Establishment of 'Comprehensive Digital Finance Innovation Plan' Combining 'Innovation + Regulation'

"Encouraging Innovation While Minimizing Side Effects Through Regulatory Framework"

Lowering Entry Barriers for Startups and Introducing Small-Amount Deferred Payment for OO Pay

[Asia Economy Reporter Kim Hyo-jin] Financial authorities are preparing specific regulations to ensure fair competition and prevent consumer harm in response to the full-scale entry of Big Tech (large information and communication companies) into the financial industry. At the same time, the financial authorities plan to significantly rationalize entry regulations and expand the scope of business to promote the emergence of innovative electronic financial service providers.

On the 26th, the Financial Services Commission announced the 'Comprehensive Innovation Plan for Digital Finance' containing these details.

Establishing Financial Platform Management Measures for Consumer Protection

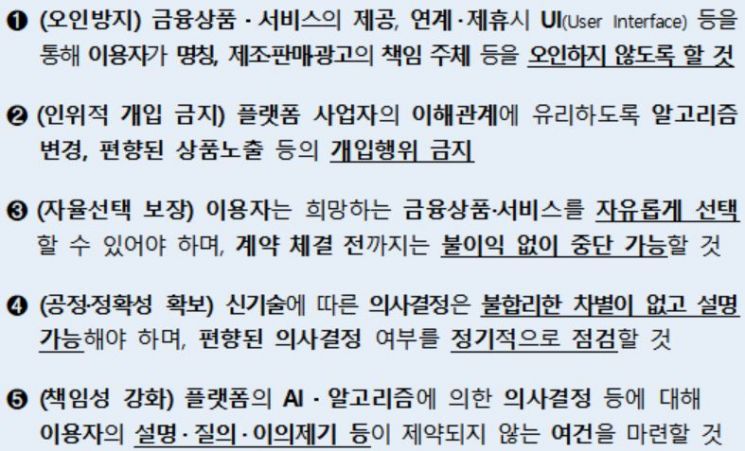

The financial authorities intend to encourage innovation resulting from Big Tech's entry into finance while minimizing side effects by establishing a management and regulatory system. To this end, when financial products and services are offered on financial platforms or linked/partnered with other financial companies, they plan to create a user interface (UI) environment that prevents consumers from misunderstanding the name of the product or service and the responsible party for manufacturing, sales, or advertising.

This is in consideration of recent controversies such as the naming of the 'Naver Account.' The 'Naver Account' is actually a CMA (Comprehensive Asset Management Account)-RP (Repurchase Agreement) type account created and operated by Mirae Asset Daewoo. Due to concerns raised by financial authorities and others that it could be mistaken for a regular 'bank deposit account' protected by deposit insurance, Naver changed the product name to 'Mirae Asset Daewoo CMA Naver Account.'

The financial authorities also plan to prohibit intervention acts such as changing algorithms to favor platform operators and expose biased products, allowing consumers to freely choose the financial products or services they want and to stop transactions without disadvantage until a contract is concluded.

Furthermore, they will create conditions where consumers are not restricted in explanations, inquiries, or objections regarding decision-making by platform artificial intelligence (AI) and algorithms, and regularly check for biased decision-making issues caused by new technologies. The financial authorities will also specify regulations prohibiting interest payments on consumer funds, conduct periodic inspections of illegal or unfair acts by merchants, and prohibit direct possession of consumer funds.

To secure trust in digital finance, the responsibility of financial companies and electronic financial service providers for electronic financial accidents will be strengthened. Accordingly, in the event of an electronic financial accident, the compensation liability of financial companies will be expanded. Limited liabilities such as forgery or alteration of access media and hacking will be expanded to 'unauthorized transactions' (payments or remittances not permitted by the user). This broadens the definition of 'electronic financial accidents' beyond specific technical incidents.

However, the financial authorities plan to rationalize the consumer protection system by imposing cooperative efforts on consumers to prevent electronic financial accidents. For example, cases where access media leakage or exposure could have been easily detected will be excluded from intentional or gross negligence by financial companies.

Lowering Entry Barriers for Startups and Introducing Innovative Services like MyPayment

Meanwhile, the financial authorities will adjust the minimum capital requirement for startups with innovative ideas to enter electronic finance more smoothly from the current 500 million to 5 billion KRW by industry to 300 million to 2 billion KRW. The seven subdivided electronic financial business types?electronic funds transfer, electronic money, prepaid electronic payment instruments, debit electronic payment instruments, electronic payment agency, payment escrow, and electronic billing payment?will be simplified into funds transfer, payment, and payment agency businesses. This reflects changes in the financial environment where service convergence and fusion are activated.

'MyPayment' (payment instruction transmission business), which does not hold customer funds but transmits transfer instructions for payments and remittances for all customer accounts through a single application, and 'Comprehensive Payment Service Providers,' which directly issue and manage customer payment accounts and provide one-stop payment and transfer services, will also be implemented.

To enhance consumer convenience, a limited small-amount post-payment function will be introduced for payment service providers. Up to 300,000 KRW can be provided only for the shortfall between prepaid funds and payment amounts. Unlike credit cards, cash services, revolving credit, and installment services are prohibited, and interest is also restricted. The financial authorities will also raise the prepaid electronic payment instrument recharge limit from the current 2 million KRW to a maximum of 5 million KRW, expanding the payment function range to electronic products and travel goods, and set a daily total usage limit of 10 million KRW to prevent excessive transactions.

Amendment Bill to be Submitted to the National Assembly in Q3 and Launch of 'Digital Finance Council'

The financial authorities will also ensure that open banking participant institutions, provided information, and fees are smoothly adjusted according to infrastructure accessibility and reciprocity, clarify the roles and responsibilities of operators of payment systems, and secure the stability of digital payments by establishing legal grounds for open banking and digital payment transaction clearing.

In response to the abolition of the public certification system, they will present technical requirements for secure authentication methods and strengthen authentication by financial companies for high-risk transactions. At the same time, new identity verification methods such as facial recognition and decentralized identity (DID) will be accepted.

The financial authorities plan to submit the amendment bill to the Electronic Financial Transactions Act containing these details to the National Assembly in the third quarter of this year. They will also operate a 'Digital Finance Council' for communication and cooperation among the public and private sectors, financial industry, fintech companies, and Big Tech.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)