[Asia Economy Reporter Kiho Sung] The average tenure of outside directors at South Korean companies was found to be relatively short compared to major countries. In South Korea, the Enforcement Decree of the Commercial Act limits outside directors' tenure to no more than six years, whereas in major countries, a significant number of outside directors serve long terms exceeding six years.

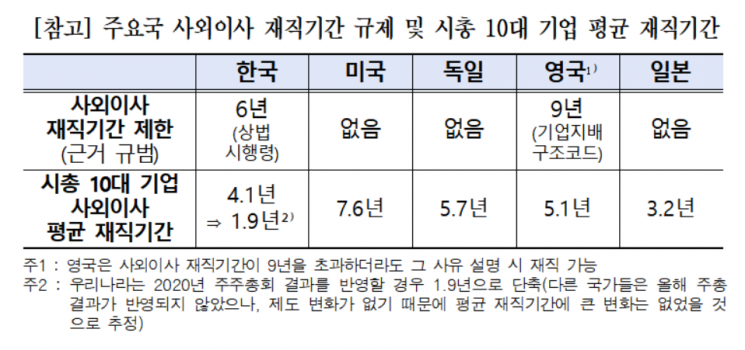

On the 9th, the Korea Employers Federation (KEF) revealed this in its report titled "International Comparison and Implications of Outside Director Operations." KEF compared and analyzed the operation status of outside directors at the top 10 companies by market capitalization in five countries including South Korea, the United States, Japan, the United Kingdom, and Germany. The average tenure of outside directors by country showed that the U.S. had the longest at 7.6 years, while South Korea was the second shortest at 4.1 years, following Japan. This data is based on the period before the amendment of the Enforcement Decree. Notably, when reflecting the results of regular general meetings of shareholders held after the amendment (post-March 2020), South Korea’s average tenure shortened to 1.9 years, making it the shortest among major countries.

Since January 29 of this year, South Korea has prohibited outside directors from serving more than six years at a single company under the revised Enforcement Decree of the Commercial Act. However, in major overseas countries, outside directors can serve long terms based on their capabilities. In particular, more than half of the outside directors at the top 10 U.S. companies by market capitalization are long-term directors. If South Korea’s tenure restrictions were applied in the U.S., more than half of the outside directors would be replaced.

Among the countries compared, South Korea is the only one that regulates outside directors’ tenure by law. The United Kingdom sets a maximum appropriate tenure of nine years for outside directors through its Corporate Governance Code, but exceptions are allowed if reasons are explained. At the time of the survey, 8.9% of outside directors had served more than 10 years.

Analyzing the main career backgrounds of outside directors at the top 10 companies by market capitalization, it was found that in major countries except South Korea, the majority of outside directors were former business executives (CEOs, officers, etc.) with expertise and experience in various industries. In contrast, South Korea had the highest proportion of academics such as professors, and the lowest proportion of business executives among the five countries compared.

Additionally, an analysis of the top and bottom 40 companies listed on the Korea Composite Stock Price Index (KOSPI) showed that the average tenure of outside directors was longer in lower market capitalization companies than in higher ones. The reduction in average tenure due to outside director replacements this year was also more significant in lower market capitalization companies, suggesting that the recently implemented tenure regulations have imposed a greater burden on small and medium-sized listed companies.

Before the 2020 regular general meeting of shareholders (prior to the Enforcement Decree application), the average tenure of outside directors at the bottom 20 small and medium-sized companies was 6.2 years, longer than the 3.7 years at the top 20 large companies, with a higher proportion of directors serving more than six years.

Following the replacement and new appointments of outside directors at this year’s regular shareholders’ meetings, the average tenure of outside directors at the top and bottom 40 companies was significantly shortened (from 4.3 years to 2.1 years). The change was especially pronounced in the bottom 20 small and medium-sized companies (from 6.2 years to 2.5 years, a decrease of 3.7 years), compared to the top 20 companies (from 3.7 years to 1.8 years, a decrease of 1.9 years). This suggests that the regulatory burden from the recent Enforcement Decree amendment has had a greater impact on small and medium-sized enterprises than on large companies.

Hahm Sangwoo, Head of the Economic Research Department at KEF, stated, “It is difficult to find overseas cases where outside directors’ tenure is regulated by law.” He pointed out, “Compared to major countries, South Korea’s average tenure of outside directors was not long even before, and the introduction of uniform tenure regulations, which do not exist in advanced countries, may hinder the accumulation of expertise and competitiveness of domestic outside directors.”

He also emphasized, “Improvements to the outside director system are needed to secure expertise and diversity, including easing tenure regulations.” He added, “As the importance of convergence industries is emphasized in the era of the Fourth Industrial Revolution, it will be beneficial for corporate growth if Korean companies gradually increase the proportion of business executive outside directors with diverse insights and experiences to ensure diversity in decision-making.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.