Speeding Up Business Structure Reorganization Amid Ultra-Low Interest Rates

Strengthening Asset Management Through Aggressive Organizational Restructuring

Shift of Sales Focus from 'Fund' to 'Bancassurance'

[Asia Economy Reporter Kim Hyo-jin] An employee in charge of wealth management (WM) at a major city bank in A has recently been in 'intensive study' mode. This is because he must complete video courses prepared by the company to provide customers with high-quality 'comprehensive wealth management portfolios' covering both deposit and non-deposit products. He said, "A lot of study is especially needed on various types of investment products scattered throughout the market, and on how to link these products with the bank's existing products and the techniques involved." He added, "Not only do I have to confirm course completion, but I also have to submit a feedback-style report on the course to my department head, so it takes a considerable amount of time and effort."

Recently, B city bank launched a large-scale tiered education program for acquiring WM professional qualifications at beginner, intermediate, and advanced levels. The goal is to train as many WM-related personnel as possible as 'specialists.' B bank also established an advanced WM expert training course requiring several months of dispatched education to encourage employee participation. A B bank official said, "For employees who were immersed in their respective duties, this is quite a challenge," but added, "The financial market landscape is changing, and the bank's management policy is also evolving, so there is particularly strong interest among younger employees."

In an era where it has become difficult to sustain traditional interest income due to the aftermath of the novel coronavirus disease (COVID-19) and the ultra-low interest rate environment, major financial groups and banks are striving to fundamentally 'restructure' their business models centered on WM, breaking away from their existing sales structures.

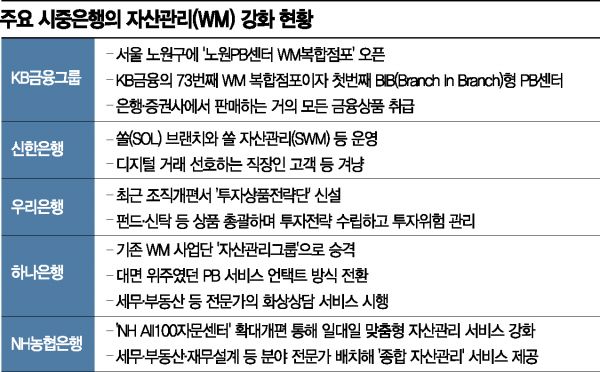

According to the financial sector on the 16th, KB Financial Group recently opened the 'Nowon PB Center WM Complex Branch' in Nowon-gu, Seoul. It is KB Financial's 73rd WM complex branch and the first 'BIB (Branch In Branch) type PB center.' Customers can access almost all financial products sold by existing banks and securities firms. Shinhan Bank operates the SOL Branch and SOL Wealth Management (SWM). The SOL Branch supports wealth management for customers who prefer digital channel transactions or find it difficult to visit branches, such as office workers. SWM is a wealth management service mainly for high-net-worth customers who primarily use digital channels. Woori Bank recently established an Investment Product Strategy Team through organizational restructuring. This team oversees asset management products such as funds and trusts, formulates various investment strategies, and manages investment risks.

Hana Bank upgraded its existing WM business unit to the 'Asset Management Group' and expanded its contact points by converting the primarily face-to-face Private Banker (PB) service to a non-face-to-face (untact) method. It also provides video consultation services through experts in various fields such as taxation and real estate. NH Nonghyup Bank expanded and reorganized the 'NH All100 Advisory Center' to strengthen one-on-one customized asset management services. The center is staffed with experts in various asset management fields, including tax accountants, real estate specialists, and financial planners.

Although banks are putting considerable effort into the WM sector, the market environment is not easy. The financial investment market has become severely frozen due to successive fund accidents such as overseas interest rate-linked derivative-linked funds (DLF) and the Lime Asset Management incident. The contraction of the private fund market is particularly noticeable. According to the Korea Financial Investment Association, as of the end of May, the private fund sales balance of 16 major city banks was 22.5495 trillion won, shrinking by 5.9458 trillion won compared to a year earlier. Compared to a month ago, it decreased by about 830 billion won, and looking at the first five months of this year alone, it declined by about 2.8 trillion won.

As a result, banks seem to be drastically reducing their fund sales divisions while strengthening bancassurance (bank-linked insurance) divisions. A representative from a city bank said, "The fund division, especially the private fund division, has entered a management mode with only minimal personnel remaining," adding, "The personnel remaining in the fund division are being intensively deployed to bancassurance sales." According to the Life Insurance Association, as of April, the initial insurance premiums for bancassurance by 24 domestic life insurance companies amounted to 1.8527 trillion won, a 24.1% increase compared to April last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.