[Asia Economy Reporter Jo Gang-wook] Recently, financial crimes such as voice phishing targeting low-income individuals with increased funding needs due to the spread of the novel coronavirus disease (COVID-19) are on the rise.

The methods are also evolving. From 'investment scams' that lure victims by claiming high returns through buying and selling virtual characters like unicorns, fish, and jewels, to high-interest small loans called 'proxy deposits' targeting teenagers, these crimes are rampant.

In particular, there are cases where teenagers lend private loans to their peers, which leads to secondary harm in the form of school violence, causing shock.

Investment Platform Scams Disguised as High-Yield Investment Schemes Are Prevalent

According to financial authorities and the financial sector on the 25th, under the recent low-interest rate environment, investment scams involving virtual characters targeting investors seeking high returns have become rampant, causing serious damage, prompting the Financial Supervisory Service (FSS) to issue a warning. These are typical 'Ponzi schemes' with no real source of profit, preserving returns for existing members using funds from new members.

According to the FSS, these companies create characters such as animals, buildings, unicorns, and fish, and advertise themselves as peer-to-peer (P2P) or e-commerce platforms where these characters can be traded, claiming to use innovative investment techniques.

These companies advertise that holding a character for a certain period automatically increases its price, and members' profits come from the trading margin when selling at a price higher than the purchase price. They claim that as trading repeats, the character's price inevitably rises, and when the price reaches a certain amount, one character splits into multiple characters.

They also promote multi-level marketing profits by paying incentives as a certain percentage of the trading profits of the referred members when new members are directly introduced. Furthermore, they manage members to prevent attrition by controlling negative opinions and complaints in group chat rooms, showing typical multi-level business behaviors.

The FSS pointed out that smooth trading requires a continuous influx of new buyers, and if new buyers do not enter, the last buyer suffers losses, which is a typical 'Ponzi scheme' or 'hot potato' form. Ponzi schemes refer to multi-level financial frauds that pay dividends to existing investors using money from new investors, originating from the fraud committed by Charles Ponzi in the 1920s.

Additionally, since the trading matching method is not disclosed, members find it difficult to know if trades are abnormally executed. Trading and transaction history can only be checked by accessing the site, so if the site suddenly closes, recovering the investment is impossible, the FSS warned.

400 Million Won Debt from Trying to Buy 'Goods'... Secretive 'Proxy Deposit' Deals Targeting Teenage Girls

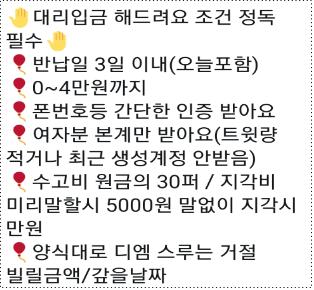

Alongside this, high-interest small loans called 'proxy deposits' targeting financially and legally vulnerable teenagers have become prevalent, with reported cases of damage.

Proxy deposit operators mainly post advertisements on social media, luring teenagers who need concert tickets, celebrity merchandise, or game expenses, lending small amounts around 100,000 won for short terms (2 to 7 days).

Although the borrowed amounts are small, the short-term interest rates range from 20% to 50%. When annualized, this reaches over 1000%.

Especially, if repayment is delayed, late fees of 1,000 to 10,000 won per hour are charged, disguised as 'late fees.' The problem is that terms like 'service fees' and 'late fees' are used, and idol photos are posted to make it appear as if the transactions are between acquaintances. Moreover, they often request contact information of family and friends under the pretext of identity verification, targeting only teenagers (especially girls).

Some teenagers even engage in proxy deposits as a way to earn pocket money. Investigations revealed that this has evolved into a form of school violence where friends' money is extorted through high-interest loans.

Looking at the damage cases, Mr. A borrowed 100,000 won for three days and repaid 140,000 won. However, he was additionally charged 50,000 won in late fees (1,500 won per hour) for 36 hours of delay and even suffered illegal collection calls at night.

Ms. B wanted to buy merchandise of her favorite idol but had no funds, so she used proxy deposits from several people via social media, borrowing between 20,000 and 100,000 won each. Unable to repay, she kept rolling over the debt and eventually repaid 4 million won including interest.

High school student Mr. C fell into gambling and raised gambling funds through proxy deposits with a weekly interest rate of 50% (annual interest rate of 2,600%), eventually accumulating gambling debts of 37 million won over four years.

"Need Quick Cash?" 'Fake Loans' Luring Unemployed College Students and Job Seekers

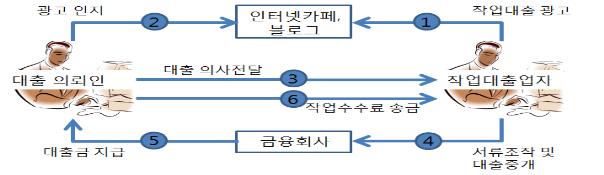

‘Fake loans’ targeting unemployed young people in urgent need of cash are also rampant, where operators forge false documents and collect large fees amounting to 30% of the loan amount.

There were 43 detected cases of 'fake loans' this year, with total loan amounts reaching 272 million won. The FSS explained that most users of fake loans were in their 20s (born in the 1990s), including college students and job seekers, and the loan amounts were relatively small (4 million to 20 million won). All loans were conducted remotely.

Fake loans are fraudulent loans involving forgery and falsification of public and private documents. Both the fake loan operators and loan applicants are accomplices subject to criminal punishment.

In a damage case, college student Mr. A, born in 1994, urgently needed money but could not get a loan from financial institutions due to lack of income proof. In March last year, he had salary and employment certificates forged by fake loan operator Mr. B and borrowed 18.8 million won from two savings banks. Mr. A paid Mr. B a fee of 5.64 million won, 30% of the loan amount, but actually received only 13.16 million won. However, the total amount Mr. A had to repay to the banks over three years, including interest, was 28.97 million won.

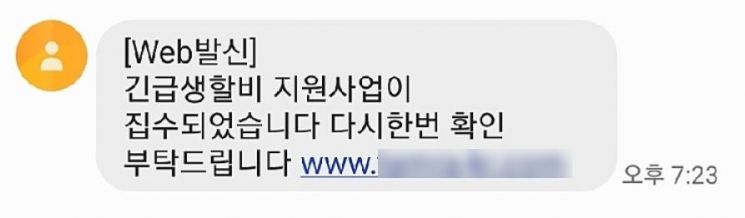

Smishing Damage Surges Amid COVID-19... Warning on 'Fake Links'

As COVID-19 spreads, smishing crimes that lure victims with 'phishing texts' such as infection confirmation, additional emergency disaster relief fund applications, and mask delivery confirmations are also rapidly increasing.

According to the National Police Agency, smishing damage cases from January to June this year totaled 251, more than three times the 83 cases during the same period last year. Last year’s total smishing damage cases were 208, already surpassed in the first half of this year.

Smishing is a combination of SMS (short message service) and phishing, referring to a crime method where clicking on a URL in a text message leads to theft of personal information.

With the rapid increase in new financial fraud damages, the FSS and the National Police Agency recently signed a 'Memorandum of Understanding for Eradicating Financial Crimes' and decided to take active measures.

The agreement includes ▲ joint promotion of effective publicity activities to prevent damage ▲ information sharing and educational support to strengthen crime response capabilities ▲ preparation of financial system improvement plans to block crime at its source ▲ and other cooperation tasks to eradicate financial crimes.

The FSS and the National Police Agency stated, "We will promptly inform the public of new financial crime methods to raise awareness and implement various preventive measures, while relentlessly pursuing criminals to protect citizens' property rights."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.