[Asia Economy Reporter Kwangho Lee] It is advantageous to replace old electronic products this year. It will become easier for foreign key talents to find employment in Korea. The simplified taxation system, a long-standing wish of self-employed individuals, will be expanded for the first time in over 20 years, significantly reducing the tax burden on small-scale individual business owners. Seasoning liquors will be excluded from liquor taxation, allowing more people to enjoy affordable 'matsul' (seasoned cooking wine).

The Ministry of Economy and Finance distributed the 'Top 10 Tax Law Amendments Closely Related to Citizens' Lives and Businesses' as part of the '2020 Tax Law Amendment' announced on the 22nd.

The top 10 include ▲Reduction of VAT burden for small-scale individual business owners ▲Expansion of customized tax support for voluntary corporate investment ▲Relaxation of tax support criteria for domestic return companies ▲Tax support for patent investigation and analysis costs for SMEs ▲Expansion of reasons for issuing revised import tax invoices ▲Exclusion of seasoning liquors from liquor taxation ▲Increase in credit card income deduction limits ▲Relaxation of tax support for Individual Savings Accounts (ISA) ▲Support for employment of foreign key talents in Korea ▲Disclosure of income tax sample data.

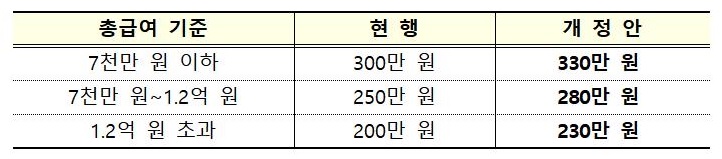

First, if you consume now, your year-end tax refund will increase. To counteract the consumption slump caused by the COVID-19 pandemic, the government has raised the income deduction limit for credit cards (including debit/prepaid cards and cash receipts), which is divided by total salary brackets, by 300,000 KRW in all brackets for this year only, allowing a maximum deduction of up to 3.3 million KRW. In other words, consumers planning to replace expensive electronics such as old TVs or refrigerators should consider doing so now.

Also, the tax support requirements for the smart ISA account have been relaxed, allowing anyone aged 19 or older residing in Korea to join even without earned income. Previously, some inquired about ISA due to its high yield (about 6.8%) but were rejected because they were classified as retirees or hesitated to join due to funds needed for marriage, but now residents aged 19 or older can easily enroll.

In particular, the simplified taxation system, a long-standing wish of self-employed individuals, will be expanded from an annual sales threshold of 48 million KRW to 80 million KRW for the first time in over 20 years, significantly reducing the tax burden on small-scale individual business owners. For example, Mr. A, a general taxpayer running a Korean restaurant with annual sales of 53 million KRW, paid 1.22 million KRW in VAT, but going forward, he will switch to simplified taxation and pay only 390,000 KRW in VAT, reducing his tax by 830,000 KRW compared to the current system.

Furthermore, investment tax credits will be integrated and simplified, greatly expanding the range of assets eligible for tax support, and incentives for increased investment and new industry investments will be strengthened. Currently, Company B mostly invests in facilities that do not fall under nine specific categories due to the nature of its business and thus could not apply for investment tax credits despite significant investments. After the amendment, business assets will generally be included in the investment tax credit scope, allowing Company B to apply for the credit.

Tax support criteria for domestic return companies (U-turn companies) will also be relaxed, allowing tax reductions on income from expanded domestic business sites when returning to Korea by expanding domestic operations. Previously, a 40% reduction in overseas production volume disqualified companies from tax reductions, but now they will be included.

An official from the Ministry of Economy and Finance said, "(The 2020 Tax Law Amendment) prioritizes support for overcoming COVID-19 damage and stabilizing people's livelihoods."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.