2020 Tax Reform Bill

Top Income Tax Rate Soars to 45%...Loses 'Justification and Practicality' Without Social Consensus

Is the Reduction of Securities Transaction Tax Easing the Burden on Ordinary Citizens?

Need to Reduce Exempt Taxpayers to Achieve Universal Taxation

Effectiveness of Expanding Investment Tax Credit Also Questioned

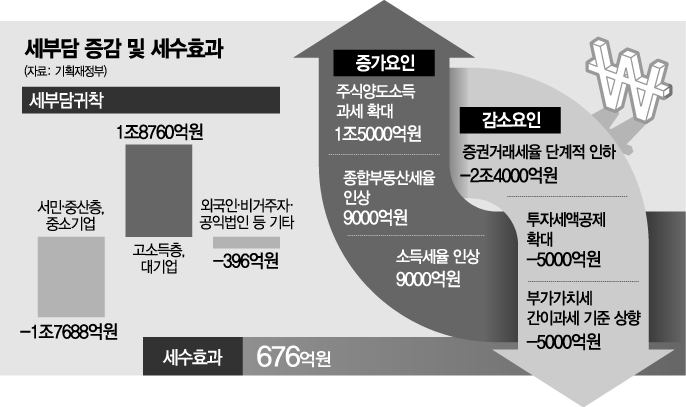

[Asia Economy reporters Kwangho Lee, Sangdon Joo (Sejong), and Sehee Jang] The government raised the top income tax rate through the '2020 Tax Law Amendment' announced on the 22nd, citing the reason as strengthening 'social solidarity.' This term not only explains the increase in the top income tax rate but also reflects the overall tone of the tax amendment, which is 'taxing the rich more and reducing taxes for the ordinary citizens.' The rationale is that it is 'fair taxation' to collect more from the wealthy who have the capacity to pay taxes and less from ordinary citizens vulnerable to the impact of COVID-19.

However, experts generally view this government stance negatively. Some even say it has lost both 'justification' and 'practicality.' The increase in the top income tax rate undermines the government's long-held principle of 'broad tax base, low tax rates,' and since there was insufficient social consensus, it is difficult to find justification. Moreover, the actual tax revenue effect is minimal, so the practical benefit is not significant. Additionally, since most of the tax relief for ordinary citizens comes from the reduction of the securities transaction tax, it is also problematic to view this tax amendment as reducing the tax burden on ordinary citizens.

◆Top Rate Raised to 45% While Keeping 39% Exempt Taxpayers... "Clear Tax Increase on the Wealthy"= The government introduced a new tax bracket for taxable income exceeding 1 billion KRW and raised the top tax rate to 45% through this tax amendment. Accordingly, the top rate, which was 38% from 2014 to 2016, increased to 40% in 2017, 42% in 2018, and will be 45% in 2021. First, Professor Woochul Kim of the Taxation Department at University of Seoul pointed out that the top rate increase is too sudden. He said, "About 16,000 people will pay income tax at the top rate, but since this was done without prior discussion, it inevitably feels unilateral, and this is ultimately a tax increase on the wealthy," adding, "Since there was no social consensus, this tax reform has lost both justification and practical benefit (additional tax revenue of 900 billion KRW from the top rate increase)."

The Taxpayers Federation pointed out that to maintain the principle of a broad tax base and low tax rates, universal taxation should be realized by reducing the 39% of taxpayers who are exempt rather than increasing taxes on the wealthy. According to the National Tax Service’s National Tax Statistics Yearbook, among 18.58 million workers who filed year-end income tax settlements for 2018, 7.22 million (38.9%) were below the taxable threshold with no tax liability.

◆Tax Relief for Ordinary Citizens and Small Businesses Lacks Impact= Experts also expressed concerns that the other pillar of this tax amendment?relief for ordinary citizens, small business owners, and small enterprises?has limited effectiveness. Professor Sangbong Kim of Hansung University’s Department of Economics said, "From the income tax perspective, since only the top rate was raised, I am not sure if this tax amendment is really for ordinary citizens," adding, "There is no data on how much the tax burden has been reduced from the income tax side."

Concerns were also raised about raising the VAT exemption threshold for simplified taxpayers from an annual sales of 30 million KRW to 48 million KRW to support ordinary citizens and small businesses. Professor Woohyung Hong of Hansung University’s Department of Economics said, "This will increase the number of exempt taxpayers by 340,000, which is excessive in terms of not taxing them," adding, "For example, in the case of gas stations, sales may be high but profit margins low, so using sales as the criterion for exemption is problematic." He also viewed the special tax reduction for small businesses as ineffective. He said, "Investment tax credits mostly target small businesses, but companies that invest and see investment effects are not small businesses but at least mid-sized or larger," advising, "If the goal is to stimulate investment through investment tax credits, it should be designed to apply universally to all companies."

◆Ultimately 'Stock Tax Cuts'... "Capital Gains Basic Deduction of 50 Million KRW Is Excessive"= The government decided to impose capital gains tax on financial investment income starting in 2023, while providing a basic deduction of up to 50 million KRW for gains from domestic stocks and public offering funds. Initially, only domestic stocks were to have a 20 million KRW deduction, but this was expanded to 50 million KRW and funds were included as well. There are criticisms that the size of the basic deduction is excessive. Professor Hong said, "If a deduction of up to 50 million KRW is given, people earning more than those working at large corporations may not pay taxes, which could cause issues with tax fairness," expressing concern that "the securities transaction tax will also be reduced by 0.02 percentage points next year, making a shortfall in tax revenue inevitable." Professor Sangbong Kim added, "Capital gains tax can only be collected when profits exceed 50 million KRW, so collecting tax based on probability is ironic."

The Taxpayers Federation pointed out that raising the basic deduction for stock capital gains to 50 million KRW is an excessive benefit compared to other income types. Instead, they suggested abolishing the basic deduction and lowering the current 20% tax rate or maintaining the original basic deduction threshold of 20 million KRW.

Ultimately, the decrease in tax revenue due to the financial tax reform is likely to lead to tax increases in other areas. Professor Woochul Kim said, "The government's position that 'this is not a tax increase but neutral' is numerically correct, but the largest part of the reduced tax burden is from the securities transaction tax, which is hard to see as tax relief for ordinary citizens," adding, "It seems meaningless to increase income tax to offset stock tax cuts." Professor Taeyoon Sung of Yonsei University’s Department of Economics also said, "It seems difficult to secure funding for expanded fiscal spending through the top rate increase alone," suggesting, "It is better to move toward universal taxation by reducing or increasing overall deduction rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.