Domestic COVID-19 Resurgence Ahead of Economic Outlooks in February, May, and August

Uncertainty Rises with US, China, and Domestic Variables Combined

[Asia Economy Reporter Kim Eun-byeol] The Bank of Korea is facing increasing concerns ahead of the release of its revised economic growth forecast on the 27th. Initially, the Bank of Korea planned to present growth rates based on scenarios reflecting the global situation, including the US and China, under the assumption that the spread of COVID-19 had somewhat subsided domestically. Since the domestic demand, which affects the domestic growth rate, was recovering to some extent, the key factor was how quickly exports would rebound in line with the global economic recovery.

However, the record-breaking monsoon season may suppress consumption, and the recent sharp increase in domestic confirmed cases has introduced an unexpected variable. Depending on the scale of the increase in confirmed cases, there is a possibility that social distancing measures could be tightened, which could deal a severe blow to consumption and domestic demand, similar to this past spring.

On the 18th, a Bank of Korea official said, "Coincidentally, every month when we announce the growth forecast, COVID-19 is spreading domestically, making it difficult to make predictions," adding, "Following the initial spread of COVID-19 in February, there were events such as the Itaewon cluster infection in May and a large-scale outbreak in August." The official also noted, "Usually, the forecast is finalized about a week before the revised economic outlook is released, with only minor adjustments afterward, but this time, the daily fluctuations in confirmed cases are so significant that we cannot let our guard down until just before the announcement."

Even if the domestic confirmed cases calm down as initially expected, the overseas situation remains uncertain. In the US, which has the greatest impact on global growth rates, the economy seemed to recover as lockdown measures were lifted, but recent economic indicators have disappointed by falling short of expectations. The effects of government stimulus are fading, and the slow pace of employment recovery is cited as a problem.

According to the New York Federal Reserve on the 17th (local time), the Empire State Manufacturing Index for this month dropped sharply by 13.5 points to 3.7 from 17.2 last month, falling well below the market expectation of 19.0. On the 14th, the US Department of Commerce reported that July retail sales increased by only 1.2% compared to the previous month, below the expected 2.3%, with the growth rate steadily decreasing compared to 18.3% in May and 8.4% in June. As disappointment over the economic recovery grows, prices of US long-term Treasury bonds, considered safe assets, are rising. In the New York bond market, the yield on the 10-year US Treasury continued to decline, falling to 0.68%.

China’s economy, which greatly influences Korea’s exports and growth rate, is showing signs of recovery, but the pace is not fast. The dynamics of the US-China trade war and changes in US policy toward China depending on the US presidential election results are also variables. KB Financial Group Management Research Institute stated, "China is expected to achieve around 5% growth in the second half of the year, recording 2-3% growth for this year," but cited the US-China trade conflict and inflation caused by heavy rains as downside risks.

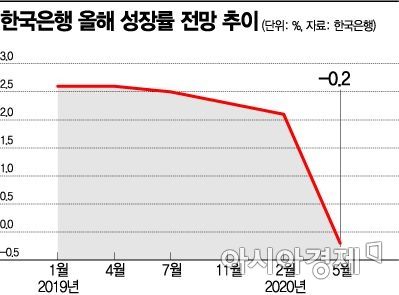

Meanwhile, in May, the Bank of Korea presented this year’s economic outlook by scenario, suggesting that in the most pessimistic case, the growth rate could fall to -1.8%. This figure was based on the assumption that the number of COVID-19 confirmed cases would peak only in the third quarter. Under the baseline scenario, which assumed the peak in the second quarter, the growth forecast was -0.2%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.