Iron Ore Prices Hit Six-Year High... Increasing Raw Material Cost Burden

Hyundai Steel Negotiating Second Half Plate Price After First Half Reduction

Steel Industry Faces Practical Losses in Shipbuilding Plate Business

[Asia Economy Reporter Hwang Yoon-joo] Following Hyundai Steel, POSCO has also decided to lower the prices of steel plates for shipbuilding. Despite a significant drop in demand for steel products due to the spread of the novel coronavirus disease (COVID-19) and a sharp surge in iron ore prices, which account for a large portion of costs, severely worsening profitability, this decision was made to share the burden with the shipbuilding industry facing a cliff in orders.

According to the industry on the 2nd, POSCO decided to reduce the price of steel plates supplied to Korea Shipbuilding & Offshore Engineering and Daewoo Shipbuilding & Marine Engineering in the second half of this year. The supply price of steel plates is contracted directly between steelmakers and shipbuilders and is not disclosed externally. Hyundai Steel had earlier reduced the price of steel plate products by 30,000 KRW per ton during negotiations in the first half of the year.

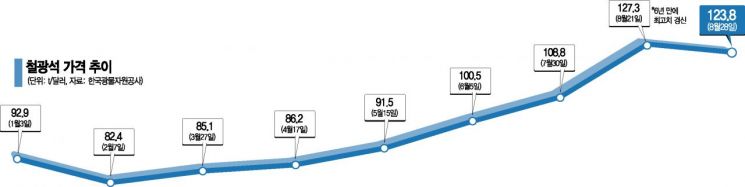

The steel industry negotiates the prices of steel plates for shipbuilding twice a year (first and second half) with the shipbuilding industry. Blast furnace steelmakers such as POSCO and Hyundai Steel have openly expressed their intention to raise product prices this year as iron ore prices surged sharply again following last year. This is because the price of the raw material, iron ore, has been rising rapidly. The international iron ore price recorded $127.38 per ton on the 21st of last month, marking the highest level in six years. Although it slightly dropped to $123.8 a week later on the 28th, it remains more than 50% higher than in February, just before COVID-19 spread worldwide.

In this context, the steel industry, including POSCO, ultimately decided to lower the supply price of steel plates, which appears to be a comprehensive consideration of the shipbuilding industry's order volume and overseas steel plate imports. According to the shipbuilding industry, global ship orders from January to July this year (6.61 million CGT) decreased by 58% compared to last year. The cumulative ship orders by July over the past three years have continuously declined, with 21.18 million CGT in 2018 and 15.73 million CGT in 2019. As a result, Korea Shipbuilding & Offshore Engineering's order achievement rate is currently below 30%, and Samsung Heavy Industries is only in the low 20% range. This can also be interpreted as the shipbuilding industry having no room to raise prices.

Instead, domestic blast furnace steelmakers such as POSCO are expected to maintain their market share in the domestic steel plate market. Although Japanese steelmakers targeted the market by supplying steel plates to domestic shipbuilders at low prices, the price reduction has restored price competitiveness.

The steel industry is tightening emergency management measures after lowering steel plate prices to share the pain with the shipbuilding industry. POSCO is focusing on the "smartification of blast furnaces." The No. 3 blast furnace at Gwangyang Steelworks has been reborn as a "smart steelworks" operated by artificial intelligence (AI) with zero errors from raw material input to blast furnace temperature control, and the small and old No. 1 blast furnace at Pohang Steelworks will cease operations starting next year. The plan is to improve production efficiency and reduce costs through these measures. Additionally, rolling lines such as hot rolling and steel plates will continue cost-cutting activities by operating facilities flexibly, focusing on low-profit products. From a financial perspective, the focus has shifted from profit and loss to cash flow.

An industry official said, "As can be seen from the fact that Steelmaker A has already dismantled two steel plate production lines due to unprofitability, the steel plate business is practically running at a loss," adding, "Since raw material costs have nearly doubled and product prices have been lowered, it is becoming even more difficult for the steel industry to secure profitability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)