Investigation of 73 Building Transactions Over 100 Billion KRW in Seoul Since Moon Administration

Total Market Price 19.0132 Trillion KRW vs Official Land Price 7.3454 Trillion KRW

Kyung Sil Ryun: "Government's Announced Market Price Reflection Rate Falls Short at 67%"

[Asia Economy Reporter Onyu Lim] An analysis has been raised that the publicly announced land prices of buildings traded for over 100 billion won in Seoul since President Moon Jae-in's inauguration amount to only 40% of the market price. This figure falls short by more than 25% compared to the government's announced market price reflection rate for publicly announced land prices. The Citizens' Coalition for Economic Justice (CCEJ) argued, "Due to distorted publicly announced land prices, conglomerates and large corporations receive enormous holding tax benefits, exacerbating tax inequality between building and apartment owners, thus normalization of publicly announced land prices is necessary."

"Publicly Announced Land Prices of 100 Billion Won Buildings in Seoul at 40% of Market Price...Significantly Below Government Announcement"

On the 1st, CCEJ announced that after investigating 73 transactions of buildings over 100 billion won in Seoul from 2017 to the first half of this year, the average market price reflection rate of publicly announced land prices was about 40%. The total combined land market price was 19.0132 trillion won, while the combined publicly announced land price was 7.3454 trillion won.

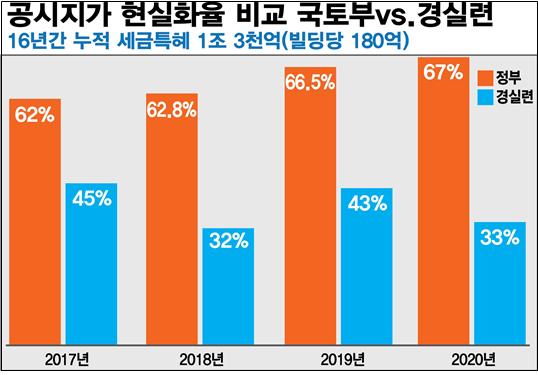

The lowest market price reflection rate was recorded in 2018, with an average of only 32%. It slightly increased to 43% in 2019, but with the recent surge in real estate prices, the realization rate for nine buildings traded this year dropped again to 33%. There has never been a year when the publicly announced land price market price reflection rate exceeded 50%.

CCEJ claims that this figure is significantly lower than the market price reflection rate disclosed by the government. The government previously announced that the average market price reflection rate of publicly announced land prices was 65.5%, with commercial and office land market price reflection rates at 66.5% in 2019 and 67% this year.

A CCEJ official pointed out, "The government said it would realize publicly announced prices to recover unearned income from real estate and stabilize housing for ordinary citizens, but the annually announced publicly announced land prices fail to keep pace with soaring land prices," adding, "Due to the excessively low publicly announced land prices, building owners such as conglomerates and large corporations are enjoying tax benefits."

"Annual Holding Tax Benefits of 81.5 Billion Won from 73 High-Value Buildings...Discrimination Compared to Apartment Holding Taxes"

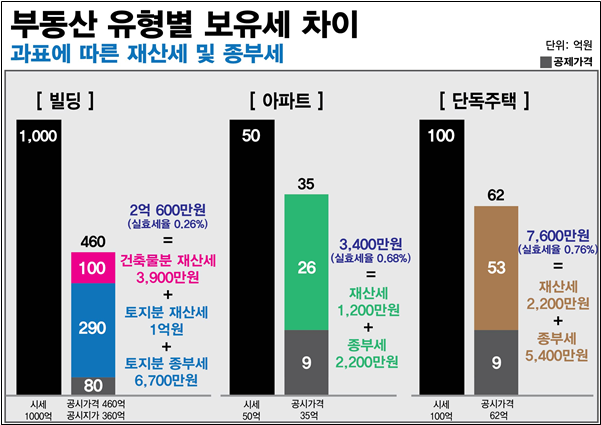

CCEJ revealed that due to unfair publicly announced land prices, conglomerates and wealthy real estate owners are expected to receive a total annual holding tax benefit of 81.5 billion won, averaging over 1.1 billion won per building, from 73 high-value buildings.

When taxes are levied based on publicly announced land prices, the total annual holding tax for the 73 buildings amounts to 45 billion won (effective tax rate 0.23%). If taxes were levied according to market prices as in the U.S. and other countries, holding taxes would increase threefold to 126.6 billion won (effective tax rate 0.65%). Applying CCEJ's proposal of 80% of market price would raise holding taxes to 99.7 billion won (effective tax rate 0.51%), a 2.2-fold increase and an additional 54.7 billion won in tax revenue compared to the current amount.

For example, the Samsung SDS Tower located in Songpa-gu was traded for 658 billion won in 2019. The land price excluding the building value (standard market price) was 546.8 billion won. The total publicly announced land price in 2019 was 183.6 billion won, with a market price reflection rate of 33.6%. The land portion holding tax (property tax + comprehensive real estate holding tax) based on publicly announced land prices in 2019 was about 1.2 billion won. A CCEJ official stated, "If the market price reflection rate were applied at 80%, the holding tax would increase to 3 billion won, an 1.8 billion won increase. If 100% of the market price were reflected, the tax would be 3.8 billion won, with a tax difference of 2.6 billion won."

CCEJ demanded normalization of publicly announced land prices for building and commercial land. A CCEJ official said, "The tax deduction standard for building and commercial land is 8 billion won, which is higher than that for housing (900 million won)," adding, "Building values are not even subject to comprehensive real estate holding tax, and applying the fair market value ratio further lowers the tax base compared to market prices."

They also argued that the discriminatory tax standards compared to apartment owners should be improved. A CCEJ official said, "Tax inequality between apartment owners who have been paying taxes based on 70% of market prices and wealthy real estate owners paying taxes at 30-40% of market prices can only worsen," adding, "Strengthening holding taxes should focus not only on raising comprehensive real estate holding tax limited to housing but also on alleviating inequality, realizing fair taxation, and achieving economic justice."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.