Hankyung Research Institute 'Review of Reform Directions for Individual Consumption Tax on Automobiles' Report

Differentiated Tax Rates Based on Fuel Efficiency... Also Points Out Double Taxation of Value-Added Tax

[Asia Economy Reporter Dongwoo Lee] It has been revealed that taxes when purchasing a car are about twice as high as in Japan. Accordingly, there are calls to abolish the individual consumption tax on automobiles (개소세), which has been imposed as a luxury tax on high-priced goods in the past, to boost consumption and stimulate the economy. Furthermore, it was pointed out that inconsistent 개소세 reduction policies not only confuse producers and consumers but also undermine trust, potentially diminishing the effectiveness of the policies.

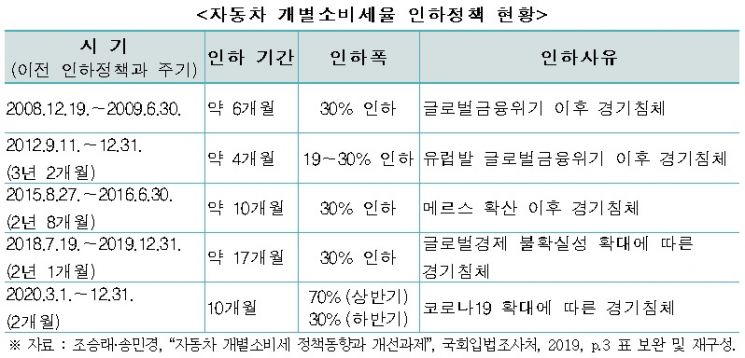

The Korea Economic Research Institute announced on the 1st through its report titled “Review of the Reform Direction of the Automobile Individual Consumption Tax” that the cycle of implementing recent 개소세 reduction policies is becoming shorter while the duration of the reductions is increasing. In fact, the 개소세 reduction policy implemented in September 2012 resumed after 3 years and 2 months since June 2009, but the policy implemented in March this year came only 2 months after December last year. During the same period, the policy implementation duration increased from 4 months to 10 months.

Im Dongwon, a senior researcher at the Korea Economic Research Institute, said, "Even if the temporary 개소세 reduction ends, if a social perception forms that it can be reduced again, normal consumption behavior becomes difficult." This means that considering the short policy cycle, consumers may postpone purchasing cars until the next reduction.

From the perspective of consumers who properly paid the automobile 개소세, issues of fairness may arise. Consumers who purchased cars in January and February this year did not receive the 개소세 reduction, which could violate the principle of tax equality.

There are also criticisms that taxes are excessive due to double taxation with value-added tax (VAT) and 개소세. The report emphasized that it is difficult to find overseas cases where 개소세 is imposed when purchasing automobiles internationally. In fact, European Union (EU) member countries impose VAT and registration tax at the automobile acquisition stage without a separate 개소세.

In Japan, instead of imposing a separate 개소세, the acquisition tax was abolished from October last year, and an environmental performance ratio tax was introduced, which varies the tax rate (0-3% for passenger cars) according to fuel efficiency. In contrast, South Korea imposes 개소세 (5%), education tax (1.5%), VAT (10%), and acquisition tax (7%) when acquiring a car, resulting in taxes about 1.9 times higher than in Japan.

The report emphasized that considering the significant impact of the automobile industry on the national economy, such as job creation effects, automobiles should be excluded from the 개소세 tax base. It argues that this can maximize the economic stimulus effect amid the recession caused by the COVID-19 pandemic.

Senior researcher Im said, "If the automobile 개소세 is maintained in the short term for reasons such as securing tax revenue, it should be revised based on fuel efficiency to focus on whether it is a luxury item or to achieve corrective tax purposes." He added, "If focusing on whether it is a luxury item, 개소세 should only be imposed on high-priced cars with engine displacement over 3000cc or priced above 40 million won."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.