[Asia Economy Reporter Donghyun Choi] The Seoul apartment market has shown signs of slowing down due to the government's real estate policy announcements and the off-season during the vacation period. On the other hand, the shortage of rental listings caused by the impact of the Lease Protection Act (Jeonse and monthly rent cap system and contract renewal request rights) continues, with price increases expanding mainly in areas preferred for excellent school districts and large complexes.

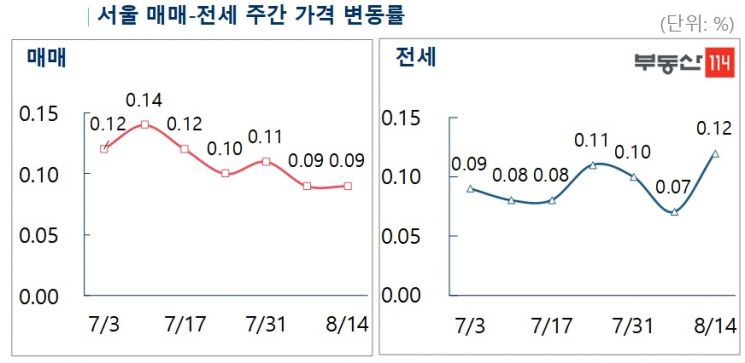

According to Real Estate 114 on the 14th, the weekly change rate of apartment sale prices in Seoul remained the same as the previous week at 0.09%. Reconstruction apartments rose by 0.02%, and general apartments increased by 0.10%. Additionally, Gyeonggi and Incheon, as well as new towns, rose by 0.07% and 0.05% respectively, showing a wider increase compared to the previous week.

In Seoul, areas with a concentration of mid-to-low priced apartments saw steady real demand, with increases in the following order: ▲Geumcheon (0.21%) ▲Dobong (0.20%) ▲Nowon (0.18%) ▲Seongbuk (0.16%) ▲Dongdaemun (0.15%) ▲Guro (0.14%). New towns increased in the order of ▲Pyeongchon (0.09%) ▲Bundang (0.08%) ▲Gwanggyo (0.08%) ▲Ilsan (0.07%) ▲Jungdong (0.07%) ▲Sanbon (0.06%) ▲Paju Unjeong (0.06%). Gyeonggi and Incheon rose in the order of ▲Gwangmyeong (0.17%) ▲Hanam (0.14%) ▲Namyangju (0.13%) ▲Yongin (0.13%) ▲Uiwang (0.13%) ▲Anyang (0.12%) ▲Hwaseong (0.11%).

The metropolitan area rental market saw a larger increase compared to the previous week due to intensified listing shortages. Seoul rose by 0.12%, Gyeonggi and Incheon by 0.08%, and new towns by 0.06%.

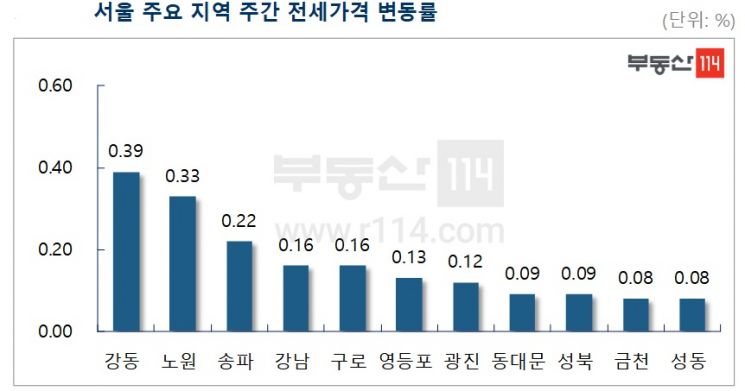

By region, in Seoul, prices increased in the order of ▲Gangdong (0.39%) ▲Nowon (0.33%) ▲Songpa (0.22%) ▲Gangnam (0.16%) ▲Guro (0.16%) ▲Yeongdeungpo (0.13%). New towns rose in the order of ▲Gwanggyo (0.10%) ▲Bundang (0.09%) ▲Pyeongchon (0.09%) ▲Gimpo Hangang (0.09%) ▲Jungdong (0.08%). In Gyeonggi and Incheon, prices increased mainly in large apartment complexes with good living conditions. By region, the increases were ▲Gwacheon (0.24%) ▲Gwangmyeong (0.21%) ▲Hanam (0.21%) ▲Anyang (0.17%) ▲Uiwang (0.17%) ▲Yongin (0.14%) ▲Namyangju (0.13%) ▲Bucheon (0.11%).

Ye Kyung-hee, senior researcher at Real Estate 114, explained, "The government is strengthening regulations, considering the establishment of a supervisory body to punish market disruption and conduct special inspections." She added, "Due to accumulated fatigue from regulations and increased market uncertainty, buyers are mainly holding back on high-priced apartments." Ye predicted, "However, as rental prices continue to rise, real demand buyers switching to purchase are intermittently entering mid-to-low priced apartments under 900 million won, so the upward trend in apartment prices in the metropolitan area is expected to continue for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)