Change of Headquarters Location for Policy Banks Including IBK

Successive Legislative Proposals in the 21st National Assembly Following the 20th

[Asia Economy Reporters Kangwook Cho, Sunmi Park] As the issue of relocating public institutions to provincial areas resurfaces, national policy banks such as KDB Industrial Bank, Export-Import Bank, and IBK Industrial Bank are facing difficulties. Recently, a bill to amend the Industrial Bank of Korea Act, which includes changing the head office location to a specific region, was submitted to the National Assembly, signaling that the relocation of national policy banks to provinces is becoming a major political issue.

However, considering the special characteristics and operational efficiency of national policy banks, there are concerns that forcibly relocating them to provinces could lead to a "weakening of financial competitiveness." Critics also point out that while countries like Tokyo and Singapore are fiercely competing to take the "post-Hong Kong" position, political circles are engaged in a muddy fight just for hosting rights.

Financial Sector Points Out "Ignoring Special Characteristics and Efficiency... Concerns Over Weakening Financial Competitiveness"

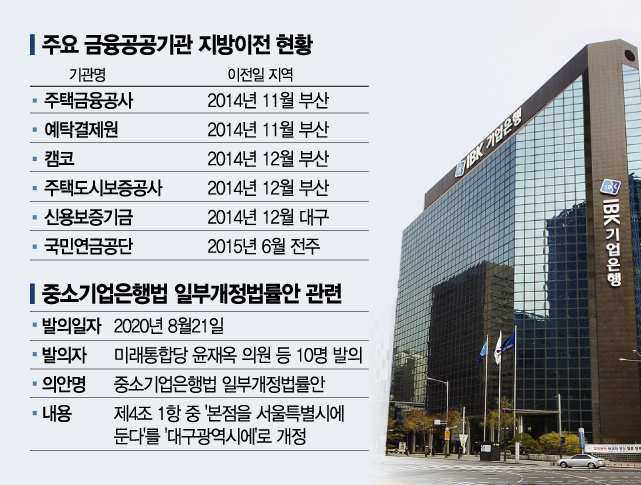

According to the financial sector on the 26th, recently, 10 lawmakers including Yoon Jae-ok of the United Future Party proposed a partial amendment to the Industrial Bank of Korea Act to relocate the IBK Industrial Bank's head office to Daegu. The current Industrial Bank of Korea Act stipulates that the bank's head office is located in Seoul, but the amendment aims to relocate it to Daegu, where 99.95% of businesses are small and medium-sized enterprises, to promote regional economic revitalization and develop local financial infrastructure from the perspective of regional balanced development.

Originally, the relocation of national policy banks to provinces was part of the current government's balanced development policy. The Presidential Committee on Balanced National Development is already conducting research for establishing a financial hub policy. The financial sector views this as preparatory work to promote the relocation of national policy banks to provinces. With the emergence of a dominant ruling party holding 177 seats in the 21st National Assembly, discussions on this issue are expected to accelerate. It is already known that the ruling party is considering relocating national policy banks to provinces.

In particular, the IBK Industrial Bank is seeing momentum not only from the ruling party but also from the main opposition party, the United Future Party, which has proposed relocation bills. Regarding this, the IBK Industrial Bank stated, "If the government decides on relocation, we will comply as a national policy bank," but added, "Since no government directive has been issued yet, the bank's strategic planning department is not currently preparing for a head office relocation."

This is not the first time the relocation of national policy banks has been discussed. In the 20th National Assembly, Kim Kwang-soo of the Democratic Peace Party proposed an amendment to move the head offices of KDB and the Export-Import Bank to Jeonbuk. Additionally, Kim Hae-young of the Democratic Party proposed relocating the head offices of KDB and the Export-Import Bank to Busan. Ten lawmakers from the Liberty Korea Party, whose constituencies include Daegu, proposed an amendment to relocate the IBK Industrial Bank's head office to Daegu.

Financial Labor Union Forms Task Force to Block Relocation... Plans Expert Forums in September-October

The financial sector holds a negative stance on the relocation of national policy banks. They argue that demands for relocation that ignore the roles and characteristics of national policy banks risk damaging policy finance functions.

The National Financial Industry Labor Union held a press conference in front of the Presidential Committee on Balanced National Development in Jongno-gu, Seoul, stating, "The collapse of the financial city Hong Kong, the so-called 'Hexit (Hongkong-Exit)' phase, is a golden opportunity for Korea to become a Northeast Asian financial hub, but can Seoul, which has the largest financial infrastructure, succeed with a strategy of relocating national policy banks?" They raised their voices against the relocation, saying, "Relocating national policy banks to provinces is a path to 'decline,' not balanced national development." Earlier in May, the labor union's branches of the Industrial Bank, IBK, and Export-Import Bank launched a "Task Force to Block the Relocation of National Policy Banks" and are preparing to hold forums inviting experts around September to October to examine the effectiveness of relocating national policy banks to provinces.

Setback Amid Post-Hong Kong Competition... Workforce Exodus Likely

Some believe that relocating national policy banks to provinces will inevitably lead to weakened competitiveness and workforce attrition. Although many financial public enterprises such as the Korea Housing Finance Corporation, Korea Securities Depository, and Korea Asset Management Corporation have already moved to provinces, there are criticisms that operational efficiency has significantly declined. Furthermore, with the government having tasked national policy banks with leading financial support for the COVID-19 pandemic, the very discussion of relocating head offices is criticized as a disconnected debate that ignores the severity of the crisis.

A financial public enterprise official explained, "Since the National Assembly, government ministries, and financial institutions are concentrated in Sejong City and the metropolitan area, business trips are frequent when dealing with related agencies. While relocating public institutions to provinces contributes positively to the regional economy, it has drawbacks in terms of operational efficiency."

According to a 2022 research report by the Financial Economy Research Institute titled "Feasibility of Relocating National Policy Banks to Provinces," comparing 89 public institutions before and after relocation (2013?2015), the total number of business trips increased by 28.3%, and travel expenses rose by 36.2%. In particular, the National Pension Service Fund Management Headquarters saw a sharp increase in resignations: 9 in 2014, 10 in 2015, and 30 in 2016 when relocation was decided. Even after relocation, resignations continued with 20 in 2017, 34 in 2018, and 20 in 2019, and the fund management staff has yet to fill its full quota of 280 employees.

Financial Public Enterprises Relocated to Provinces Show Zero Efficiency... Global Financial Hub Status Drifts Away

Experts criticize that relocating national policy banks to provinces will reduce the effectiveness of fostering a financial hub. While financial cities like Singapore and Tokyo, which are in similar positions to Seoul, are concentrating policy financial institutions in their capitals to enhance financial competitiveness, the Korean government is artificially splitting financial institutions.

Professor Sung Tae-yoon of Yonsei University's Department of Economics pointed out, "Finance requires institutions to be clustered to be effective. Relocating national policy banks contradicts the strategy to foster a financial hub, distancing finance from the market and causing side effects such as talent outflow."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)