Meritz Fire & Marine Insurance, KB Insurance, NongHyup Insurance

Contract Termination for Failing to Fulfill Disclosure Obligations

Only Paid Actual Medical Expenses, Withheld Hospitalization Fees

[Asia Economy Reporter Oh Hyung-gil] Financial authorities have imposed institutional warnings and fines on Meritz Fire & Marine Insurance, KB Insurance, and NH Nonghyup Insurance for unjustly reducing or withholding insurance payouts.

They either canceled contracts citing customers' failure to fulfill notification obligations or paid only actual medical expense insurance benefits while withholding daily hospitalization allowances or diagnosis fees.

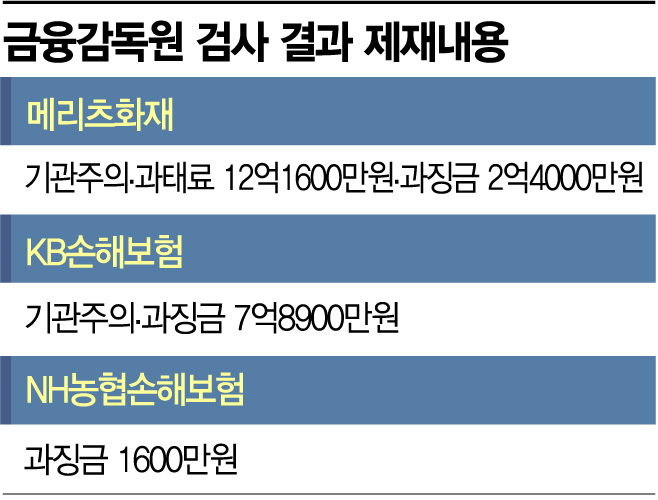

According to the financial authorities on the 7th, the Financial Supervisory Service (FSS) notified Meritz Fire & Marine Insurance of a disciplinary plan imposing an institutional warning, a fine of 1.216 billion KRW, and a penalty surcharge of 240 million KRW, totaling 1.456 billion KRW, following a comprehensive inspection. Additionally, seven related executives received disciplinary actions including reprimands (2 persons), warnings (2 persons), and cautionary warnings (3 persons).

Meritz Fire & Marine Insurance was selected as the first casualty insurance company subject to the FSS's comprehensive inspection, which was reinstated after more than four years, and underwent inspection from May to July last year.

The comprehensive inspection revealed that from 2013 to 2019, Meritz Fire & Marine Insurance unjustly reduced or withheld insurance payouts amounting to 686 million KRW on a total of 811 insurance contracts, contrary to the provisions stipulated in the insurance terms and conditions.

They canceled insurance contracts citing violations of notification obligations before or after the contract, or unjustly reduced insurance payouts despite no causal relationship with past medical history. When covering actual medical expenses, they partially paid the insured's share of medical costs after industrial accident processing or paid for cataract surgery on only one eye instead of both eyes twice.

They also failed to pay compensation for depreciation in vehicle value caused by car accidents. If repair costs for a car less than two years old exceed 20% of the vehicle's value immediately before the accident, 10-15% of the repair costs must be paid as compensation for depreciation in vehicle value.

KB Insurance was also found to have reduced or withheld insurance payouts amounting to 945 million KRW on 4,509 insurance contracts from 2016 to 2018. They paid only actual medical expense insurance benefits stipulated in the insurance terms and conditions, but did not pay fixed insurance benefits such as daily hospitalization allowances for illness or injury and fracture diagnosis fees. The FSS imposed an institutional warning and a penalty surcharge of 789 million KRW on KB Insurance. One related executive received a reprimand.

NH Nonghyup Insurance also received a penalty surcharge of 16 million KRW. It was found that from 2016 to 2018, NH Nonghyup Insurance reduced or withheld insurance payouts amounting to 130 million KRW on 117 insurance contracts.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.