Financial Services Commission Announces 'Post-COVID Era Financial Policy Directions'

Reaffirms 'Same Function, Same Regulation' Principle to Address Financial Firms' Discrimination

System Reforms Focused on Innovation Growth, Digital Finance, Inclusive Finance, and Financial Stability

[Asia Economy Reporter Kim Hyo-jin] Financial authorities have reiterated their plan to comprehensively organize infrastructure in preparation for big tech companies' entry into the financial industry, aiming to establish a fair competition foundation between big tech and financial companies. This means ensuring regulatory fairness to prevent reverse discrimination against financial companies.

Additionally, the financial authorities plan to consider introducing a bank agency system to improve management efficiency due to the expansion of banks' non-face-to-face operations and to maintain financial accessibility for digitally vulnerable groups. The case of Japan, which utilizes post offices as agencies, is expected to serve as a reference.

On the morning of the 24th, the Financial Services Commission held the Financial Development Council (Geumbalsim) at the Seoul Government Complex in Gwanghwamun, chaired by Vice Chairman Son Byung-doo, where they announced the "Post-COVID-19 Era Financial Policy Direction" containing these details.

"Realizing 'Same Function, Same Regulation' for Big Tech and Financial Companies"

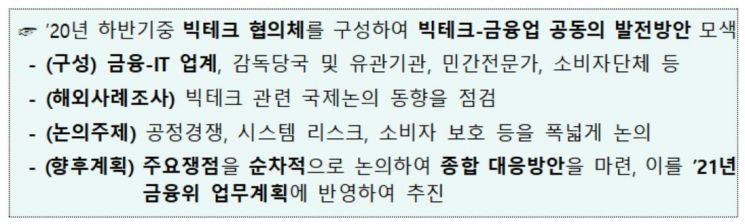

"'Big Tech Consultative Body' to be Formed Next Month to Begin Discussions"

The financial authorities stated that they will gather market opinions and investigate cases where regulatory arbitrage and fairness issues arise between big tech companies such as Naver, which are actively entering the financial industry, and existing financial companies, and improve them if necessary. Furthermore, they plan to review the regulatory system in the mid-to-long term to realize "same function, same regulation" from the perspective of financial consumers. To this end, the day before, Financial Services Commission Chairman Eun Sung-soo proposed forming a "Big Tech Consultative Body" with the heads of the five major financial holding companies next month, and discussions will continue until the end of this year to seek development plans that allow coexistence and mutual growth between both sides. The tasks derived from the consultative body will be reflected in next year's work plan and promoted, according to the financial authorities' plan.

The financial authorities also decided to establish a management system to prevent risks related to payment, security, and consumer protection that may arise from the expansion of platform channels such as big tech. In particular, they plan to establish principles that financial companies and platform companies must comply with during partnerships or collaborations and institutionalize these as model regulations by industry sector.

In line with the spread of untact (non-face-to-face) trends within the financial sector, the financial authorities plan to revise regulations related to identity verification and network separation and innovate infrastructure such as digital payment regulatory systems.

Accordingly, they intend to expand the allowance of verification methods based on digital new technologies in addition to the existing identity verification methods using identification cards. Along with this, to support the expansion of financial companies' routine telecommuting and the creation of flexible working environments, they will continuously seek ways to rationalize network separation regulations. The financial authorities plan to prepare innovation measures for authentication and identity verification systems in the third quarter of this year and rationalization measures for network separation regulations in the fourth quarter.

Moreover, the financial authorities plan to focus on nurturing new players and building data infrastructure by boldly supporting innovative fields such as big data, artificial intelligence (AI), and cloud computing. To this end, they will designate a data-specialized institution next month and announce a "Supply Chain Finance Activation Plan" in September. In October, the formal approval process for the MyData business will proceed. Additionally, they plan to establish an AI activation plan for the financial sector within this year.

"Continued Financial Support for Vulnerable Groups... Over 2.7 Trillion Won Additional Supply to Subprime Finance"

Meanwhile, the financial authorities plan to supply more than 2.7 trillion won additionally to subprime finance over the next three years to support financially vulnerable groups suffering from the aftermath of the COVID-19 pandemic. They also plan to allow financial companies to sell written-off personal claims only if future interest has been waived in advance and to limit the number of debt collection contacts to seven times per week, while allowing debtors to request restrictions on collection contacts at specific times and by specific methods.

Furthermore, the financial authorities will promote the development of mobile applications exclusively for the elderly and educational content based on financial literacy guidance to support elderly consumers who are easily excluded from financial digitalization. They also plan to provide customized services to support smooth non-face-to-face financial service use for persons with disabilities. When vulnerable groups such as the elderly attempt to trade high-risk products through non-face-to-face channels, video consultation services will be provided, and "complete sales post-monitoring" will be conducted for high-risk products traded non-face-to-face to strengthen consumer protection systems.

"Enhancing Consumer Financial Accessibility and Strategically Supporting New Growth Companies"

The financial authorities are also considering introducing a bank agency system because consumers' accessibility may decline as banks reduce branches. They are referencing Japan's system, which involves delegating all or part of a bank's operations to other entities for agency or brokerage. In Japan, currently, 73 agencies operate in collaboration with non-bank financial institutions, telecommunications, and distribution companies. The Yucho Bank (Japan Post Bank) utilizes 3,829 post offices as agencies.

In line with the goal of supporting stable growth of the real economy in the "post-COVID-19" era, the financial authorities plan to strengthen strategic financial support for companies restructuring their businesses into new growth industries and companies "returning" from overseas to Korea. Simultaneously, to revitalize the capital market, they plan to expand the sales channels of public offering funds from banks and securities firms to integrated advisory platforms and online fund supermarkets. Including this, the financial authorities plan to prepare a capital market revitalization plan within this year, containing regulatory improvement measures to strengthen asset managers' competitiveness.

The financial authorities also intend to focus on managing financial vulnerabilities exposed by the COVID-19 crisis. To suppress excessive market borrowings (such as asset-backed securities) and prevent external growth of credit finance companies, they plan to induce capital increases and strengthen autonomous liquidity risk management for individual credit finance companies. Additionally, they plan to strengthen the won liquidity ratio regulation for securities companies issuing derivative-linked securities and induce them to hold foreign currency liquidity when issuing derivative-linked securities related to overseas indices. They will also prepare measures requiring mandatory reporting to supervisory authorities if liquidity deteriorates.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)