Bank of Korea Holds Base Rate at 0.50% Annually

Downgrade of August Growth Forecast Inevitable

Surging Asset Prices Due to Excess Liquidity

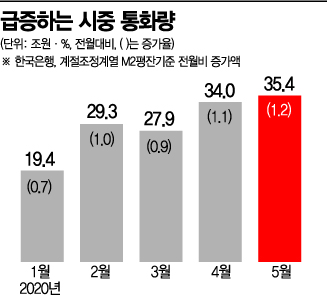

May's Money Supply at 3,053.9 Trillion KRW... Increased by 35.4 Trillion KRW in One Month, Largest Monthly Increase

Released Funds Flow into Real Estate and Stock Market... "Making Additional Liquidity Supply Difficult"

Exports Still Negative Compared to Last Year

Employment Decline Continues for Four Consecutive Months

Economic Impact of COVID-19 Persists, Judged Too Early to Withdraw Liquidity

Unless a Second Major COVID-19 Outbreak or Sharp Economic Rebound Occurs

Interest Rate Adjustment This Year Seems Difficult

[Asia Economy Reporters Eunbyeol Kim, Jehng Sehee] The Bank of Korea (BOK) kept the base interest rate at 0.50% per annum on the 16th and forecasted that this year's economic growth rate will fall short of the previously projected -0.2%. Domestic consumption has somewhat revived, but the decline in exports has slowed the pace of economic recovery. The sluggish employment situation was also cited as a reason why this year's growth rate is expected to fall below projections.

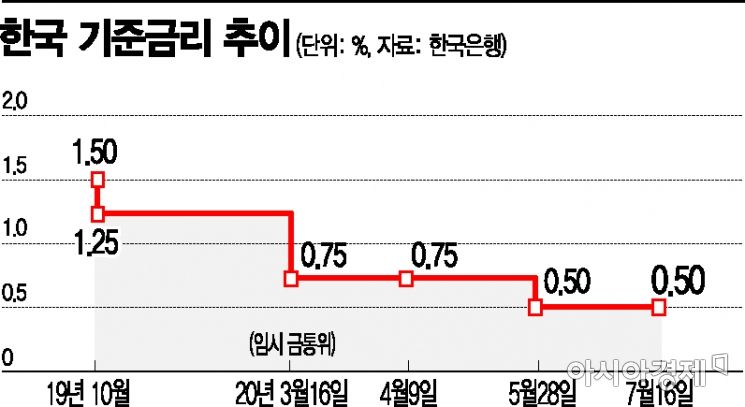

The Monetary Policy Board of the BOK held a meeting chaired by Governor Lee Ju-yeol on the 16th and decided to keep the base interest rate at 0.50% per annum. Previously, on May 28, the Board had lowered the base rate from 0.75% to a record low of 0.5%. This decision is interpreted as maintaining a low interest rate stance for the time being amid delayed economic recovery in the second half due to COVID-19 and increasing external uncertainties.

Governor Lee stated, "While restrictions on economic activities have eased and private consumption rebounded thanks to government support measures, exports continued to decline and construction investment adjusted," adding, "Facility investment recovery was also constrained, resulting in a continued sluggish trend." He also reported that employment remained weak with a significant decrease in the number of employed persons. Furthermore, he said, "Facility and construction investments are expected to show a gradual improvement, but consumption and export recovery are anticipated to be somewhat slower than initially forecasted," and "The growth rate for this year is expected to fall below the May projection of -0.2%."

Consumer price inflation and core inflation are expected to remain in the low single digits. This is a downward revision from the May monetary policy statement, which forecasted consumer price inflation in the low single digits and core inflation in the mid-single digits. The decline in international oil prices and low inflationary pressure from the demand side were cited as causes.

On the morning of the 16th, Lee Ju-yeol, Governor of the Bank of Korea, presided over the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul, and struck the gavel.

On the morning of the 16th, Lee Ju-yeol, Governor of the Bank of Korea, presided over the Monetary Policy Committee meeting held at the Bank of Korea in Jung-gu, Seoul, and struck the gavel.

However, concerns were raised that the overflowing liquidity is only inflating asset prices such as real estate, and due to the effective lower bound, the BOK could not lower the base rate further. On this day, the BOK expressed concern over the recent rise in housing prices and the sharp increase in household loans. Governor Lee said, "The scale of household loan increases expanded significantly compared to the previous month, and housing prices rose in both the metropolitan area and provinces."

The BOK's decision to hold rates also reflects a policy mix related to the government's real estate stabilization measures. On the 10th, Deputy Prime Minister and Minister of Economy and Finance Hong Nam-ki indirectly stated that the BOK's rate cuts had influenced the rapid rise in real estate prices and that further cuts should be avoided. Another reason for holding rates is to observe the effects of the third supplementary budget execution. However, the BOK is closely monitoring the possibility that increased issuance of deficit government bonds due to the supplementary budget could push up government bond yields. After the May Monetary Policy Board meeting, Governor Lee said, "We are closely watching the possibility of market instability if a large amount of government bonds is issued," and "If long-term interest rates fluctuate, we will actively purchase government bonds to stabilize the market."

Professor Kim Soyoung of Seoul National University's Department of Economics said, "As COVID-19 prolongs, export, investment, and employment indicators are all deteriorating," adding, "Downward pressure on the economy is increasing, making it inevitable for the BOK to revise down its initial growth forecast of -0.2%." The BOK is expected to lower its growth forecast in the revised economic outlook next month.

Assets Soared Due to Low Interest Rates... "Not Yet Time to Withdraw Money"

The BOK's Monetary Policy Board cut rates sharply twice in the first half of this year. In March, amid financial market turmoil, it executed a 'big cut' from 1.25% to 0.75%, and in May, it lowered the rate by an additional 0.25 percentage points.

Following the rate cuts, the money supply in the market surged. In May, the broad money supply (M2, seasonally adjusted average balance) reached 3,053.9 trillion KRW, increasing by 35.4 trillion KRW (1.2%) in one month. This is the largest monthly increase since related statistics began in 1986. M2 includes cash, demand deposits, money market funds (MMFs), and other short-term financial products that can be quickly converted into cash, serving as a broad monetary indicator. When households and companies take out loans, the cash deposited in their accounts is counted in M2. Considering the sharp increase in household loans in June, the money supply is expected to rise further. Due to excess liquidity, the 'real money gap rate' reached the 8% range in the first quarter, meaning the money supply in circulation was more than 8% above the appropriate level.

The asset market is rising based on this abundant liquidity. While low interest rates are not the sole cause, the correlation is widely acknowledged. The nationwide housing price composite index compiled by KB Live On was 102.4 last month, up 2.2% from 100.2 at the end of last year. The stock market has also recovered to pre-COVID-19 levels, with investor deposits (excluding on-exchange derivatives deposits) reaching a record high of 50.5095 trillion KRW on the 26th of last month.

Professor Sung Tae-yoon of Yonsei University's Department of Economics said, "The central bank does not base its policy solely on real estate, but with housing prices surging in some parts of Seoul, it is true that additional liquidity supply is difficult," adding, "If rates are lowered further, funds flowing through corporations despite government loan regulations could be channeled into real estate."

However, Monetary Policy Board members judge that it is not yet time to withdraw funds. According to the Ministry of Economy and Finance and Statistics Korea, the number of employed persons in June decreased by 352,000 compared to the same month last year, marking the fourth consecutive month of decline. Exports are showing signs of recovery but remain negative compared to last year. The consumer price inflation rate in June was 0%, far below the inflation target of 2%.

Low Possibility of Additional Rate Cuts This Year... Challenge Is to Channel Idle Funds into Productivity

Experts expect the BOK to keep rates unchanged until the end of this year. Unless there is a dramatic event such as a second major COVID-19 outbreak or a V-shaped economic rebound, adjusting rates will be difficult. Lee Sae-min of Hana Bank Financial Investment Research Institute said, "The corporate bond and commercial paper markets have stabilized, and real economic recovery requires a long time," adding, "Even if rates are cut further, it will be difficult to achieve effects, so lowering rates further is unlikely." However, she noted that the situation in the U.S. could be a variable. If COVID-19 cases surge in the U.S. and the Federal Reserve adopts yield curve control (YCC) or negative interest rates in response, the BOK might have room to act. Oh Chang-seop, a researcher at Hyundai Motor Securities, also said, "There is a consensus that the BOK will keep rates unchanged through the end of the year."

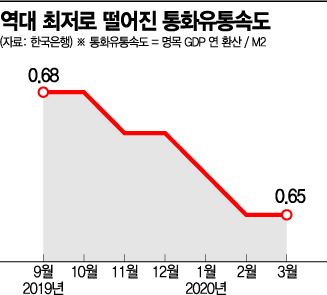

The challenge is to guide the large idle funds to flow into productivity-enhancing areas. The velocity of money circulation, calculated by nominal GDP, fell to 0.65 in March, the lowest since the BOK began compiling money supply data in December 2001. The velocity of money circulation measures how many times a unit of money is used in transactions over a certain period, and this decline indicates that economic vitality is weakening and money is not flowing into consumption or investment.

Professor Lee In-ho of Seoul National University's Department of Economics pointed out, "The problem is that even if interest rates are lowered, the economy is not moving at all," adding, "The Monetary Policy Board is adjusting rates, but it is essentially ineffective, and the funds raised at the lowered rates are not leading to (productive) investment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)