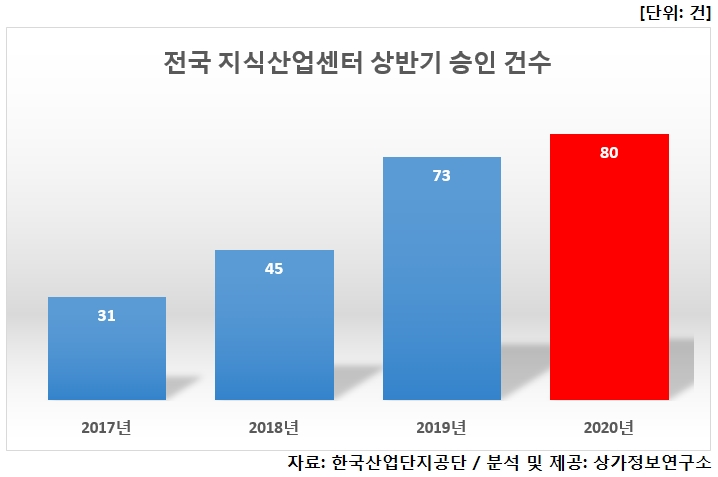

31 Cases in 2017 → 80 Cases This Year

Increased Interest in Income-Generating Real Estate as Residential Property Regulations Tighten

However, Some Unsold Properties Appear Due to Economic Downturn from COVID-19 and Others

[Asia Economy Reporter Onyu Lim] The number of new and modified approvals for knowledge industry centers (formerly apartment-style factories) in the first half of this year reached an all-time high. As residential real estate regulations tighten, interest in income-generating real estate such as knowledge industry centers is growing. However, caution is needed as some areas are experiencing unsold units due to the domestic economic downturn caused by COVID-19.

According to an analysis by the Commercial Information Research Institute of data from the Korea Industrial Complex Corporation on the 2nd, the total number of knowledge industry centers newly established or modified approved by local governments in the first half of this year was 80, the highest since 1970. The number of approvals in the first half of previous years were ▲2017 (31 cases) ▲2018 (45 cases) ▲2019 (73 cases). Accordingly, the total construction area of knowledge industry centers this year is expected to reach 3,592,583㎡.

The region with the most knowledge industry center approvals nationwide was Gyeonggi-do, with a total of 45 approvals. This was followed by ▲Seoul (13 cases) ▲Incheon (10 cases) ▲Chungbuk (3 cases). It was found that 85% of all knowledge industry center approvals in the first half were concentrated in the metropolitan area.

Researcher Hyuntaek Cho of the Commercial Information Research Institute said, “Knowledge industry centers attract high interest due to small investment amounts, relatively flexible loan environments, and tax reduction benefits, but some centers have poor sales performance due to oversupply. Moreover, with the recent spread of COVID-19 and the ongoing domestic economic downturn, the investment atmosphere for knowledge industry centers has frozen.”

Concerns are also emerging that polarization in the knowledge industry center market will worsen. Researcher Cho analyzed, “As supply increases and the market stagnates, factors such as location, transportation environment, and product composition of knowledge industry centers are becoming more important, and polarization by region and product type is expected to deepen gradually.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)