naver platform, there was concern in the financial sector that customers could defect not only from banks but also from securities and card companies.

However, the industry evaluates that the Naver Financial’s first ambitious financial product has underperformed. In comparison, Kakao Pay Securities’ account, launched last February, surpassed 500,000 accounts within about a month and exceeded 1 million subscribers by its 100th day.

Controversy Over Naming and Deposit Protection

The slowdown in the popularity of the Naver Bank Account is interpreted as partly due to resistance from the financial sector, especially commercial banks. When the Naver Bank Account was launched, the banking sector questioned whether it was appropriate to use the name of a giant IT company, Naver, together with the term ‘bank account’ for a CMA account that is not protected by deposit insurance. Financial sector insiders reportedly conveyed these opinions not only publicly but also behind the scenes to financial authorities.

One financial sector official said, “At the beginning of the launch, financial consumers confused the Naver Bank Account with a bank account, but after observing this controversy, they realized it was a CMA product without deposit protection.”

Eventually, Naver Financial changed the name of the Naver Bank Account to ‘Mirae Asset Daewoo CMA Naver Bank Account.’ When searching for the Naver Bank Account online, the account name now includes ‘Repurchase Agreement (RP) type’ at the end, clearly indicating that the Naver Bank Account is a financial investment product.

There are also criticisms that the product’s appeal has diminished due to many additional conditions after the promotion. Starting this month, to receive a 3% yield on up to 1 million KRW, the previous month’s Naver Pay payment amount must be at least 100,000 KRW; if this performance is not met, the interest rate drops to only 1%. Even if conditions are met, 3% is paid only on balances up to 1 million KRW, 1% on 1 million to 10 million KRW, and 0.35% on amounts exceeding 10 million KRW, which is not much different from bank deposit interest rates, making it difficult to attract subscribers.

Naver’s Financial Moves: Next Steps Are Loans and Insurance

Nevertheless, the financial sector remains vigilant about Naver’s financial sector advances. After launching the account, Naver Financial registered the ‘NF Insurance Service’ corporation on June 22, which operates as an insurance agency (GA), and plans to introduce small business loans and postpaid payment services within the fourth quarter of this year. Mirae Asset Capital will handle the loan service, while Naver Financial will conduct loan screening. The core is its proprietary Alternative Credit Scoring System (ACSS), which is expected to play a role in mediating loans to businesses that find it difficult to obtain loans from existing financial institutions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.