If it is judged that the data was submitted knowing the possibility of illegality, prosecution will be reported

If it is difficult to confirm awareness of violation but the matter is serious, investigative agencies will be notified

[Asia Economy Reporter Moon Chae-seok]

#1. Lee Hae-jin, Global Investment Officer (GIO) of Naver (NAVER), was reported to the prosecution on February 16 for violating the Fair Trade Act by omitting 20 affiliates, including his affiliate Line Friends, his own company Jium, and a relative's company Hwaeum, when submitting data for designation as a mutual investment restriction business group in 2015 to the Fair Trade Commission (FTC). About a month later, on March 13, the prosecution dismissed the charges against GIO Lee. At that time, the FTC stated, "This case serves as a reminder that submitting false data before the designation of a public disclosure business group can also be strictly sanctioned depending on the degree of violation," urging companies to improve the accuracy of submitted data.

#2. Kim Beom-su, Chairman of Kakao, was prosecuted and tried for submitting designation data with five omitted affiliates during the 2016 mutual investment restriction business group designation, but was acquitted in all three trials. The court judged that "it is difficult to see that Chairman Kim knew of or intentionally allowed the submission of false data by the staff." The FTC explained that "while Kakao only omitted companies owned by affiliate executives, Naver omitted affiliates directly owned by the same person, GIO Lee, and his relatives," making it difficult to equate the two cases.

#3. On May 19, the FTC's Corporate Group Division uncovered allegations of false submissions of designation data by Hite Jinro, SK, Hyosung, and Taekwang. When designating large business groups with total assets exceeding 5 trillion won every May, the FTC judged that some of the pre-submitted data were false and launched an investigation. Hite Jinro was found to have failed to report affiliates owned by relatives of Chairman Park Moon-duk, SK and Hyosung had false or omitted parts in the designation data submission process, and Taekwang was found to have submitted false data related to nominee stock holdings by former Chairman Lee Ho-jin.

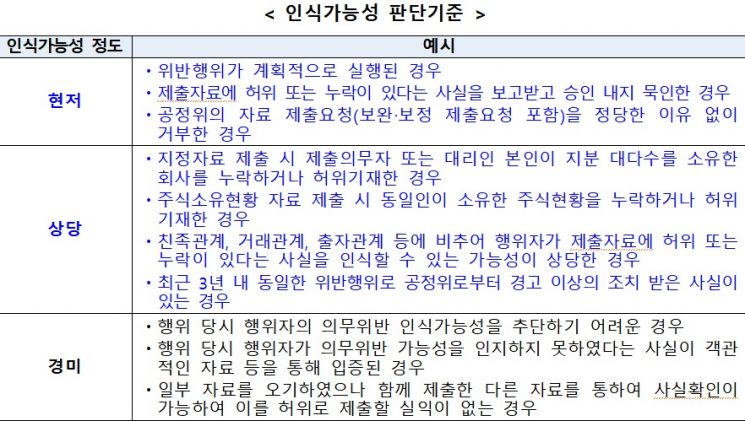

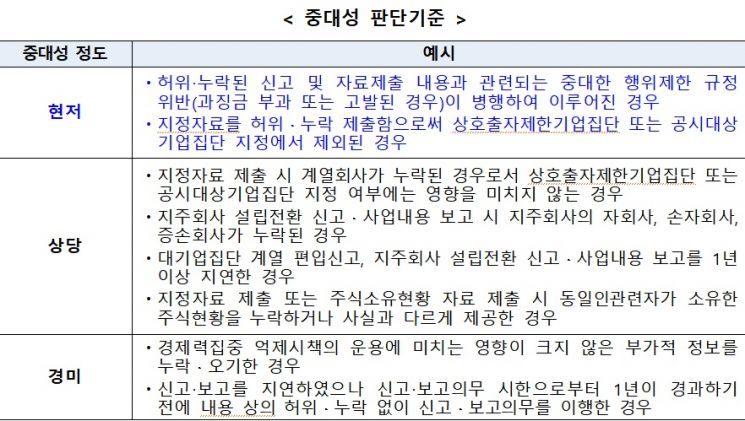

The FTC announced on the 7th that it has established clear criteria for reporting to the prosecution regarding suspected violations of reporting and data submission obligations by business groups. Starting from the 8th, it plans to enact and implement the "Guidelines for Prosecution of Violations of Reporting and Data Submission Obligations Related to Business Groups." It explained that it will decide whether to report to the prosecution by classifying the "recognizability" and "seriousness" of violations into three levels: significant, considerable, and minor.

◆If the likelihood of prior knowledge of violation is 'significantly' high, report to prosecution

The core of the prosecution guidelines is the message that there is justification to report to the prosecution if a company knowingly conceals a violation. This means that violations such as submitting false designation data, violations of reporting on holding company establishment/conversion and business content, and reporting violations of stock ownership status of business groups, if knowingly concealed and detected, will be subject to criminal punishment.

According to the guidelines, cases for prosecution include ▲both recognizability and seriousness being significantly high (high) ▲recognizability being considerably high (medium) and seriousness being significant (high) ▲both recognizability and seriousness being considerably high (medium). However, if recognizability and seriousness are considerably high, the decision to prosecute will consider factors such as voluntary reporting and whether the company belongs to a large business group.

The FTC stated that it will consider the recognizability as "significantly high (high)" and immediately report to the prosecution in cases such as ▲planned execution of the violation ▲being informed and approving or tacitly allowing false or omitted data in submitted materials ▲unjustifiably refusing the FTC's request for data submission (including requests for supplementary or corrected submissions).

Even if recognizability is "considerably high (medium)," if the violation is serious, the FTC will report to the prosecution. Cases where recognizability is "considerably high" include ▲the submitter or agent submitting designation data omitting or falsely stating companies in which they own the majority of shares ▲omitting or falsely stating stock ownership status of shares owned by the same person ▲considerable possibility that the actor recognized false or omitted data based on kinship, transaction, or investment relationships ▲having received warnings or higher sanctions from the FTC for the same violation within the past three years.

◆Even if it is difficult to confirm awareness of violation, notify investigative agencies

The FTC clearly stated that even if it is difficult to confirm whether a company knew of the violation, it can notify investigative agencies if the violation is serious.

This means that cases similar to the court ruling on Kakao Chairman Kim, where some errors existed but submitting false data was deemed pointless, will not be immediately reported to the prosecution.

Specifically, cases such as ▲difficulty in inferring the actor's awareness of the violation at the time of the act ▲objective evidence proving the actor did not recognize the possibility of violation at the time ▲some data errors but fact verification possible through other submitted materials, making false submission pointless, will result in warnings or notification to investigative agencies.

Separately from establishing prosecution guidelines, the FTC plans to prepare effective monitoring measures for violations of reporting and data submission obligations by companies. For example, it is considering introducing a reward system for reporting disguised affiliates.

Sung Kyung-je, Director of the Corporate Group Policy Division at the FTC, said, "Through the establishment of these prosecution guidelines, we will secure consistency in law enforcement against procedural violations by business groups and increase predictability for compliant companies," adding, "It is expected to raise awareness among business groups about intentional false reporting and data submission, effectively preventing and improving legal violations."

Director Sung added, "The FTC will continue to monitor violations of reporting and data submission obligations related to business groups," and "We will also implement institutional improvements such as introducing rewards for reporting disguised affiliates to effectively monitor violations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.