Speeding Up Data Integration Across Industries Like Finance, Telecommunications, and Distribution

Utilized for Small Business Marketing, Public Administration, and Services

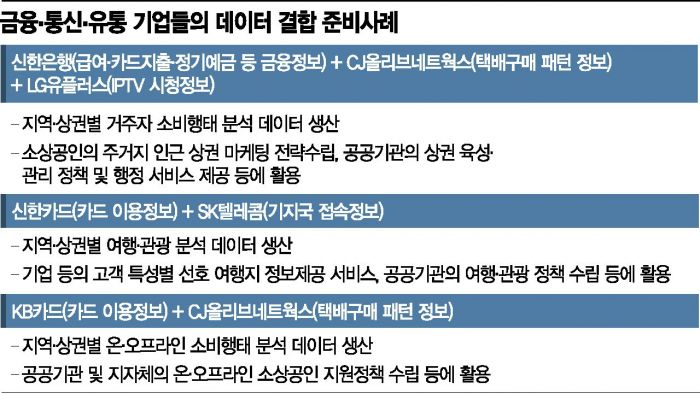

[Asia Economy Reporter Kim Hyo-jin] Shinhan Card is preparing to produce data that can comprehensively analyze consumers' travel and tourism consumption patterns in collaboration with SK Telecom. For example, Shinhan Card extracts information on card merchant usage when a male office worker in his late 30s travels to a specific region, then combines it with SK Telecom's base station connection data to create travel and tourism consumption pattern information preferred by the demographic represented by this traveler.

Shinhan Bank is also promoting data integration to analyze consumer behavior by commercial district together with CJ OliveNetworks and LG Uplus. This involves merging financial information such as salary, card spending, and time deposits with CJ OliveNetworks' online channel delivery pattern data and LG Uplus' IPTV viewing information. This will enable the production of data on what types of consumption consumers mainly engage in by income level in specific commercial districts and through which channels consumption occurs.

KB Kookmin Card is also preparing to produce data by combining characteristics of regional consumption, online and offline industry payment information, regional online delivery information, and online consumption item information together with CJ OliveNetworks. Small business owners can use such data to establish marketing strategies within commercial districts, and public institutions can utilize it for more efficient policy-making and administrative service provision.

Data integration across different industries is becoming visible. The 'data alliances' in line with the government's and industry's 'data economy' policy have officially begun.

According to the financial sector on the 7th, Woori Financial Group plans to introduce 'hyper-personalized customized financial products' utilizing KT's data analysis technology through a 'financial and information and communication technology (ICT) new business alliance' with KT.

Busan Bank signed a 'business agreement for financial benefit services for customers in the credit rating blind spot' with KT and Korea Credit Bureau (KCB) in April, and JB Financial Group's Jeonbuk Bank and Gwangju Bank also formed a consortium with SK Telecom and other SK Group affiliates and were selected as operators for the 'MyData Demonstration Service Support Project' led by the Ministry of Science and ICT.

Jeonbuk Bank and Gwangju Bank plan to develop a new credit evaluation system and personalized financial products by utilizing mobility data from SK Telecom's T map and SK Energy's gas stations.

In response to these movements, financial authorities designated the Credit Information Service and the Financial Security Institute as specialized institutions supporting data integration the day before. This is a measure following the enforcement on the 5th of the amended Credit Information Act, which introduced the concepts of anonymous and pseudonymous information and allowed data integration through government-designated specialized data institutions.

Financial Authorities Designate Specialized Data Institutions

Support for Data Anonymization and Pseudonymization

Anonymous information is data processed so that individuals cannot be identified and can be freely used without restrictions. Pseudonymous information is data processed so that individuals cannot be identified unless additional information is combined, and can be used without consent for statistical compilation (including commercial purposes), research, and public interest record preservation.

Specialized data institutions safely combine data requested by companies and then deliver it after anonymizing and pseudonymizing it so that the data subjects cannot be identified. For example, if pseudonymization is requested for information about a woman named 'Shin Saimdang' born in 1974 who uses the mobile phone number '010-1234-5678,' her name is converted into an ID like '9A00F1155584BA5,' the phone number is deleted, and the data is processed and delivered including financial information such as how many insurance policies she holds.

The financial authorities plan to promote the activation of financial sector data exchanges to ensure smooth distribution of data combined through specialized data institutions. As of the end of last month, 77 companies are participating in the financial sector data exchange. The number of products is 406, with 313 transactions amounting to 390 million KRW (20 paid transactions).

Various data related to finance, real estate, daily life, and businesses are being traded, including regional-level income, expenditure, and financial asset information of financial companies, sales status information by building unit and industry, delivery app customer and restaurant-linked card sales information, online mobile phone payment consumption information, and import-export competitor information.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.