Rising Jeonse Prices Due to Real Estate Measures Increase Financial Strain

Low-Income and Middle-Class Buyers Reach Out to Secondary Financial Institutions

"Limitations in Approach to 'Prevent Speculation but Ensure Housing Stability'”

[Asia Economy Reporter Kim Hyo-jin] Cha Sang-guk (42, pseudonym), who lives in Gyeonggi-do and works as a deputy general manager at a mid-sized company in Seoul, recently took out a 50 million won loan from a savings bank for the first time. Due to urgent circumstances, he needed to move from his current jeonse (long-term lease) house to a place near his company, but with Seoul’s jeonse prices soaring recently and the loan limit from his main bank being insufficient, he had no choice.

He considered stretching himself to get a mortgage loan (jumdae) to buy a home, but the real estate measures implemented repeatedly this year made that impossible. Since both he and his spouse work, it was also difficult to receive support from various policy financing programs aimed at first-time homebuyers.

Mr. Cha lamented, "After paying for child-rearing expenses, living costs, and loan interest, there is almost no money left despite both of us working. Even to find a much smaller jeonse house than where we currently live, we have to gather money from here and there at an unbearable level."

Amid the government’s stringent real estate policies, bank loans for jeonse and credit have surged, and 'actual demanders' who could not borrow from banks have flocked in large numbers to the secondary financial sector, where interest rates are higher. Critics point out that the 'regulatory drive' intended to curb real estate speculation and stabilize housing for the working and middle classes is instead exacerbating their housing and financial difficulties.

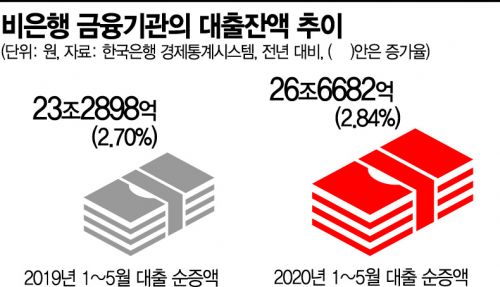

According to the Bank of Korea on the 10th, the outstanding loans from non-bank financial institutions such as savings banks, insurance, and credit card companies from January to May this year amounted to 968.068 trillion won, an increase of 26.7294 trillion won (2.84%). This increase is 3.4396 trillion won more than the same period last year (23.2898 trillion won).

Financial companies explain that a significant portion of these loan demands are for housing funds. A representative from Savings Bank A hinted, "In previous years, many people took out loans for living expenses, but recently, inquiries for securing jeonse deposits have noticeably increased."

A financial sector official said, "It seems there were inherent limits in the government’s approach to prevent speculation while ensuring no difficulties for actual demanders such as the middle class," adding, "Real estate policies cannot have uniform effects across different social classes, so the difficulties of actual demanders will continue."

In particular, credit loan interest rates from savings banks or card loans often exceed the high teens in annual percentage rates, imposing a significant burden on the financial lives of the working and middle classes. Even savings banks affiliated with financial holding companies, which offer relatively better conditions, have loan interest rates exceeding the high 13% range. Card loans also have their lowest rates in the 12% range. Mortgage loans from savings banks typically range from 4% to 6% annually, more than double the average bank interest rate of around 2%.

The adverse effects of government policies are also evident in the banking sector. As of the end of July, the outstanding balance of jeonse loans from the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?was 94.0556 trillion won, an increase of 2.0201 trillion won (2.2%) from the previous month. Compared to the end of last year, it rose by 13.6024 trillion won (16.9%).

Buying a Home Is Out of the Question... Debt Party to Catch Up with Jeonse Prices

Bank Sector’s Jeonse and Credit Loans Continue to Surge

The month-over-month increase in jeonse loans from the five major banks was 2.7034 trillion won in February this year, the largest since related statistics began in 2016. It slightly decreased in March (2.2051 trillion won) and April (2.0135 trillion won), then fell below 2 trillion won in May (1.4615 trillion won) and June (1.7363 trillion won), but rose back to the 2 trillion won level last month.

The surge in jeonse loans in July is considered particularly unusual, as the moving demand is low due to the rainy season and vacations, which are typically off-seasons in the rental market. According to the Seoul Real Estate Information Plaza, the number of apartment jeonse contracts concluded in Seoul last month was 6,972, only about half of February’s 13,704 contracts.

Nevertheless, the increase in jeonse loans is interpreted as meaning that many people need to borrow due to the significant rise in jeonse prices.

The increase in credit loans due to the 'mortgage loan balloon effect' is also continuing. The outstanding balance of personal credit loans at the five major banks at the end of July was 120.2042 trillion won, up 2.681 trillion won (2.28%) from the end of June. This is the second-largest increase following June’s 2.8374 trillion won (2.47%) rise, which was the biggest increase this year. Personal credit loans at the five major banks have increased continuously except for January.

Only in April (49.75 billion won) did the growth temporarily slow. This is interpreted as a complex effect of 'panic buying' driven by soaring housing prices and the 'Donghak Ant Movement,' where people borrow money to invest in stocks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)