Exchange Rate Volatility and Fluctuation Range Also Narrowed

[Asia Economy Reporter Kim Eun-byeol] As the weak dollar trend continues, the won-dollar exchange rate has been steadily declining. Despite concerns over the resurgence of COVID-19 and US-China conflicts, the exchange rate decline due to the weak dollar is notable.

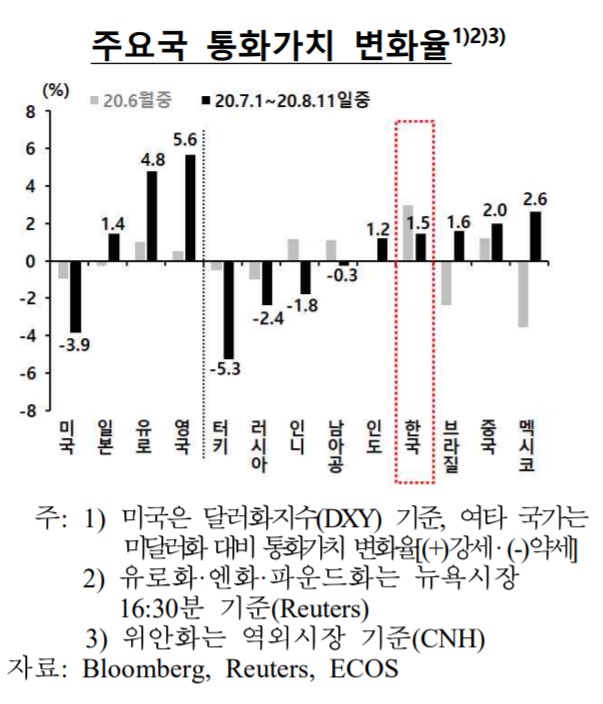

According to the "International Finance and Foreign Exchange Market Trends after July" announced by the Bank of Korea on the 13th, the won-dollar exchange rate was 1,185.6 won (closing price) on the 11th, down from 1,203.0 won at the end of June. During this period, the Korean won appreciated by 1.5% against the US dollar.

Therefore, among emerging markets during this period, the Korean won showed strength following Mexico (+2.6%), China (+2.0%), and Brazil (+1.6%). Among developed countries, the British pound (+5.6%), euro (+4.8%), and Japanese yen (+1.4%) appreciated, while the US dollar depreciated by 3.9%.

An official from the Bank of Korea stated, "While global stock prices rose sharply, the dollar weakened due to factors such as the Federal Reserve's continued accommodative monetary policy," adding, "The domestic foreign exchange sector maintained stability, with the won-dollar exchange rate declining."

Volatility in the won-dollar exchange rate also decreased in July compared to the previous month. The exchange rate volatility in July was 0.24%, with a fluctuation range of 2.9 won, down from 0.52% and 6.3 won in June.

Foreign investors' securities investment funds saw continued inflows into bonds, and stock funds also turned to net inflows. In July, stock funds recorded an inflow of $1.39 billion, turning positive, while bond funds saw an inflow of $3.01 billion, mainly from private funds. Therefore, foreign investors' total domestic securities funds inflow amounted to $4.39 billion, expanding compared to $2.48 billion in June.

In July, external foreign currency borrowing conditions were favorable, with domestic banks' long-term borrowing spreads continuing to decline. The 5-year foreign exchange stabilization bond CDS premium fell to 25 basis points (1bp=0.01 percentage point) last month, down from 27 basis points the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.