Credit Transactions Loan 15.6 Trillion Won... Record Highs Set Consecutively

Hoping for Big Gains but Sometimes Lost to Forced Sales in a Day

"Gap Between Real Economy and Stock Market May Narrow... Special Caution Needed"

[Asia Economy Reporter Minwoo Lee] Office worker Kim Kyungho (34, pseudonym) thought investing in stocks was better than savings, so he put a fixed amount of his monthly salary into his stock account every month. He made a decent profit and gradually became interested in investing. However, he increasingly felt the lack of initial capital. Then, he heard about margin buying, where you borrow money from a securities firm to buy stocks, and started "debt investing" (borrowing money to invest in stocks). The first few months were profitable. He enjoyed the fact that he could earn profits without capital by paying fees. Kim said, "At first, I was nervous, but after making some money a few times, I became bolder. Before I knew it, I found myself thinking of the margin loan limit as if it were my own money, so I have been trying to control myself little by little."

Office worker Jung Minjun (39, pseudonym) has had a painful experience with debt investing. He started margin buying last year after listening to his friends. At first, he traded without major problems. The problem arose during the market crash in March caused by the novel coronavirus (COVID-19). The stocks he held plummeted in price, and he was subject to a forced liquidation. Forced liquidation means that if a customer fails to repay the borrowed money within the agreed period, the securities firm forcibly sells the stocks regardless of the customer's intention. Jung said, "The KOSPI dropped nearly 200 points in one day, and I was forced to liquidate about 30 million won without having time to prepare a large sum of money. But seeing the stock prices rise the very next day was heartbreaking." He added, "If I hadn't done debt investing, I would have suffered for a few days but eventually recovered the principal. But seeing the investment funds I had accumulated disappear in just one day made me unable to focus on anything."

As the stock market rebounds sharply, the scale of debt investing?borrowing money to buy stocks?is reaching record highs day by day. In particular, debt investing among young people has increased noticeably. There is an analysis that young people who had previously invested in Bitcoin and real estate are now turning to debt investing for a quick profit.

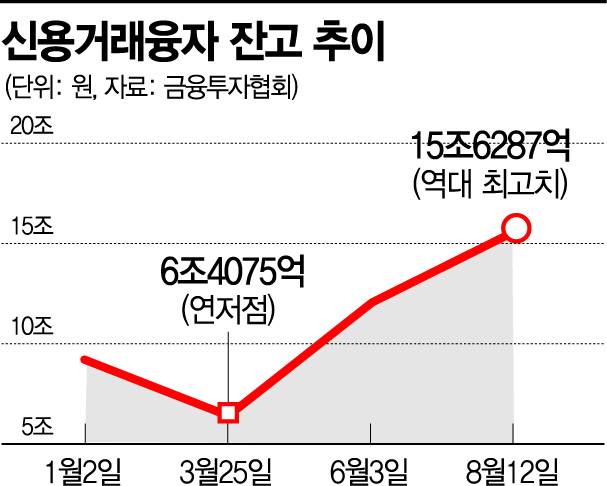

According to the Korea Financial Investment Association on the 14th, the outstanding balance of margin loans for individual investors borrowing from securities firms to invest in stocks reached a record high of 15.6287 trillion won as of the 12th. This marks the 11th consecutive business day of record-breaking. Compared to the lowest point of 6.4075 trillion won on March 25, the atmosphere is completely different. As the "Donghak Ant Movement," where individual investors massively enter the stock market, unfolds, the scale of debt investing has also grown accordingly.

According to data received by Rep. Yoon Doohyun of the United Future Party from the Financial Supervisory Service, the number of people borrowing money from securities firms increased by 24.9%, from 131,769 in the first half of this year to 164,665. Compared to three years ago, it has increased by nearly 60%. Debt investing among young people has clearly increased. The outstanding balance of margin loans for people in their 20s grew from around 310 billion won in 2017 to 720 billion won by the end of the first half of this year. An industry insider said, "Many young people who experienced the Bitcoin craze have recently seen the soaring apartment prices and recklessly borrowed money to invest in stocks. It is bittersweet to see them driven by a get-rich-quick mentality."

Margin buying allows individuals to participate easily with only a certain level of deposit (collateral), which can lead to reckless investment. Moreover, when stock prices fall sharply or volatility is high, the risk increases significantly. Kim Youngik, adjunct professor at Sogang University Graduate School of Economics, said, "Recently, a liquidity-driven market has emerged, and everyone is rushing into stocks, but there is still a large gap between the real economy and the indices. It is expected that this gap will narrow in the future, so reckless investment, especially borrowing to invest, is a very concerning issue at this time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.