Introduction of Average Inflation Targeting Seen as a Major Shift in Central Bank Policy

Signals Active Response to Employment Issues... Market Eyes September FOMC Message

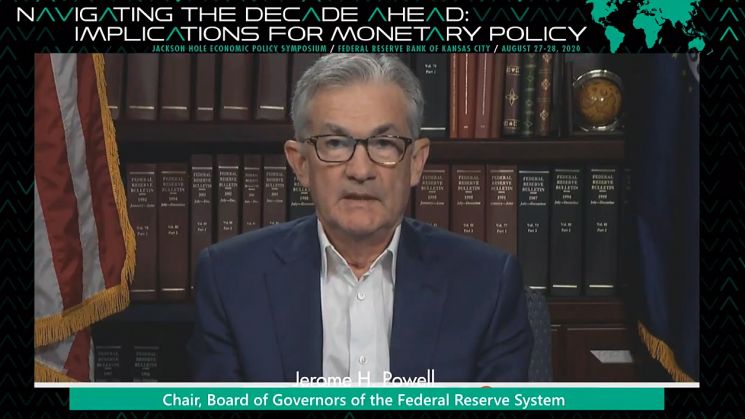

Jerome Powell, Chair of the U.S. Federal Reserve (Fed), is delivering a speech at the Jackson Hole meeting held online on the 27th (local time). [Image source=Yonhap News]

Jerome Powell, Chair of the U.S. Federal Reserve (Fed), is delivering a speech at the Jackson Hole meeting held online on the 27th (local time). [Image source=Yonhap News]

[Asia Economy Reporter Jeong Hyunjin] "The U.S. Federal Reserve (Fed) strengthening its employment goals reflects the changed world." Wall Street Journal (WSJ)

The Fed's adoption of the Average Inflation Target (AIT) is regarded as a milestone in central bank policy shifts. Emphasizing 'maximum employment' over inflation itself is considered a tremendous change.

The background of the Fed's policy change lies in prolonged low inflation and the sharp economic downturn caused by the COVID-19 pandemic. The deterioration of the labor market has become more important than inflation. By adopting the average inflation target, the Fed aims to respond more flexibly to price increases while maintaining low interest rates for an extended period to pursue economic stability through employment recovery. This contrasts with the Fed's previous approach of firmly responding to inflation with rate hikes while only flexibly reacting to employment when it deviated significantly from a certain benchmark.

In its statement, the Fed emphasized that "maximum employment is a broad and inclusive goal." Notably, regarding monetary policy decisions on maximum employment, the Fed changed the term from 'deviation' to 'shortfall,' indicating a willingness to actively respond if employment decreases. This signals the direction of monetary policy concerning employment issues.

Experiences where inflation did not rise even under full employment also played an important role in the Fed's policy. In February, the U.S. unemployment rate hit 3.5%, the lowest in 50 years. However, inflation at that time did not exceed 2% significantly. Since the inflation target was first introduced in 2012, the target has rarely been met. The U.S. core inflation rate rose to about 2.1% in 2018 but was below the target before and after that, and due to the COVID-19 impact, it fell below 1% this year. The New York Times (NYT) reported that the Fed raised interest rates nine times from 2015 to 2018 to prevent overheating as unemployment fell, but no signs of inflation appeared.

This confirms that the Phillips curve formula, which suggests that extremely low unemployment leads to economic overheating, has recently not been working. Ultimately, the Fed seems to believe that the feared scenario of current unemployment falling below the natural rate and causing rapid inflation is unlikely to occur in reality, calling it "an important philosophical change in the Fed's 107-year history," according to WSJ.

Additionally, before COVID-19, Europe and Japan introduced negative interest rates, but low inflation and low growth persisted, influencing the Fed's adoption of the average inflation target. Traditional monetary policy of lowering rates to raise inflation has become ineffective due to prolonged low inflation, significantly reducing the central bank's ability to conduct monetary policy. Fed Chair Jerome Powell said, "We have seen negative dynamics occurring in other major economies, and once formed, these dynamics can be very difficult to break," adding, "We want to prevent such dynamics from occurring here (in the U.S.)."

As the Fed attempts a shift in monetary policy, investors express both skepticism and anticipation. Although the broad framework of change has been presented, Powell's statement that rate hikes could occur if average inflation exceeds 2% leaves ambiguity about how long the current zero interest rate will be maintained. Attention is focused on the message from the Federal Open Market Committee (FOMC) meeting scheduled for next month on the 15th and 16th.

Following the Fed's policy change, long-term U.S. Treasury yields rose while short-term yields fell. Long-term bonds such as the 10-year and 30-year saw prices drop due to increased concerns about policy in the long term, while short-term yields rose reflecting expectations of maintaining zero rates. A foreign news outlet reported that the spread between 30-year and 5-year Treasury yields recently widened to the largest gap in three months.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.