Samsung Electronics-TSMC, Fierce Competition for Semiconductor Throne

Planning Record-High Semiconductor Investment This Year to Secure Market Lead

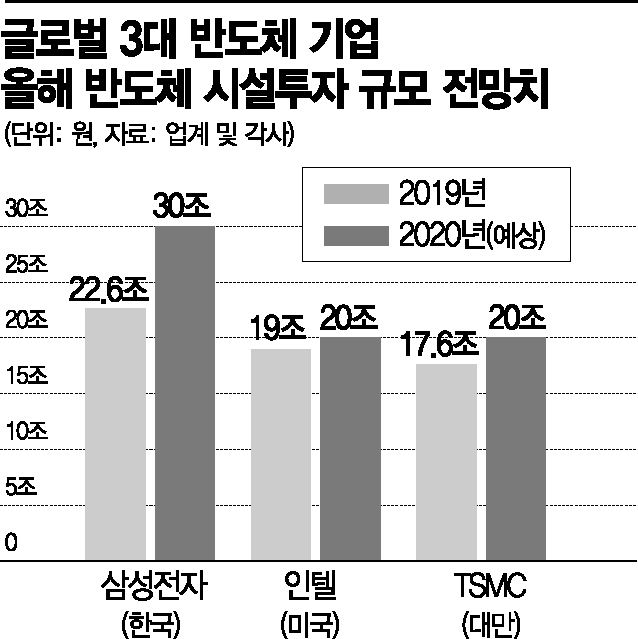

[Asia Economy Reporter Changhwan Lee] Samsung Electronics and TSMC, which lead the global semiconductor market, have recently increased their capital expenditures one after another, engaging in an investment competition. Analysts say that while another competitor, Intel, has been sluggish in technology development, the battle for technological leadership to dominate the future semiconductor market is intensifying.

According to the industry on the 14th, Taiwan's TSMC recently held a board meeting and approved capital expenditures of $5.27 billion (approximately 6.24 trillion KRW). These funds will mainly be used for semiconductor facility investments and new technology research and development (R&D).

TSMC is the world's largest semiconductor foundry company, occupying about 54% of the global foundry market. With its foundry-only business, it ranks among the world's top three semiconductor companies alongside the comprehensive semiconductor companies Intel from the U.S. and Samsung Electronics from South Korea.

TSMC's expected capital expenditure for this year is $17 billion (approximately 20 trillion KRW), and the funds approved at this board meeting are part of that amount. The company initially planned to spend about $16 billion on facility investments this year but recently increased the investment scale.

This is interpreted as due to increased semiconductor orders from customers driven by the rise in non-face-to-face (untact) demand amid the spread of the novel coronavirus disease (COVID-19) this year, as well as additional orders from new customers.

Samsung Electronics is also aggressively investing in semiconductors recently. Samsung Electronics' semiconductor facility investment in the first half of this year was 14.7 trillion KRW. This is a 67% increase compared to 8.8 trillion KRW invested during the same period last year, marking the largest half-year investment ever.

Samsung Electronics is significantly increasing its investment scale to achieve Vice Chairman Lee Jae-yong's goal of becoming the world's number one system semiconductor company by 2030. It plans to expand its semiconductor business by intensively constructing new semiconductor factories at its Pyeongtaek Campus. Currently, the P1 production line is operating at the Pyeongtaek Campus, and the P2 line is expected to start operation in the second half of this year, with construction of the P3 line also beginning.

There are several reasons why Samsung Electronics and TSMC are competing in semiconductor investments. First, the global semiconductor market is expected to grow rapidly due to the Fourth Industrial Revolution. Semiconductors serve as core components in most new industries such as untact, autonomous vehicles, AI (artificial intelligence), and 5G.

In the first half of the year, major semiconductor companies' sales were led by Intel with $38.951 billion (approximately 46.18 trillion KRW), ranking first. Samsung Electronics was second with $29.75 billion (approximately 35 trillion KRW), and Taiwan's TSMC was third with sales of $20.717 billion (approximately 24.57 trillion KRW).

Intel's delayed technology development, despite holding the top position in the semiconductor industry for a long time, has also fueled competition from latecomers. Intel announced in its Q2 earnings report last month that the stabilization of yield for its latest 7-nanometer (nm) semiconductor process has been delayed, postponing the launch of new products. Samsung Electronics and TSMC are advancing miniaturization from 7nm to 5nm, acknowledging a technological gap with Intel.

Accordingly, the technological competition between Samsung Electronics and TSMC is expected to become even fiercer. Samsung Electronics also announced that it succeeded in producing system semiconductors applying 3D stacked package technology for the first time in the industry. This is evaluated to be about a year ahead of TSMC.

An industry insider said, "Due to the Fourth Industrial Revolution, the technological level demanded by semiconductor customers has been increasingly rising recently," adding, "Ultimately, successful technology investment will determine the dominance in the semiconductor industry market for decades to come."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)