Hana Financial Research Institute 'Overseas Regulatory Trends Following Big Tech's Entry into Finance' Report

Global Financial Supervisory Authorities and Major Countries Minimize Financial System Risks

[Asia Economy Reporter Jo Gang-wook] Amid intensifying controversy over reverse discrimination related to the entry of giant IT companies, known as Big Tech, into the financial industry, overseas financial authorities have already established various regulations to prevent market monopolization by Big Tech. Accordingly, there are calls within South Korea to recognize the limitations of unfair regulations between large platforms and financial companies and to urgently supplement regulations to prevent financial consumer harm.

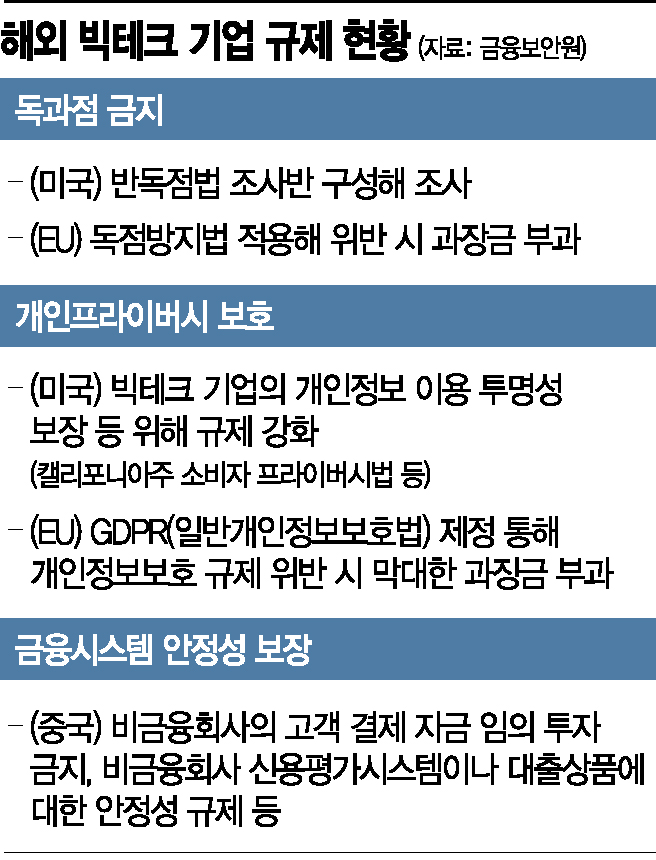

According to the report titled "Overseas Regulatory Trends Following Big Tech's Entry into the Financial Industry," released on the 24th by Hana Financial Management Research Institute, financial authorities in major countries such as the United States, the European Union (EU), and China are preparing new regulatory measures due to concerns about 'new monopolies and oligopolies' like data monopolization by massive IT companies as Big Tech enters the financial market. They emphasized the principle of "same functions, same regulations" and highlighted the need for institutional mechanisms that allow fair competition between Big Tech and financial companies.

In fact, the EU and the United States are sanctioning Big Tech's anti-competitive financial market product launches through amendments to "competition law modernization." Additionally, the Financial Stability Board (FSB) has recognized unfairness in data sharing and authority between Big Tech and financial companies and recommended the reestablishment of related regulations. China has established "NetsUnion" to ensure that clearing transactions between Big Tech and banks occur at a single clearinghouse, thereby enhancing the transparency of Big Tech's payment platforms.

Along with this, the report forecasts that regulations on Big Tech's data utilization will strengthen in the future, starting with Germany, which prohibits Facebook from combining data collected from other institutions. Already, the Group of Seven (G7) countries, including the United States, Germany, and Japan, have agreed on principles for imposing digital taxes on multinational corporations. Japan has also prepared a new digital law requiring giant IT companies to regularly report transaction information.

The report points out that the reason global financial supervisory bodies and major countries are shifting toward strengthening regulations on Big Tech due to unfairness and monopolistic issues arising from Big Tech's entry into the financial sector is that if different regulations are applied to Big Tech, which performs banking operations, than to financial companies, and financial system risks are not minimized, a global financial crisis could occur. Since Big Tech has entered the financial industry without separately acquiring a financial license, it remains in a regulatory blind spot for various financial regulations, unlike banks that are subject to stringent supervision.

Accordingly, there are calls within South Korea to recognize the limitations of unfair regulations between large platforms such as Kakao and Naver and financial companies and to supplement regulations to prevent financial consumer harm.

Ko Eun-ah, senior researcher at Hana Financial Management Research Institute and author of the report, emphasized, "As the domestic MyData industry fully develops, the boundaries between financial and non-financial companies will become unclear, intensifying competition and continuing controversy over reverse discrimination," adding, "As the market size of Kakao Pay and Naver Pay grows, prepaid charging funds are also rapidly increasing, making it urgent to establish consumer protection regulations that can safely guarantee consumers' funds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.