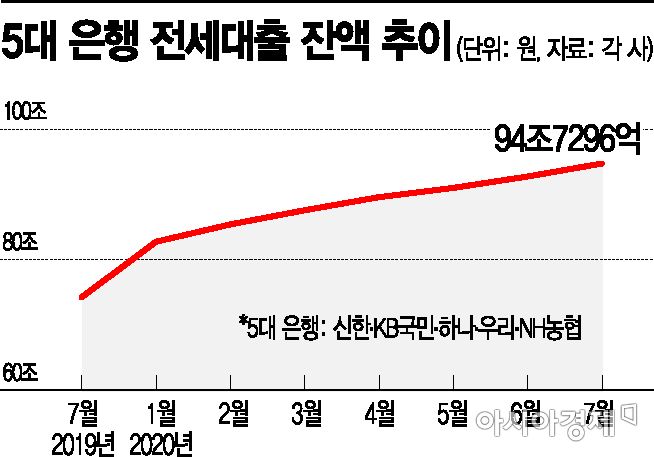

Rising Jeonse Prices Reduce Transaction Volume

But Individual Prices High, Loan Balances Increase

As of End of July, 94.73 Trillion KRW

Year-End Forecast May Reach Record 100 Trillion KRW

[Asia Economy Reporter Kim Min-young] It has been revealed that jeonse (long-term lease) loans from major commercial banks have surged by more than 20 trillion won over the past year. The monthly balance of jeonse loans, which had temporarily stalled, has also turned to an upward trend. Although transaction volumes have decreased due to the recent surge in jeonse prices, the loan balance has increased because individual prices are exceptionally high.

According to the banking sector on the 6th, the balance of jeonse loans from the five major banks?Shinhan, KB Kookmin, Hana, Woori, and NH Nonghyup?was recorded at 94.7296 trillion won as of the end of last month. This is an increase of 20.4887 trillion won from 74.2409 trillion won in July last year. If this trend continues, there are forecasts that the jeonse loan balance could exceed 100 trillion won for the first time around the end of this year or early next year.

In July alone, jeonse loans increased by a net 1.9923 trillion won. Considering that July is a low moving season due to midsummer and the rainy season, this is a significant amount of lending. Compared to July last year (1.5653 trillion won), about 400 billion won more loans were issued.

Although the government tightened regulations on jeonse loans for homeowners by requiring repayment of existing jeonse loans when purchasing apartments over 300 million won in regulated areas and restricting jeonse loan guarantees for homeowners with properties valued over 900 million won through the June 17 real estate measures, there was no decrease in jeonse loans. The monthly net increase in jeonse loan balances at the five major banks decreased from February to May after a peak of 2.6514 trillion won in February, but rose again to 1.7374 trillion won in June and continued to increase in July.

Mismatch Between Jeonse Supply and Demand is the Cause

Experts interpret the increase in jeonse loans as a result of a mismatch between jeonse supply and demand. As housing sale prices rise, jeonse prices have also surged, but the supply is insufficient, leading to a sharp increase in jeonse loans. A financial sector official said, “The reduced supply of jeonse has driven up jeonse prices, which in turn has led to an increase in jeonse loans.”

In fact, jeonse contracts for housing in the Seoul metropolitan area have sharply decreased. According to the Seoul Real Estate Information Plaza, the number of jeonse transactions for apartments in Seoul last month was 6,304, dropping below 6,000 for the first time in nine years since statistics began in 2011. Compared to February this year, which recorded the highest number at 13,661 transactions, this is only about 46%. The number of apartment jeonse and monthly rent transactions posted on the Gyeonggi Real Estate Portal also decreased continuously from the peak of 27,103 in February to 12,326 last month. Meanwhile, jeonse prices are skyrocketing. According to KB Real Estate Live On, the jeonse price for housing in Seoul rose by 0.68% last month compared to June. The national average also increased by 0.44% during the same period. Nationwide jeonse prices have been rising, with increases of 0.08% in April, 0.06% in May, and 0.27% in June.

However, opinions differ on the future trend of jeonse loans. Some believe that due to the implementation of the “Three Lease Laws” (Jeonse and Monthly Rent Reporting System, Jeonse and Monthly Rent Cap System, and Contract Renewal Request Right System), the shortage of supply will continue for the time being, leading to continued jeonse price increases and thus further growth in jeonse loans. On the other hand, some argue that if landlords raise jeonse deposits by no more than 5% due to the law, the rise in jeonse prices will slow, and if cases of converting jeonse to monthly rent increase, the absolute deposit amounts will decrease, which will contribute to a reduction in loans.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)