Ahead of Next Month's P2P Act Enforcement

Increasing Burden of Stringent Business Conditions

Loan Balances of Tens of Billions per Site

Investors Could Lose All Funds Before Their Eyes

[Asia Economy Reporter Kim Min-young] It has been revealed that one-quarter of the member companies belonging to the Korea P2P Finance Association, which is composed of peer-to-peer (P2P) finance companies, are effectively in a state of business suspension. Even the companies affiliated with the P2P Association, which still hold some credibility, are reportedly feeling burdened by the stricter business conditions ahead of the implementation of the Online Investment-Linked Finance Act (P2P Act) next month and are shutting down their operations. If P2P companies close, investors may lose all their invested funds, making damage inevitable.

According to financial authorities and related industries on the 24th, a check of the websites of 46 P2P Association member companies found that 11 have either suspended operations or entered the process of closure. Company A has not handled new investment products since March, and Company B has not sold products since December last year. Company C, which started business in 2016 and is relatively well-known in the industry, also stopped launching new products after August last year. This company is currently engaged in repayment and interest payment operations for existing products. A P2P industry insider explained, “Ahead of the P2P Act enforcement, with the appointment of compliance officers, strengthened capital requirements, and submission of audit reports, the business environment is becoming increasingly stringent, leading to more companies shutting down.”

Some Only Conduct Debt Collection After Closure Notice

Company D has even announced its closure. In an announcement last April, the company stated that due to ongoing management difficulties, it would return its loan business registration certificate to the Financial Supervisory Service. The company said in the notice, “All loan business functions except for the collection of existing loans will be suspended, and the closure process will effectively proceed.”

The problem is that when P2P companies close while loan balances ranging from several hundred million to several billion won remain, investors may suffer full principal losses. Some companies that have suspended operations continue loan repayment tasks to prevent investor damage, but many cases lead to delinquency due to lack of collection efforts.

In the case of Company D, the loan balance is about 2.6 billion won, and it has publicly announced a 100% delinquency rate. This means that no repayments on existing loans are being made at all.

There are also companies that have announced a 0% delinquency rate. However, this is due to selling receivables overdue by more than 30 days to collection agencies, which makes it appear as if there are no delinquencies, but industry insiders say investors are still incurring losses.

Adding to the distrust even among association members, the market is flooded with about 240 companies, making it impossible to even grasp the insolvency and closure possibilities of non-member companies.

About 200 Non-Member Companies Flood the Market

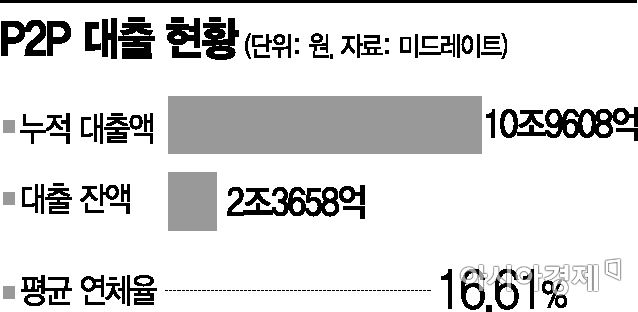

According to P2P statistics firm Midrate, as of this date, the cumulative loan amount reaches 10.9608 trillion won, and the outstanding loan balance is 2.3658 trillion won. The average delinquency rate has reached 16.61%, more than tripling compared to 5.5% at the end of 2017 over two and a half years.

Financial authorities have demanded that all P2P companies submit audit reports by the 26th of next month and have urged investors to exercise caution. This is to check whether there are more cases like ‘Nexpun’ and ‘Popfunding,’ which have recently been investigated by the police or had executives arrested for fabricating loan receivables to embezzle investment funds or engage in ‘Ponzi schemes.’

P2P loans place the responsibility for investment results on the investors. P2P companies create platforms that connect investors and borrowers and earn fees from both sides.

The financial authorities stated, “Investors should be cautious, especially with companies offering investor loss compensation, excessive rewards, or high returns, as these are more likely to involve mis-selling and poor-quality loans.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.