Polarization Even in Temporary Layoffs

Permanent Layoffs Amid Employment Recovery

2 Million Likely Unemployed Next Year

Leading to Income Polarization

[Asia Economy reporters Naju-seok and Jeong Hyunjin] It is projected that one-quarter of the temporarily laid-off workers in the United States after the COVID-19 pandemic will not return to the labor market at all. Concerns are also growing that if temporarily laid-off workers fail to return to their workplaces, COVID-19 will further widen income inequality.

According to Bloomberg News on the 23rd (local time), Goldman Sachs, a U.S. investment bank, estimated that out of 9.2 million temporarily laid-off American workers during the COVID-19 crisis, 2 million will still be unable to find jobs next year. Although temporarily laid-off workers have been returning to the labor market rapidly as economic activities resumed after lockdown policies were lifted, Goldman Sachs noted that the recovery pace has slowed since July.

This projection is based on the judgment that despite economic and employment recovery trends, the shock of COVID-19 will continue to disrupt the labor market. The employment market is bound to contract as long as COVID-19 is not completely eradicated. Joseph Bricks, a Goldman Sachs analyst, analyzed, "There are signs of other movements such as worsening reemployment prospects for temporarily laid-off workers since July."

The more difficult it becomes to return to the labor market, the more income inequality is expected to deepen. This can be seen in the jobs that have been maintained during the COVID-19 situation. High-income office jobs that allow telecommuting were largely unaffected. According to a survey conducted in China in June targeting over 5,000 households, the income of households earning over 300,000 yuan annually (approximately 51.48 million KRW) increased in the second quarter compared to the same period last year. In contrast, households with annual incomes below 50,000 yuan recorded the largest decline.

Not only income but also asset imbalance has intensified. Low-income groups with unstable employment hold relatively fewer assets, while high-income groups have experienced a sharp rise in asset values due to COVID-19. The U.S. stock market has reached all-time highs, and prices of safe assets such as gold continue to soar. COVID-19 has become an opportunity to further accumulate wealth.

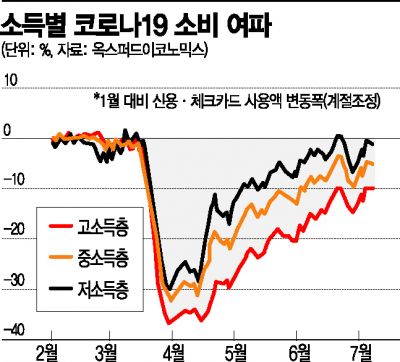

Savings also show a clear difference between low-income and high-income groups. According to a recent report by Oxford Economics titled "Pandemic-Driven Inequality Outcomes," when U.S. consumers were divided into three groups based on income, the credit and debit card usage of high-income consumers dropped by nearly 40% from January to April. This decrease was about 10 percentage points larger than the approximately 30% decline seen in low-income groups. High-income groups reduced discretionary spending such as travel and dining out due to social distancing measures, resulting in a larger decrease.

John Payne, an economist at Oxford Economics, said, "In the case of low-income groups, if income decreases, they can either reduce consumption accordingly or maintain consumption but increase debt," and he believed that since their consumption mostly consists of necessities, they are more likely to choose the latter. This means low-income groups cannot reduce purchases of daily necessities immediately and end up buying them even by borrowing. Ultimately, debt burdens will inevitably increase. Considering that high-income groups have more capacity to increase savings in preparation for future uncertainties, the income gap is likely to widen further in the future.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)