Falling Out of Samsung Electronics' Top Personal Net Purchase Stocks Since Last Month

Bio and Untact Fill the Gap... Popularity of 'Trend Stocks'

Quick-Moving Retail Investors... Switching Between Inverse and Leverage in Short Periods

[Asia Economy Reporters Juyoun Oh, Minwoo Lee] Individual investors, often called 'ants,' are recently changing their trading behavior. Unlike in March when the 'Donghak Ant Movement' gained momentum and they focused on buying the leading stock Samsung Electronics, their attention has shifted to bio and untact (non-face-to-face) 'trend stocks' such as SK Biopharm and NAVER. In the case of leveraged and inverse products that track index rises or falls, they are responding short-term to prepare for volatility.

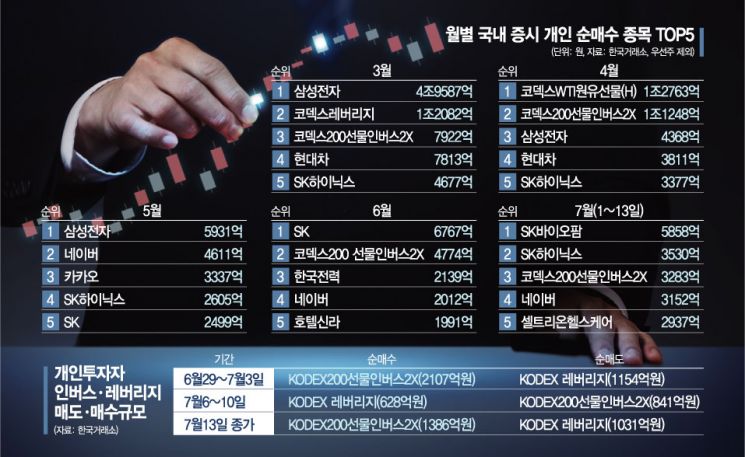

According to the Korea Exchange on the 14th, individual investors have net purchased Samsung Electronics worth 23.4 billion KRW so far this month until the previous day. This ranks 27th among individual net purchase stocks in the domestic stock market. This is the second time this year, following last month, that Samsung Electronics did not rank in the top 5 for individual net purchases. In the previous month, it did not even appear in the top net purchase stocks. Rather, it was the second highest in individual net sales with 503.4 billion KRW sold. Despite being the undisputed number one in market capitalization and showing an 'earnings surprise' with operating profit of 8.1 trillion KRW in Q2, up 22.7% year-on-year, individual investors' interest has cooled. This contrasts with March when it achieved a record net purchase of 4.9587 trillion KRW and consistently ranked in the top 3 for individual net purchases every month since the beginning of the year.

The gap left by Samsung Electronics has been filled by trend stocks such as bio and untact sectors. Last month, the top individual net purchase stock was SK, the holding company of the SK Group. Individual investors, buoyed by expectations ahead of the SK Biopharm subsidiary's IPO, net purchased a total of 676.7 billion KRW. Continuing this trend, SK Biopharm, which was listed on the 2nd of this month, ranked first with 585.8 billion KRW in individual net purchases. NAVER, considered a representative untact stock based on various online platforms from shopping to finance and payments, began appearing in the rankings from May. At that time, it ranked second with 461.1 billion KRW net purchases, following Samsung Electronics. Since then, individual buying momentum continued with 201.2 billion KRW in fourth place last month and 315.2 billion KRW in fourth place this month (as of the 13th). On the 10th, NAVER surpassed 300,000 KRW for the first time ever, setting a new high.

Individual investors' heightened sensitivity in investment responses is also clearly reflected in exchange-traded funds (ETFs) that track indices. When investing in leveraged ETFs that profit from index rises or inverse ETFs linked to index falls, the usual holding period was about a month in the same direction, but recently this cycle has shortened to a weekly basis. As the KOSPI fluctuates between 2100 and 2200 points, individuals tend to bet on rises one week and falls the next.

From the 29th of last month to the 3rd of this month, the stock most purchased by individuals was 'KODEX200 Futures Inverse 2X,' with net purchases worth 210.7 billion KRW over the week. During this period, the KOSPI rose 2.81% from 2093.48 to 2152.41. Expecting a decline after the rise, they accumulated inverse ETFs. Conversely, they sold 115.4 billion KRW worth of KODEX leveraged ETFs.

From the 6th to the 10th of this month, as the KOSPI broke through the 2200 mark, they sharply switched to leveraged ETFs. During this period, they net purchased 62.8 billion KRW of KODEX leveraged ETFs and sold 84.1 billion KRW of KODEX200 Futures Inverse 2X, responding oppositely to the previous week. On the 10th, when the index closed lower, they net purchased 70.2 billion KRW worth of leveraged ETFs in a single day. On the next trading day, the 13th, as the index rebounded more than 1%, KODEX leveraged ETFs rose 3.84%. On the day of the sharp rise, individuals again bought inverse ETFs. Based on the closing price on the 13th, individuals sold 103.1 billion KRW of KODEX leveraged ETFs to realize profits, while buying 138.6 billion KRW of KODEX200 Futures Inverse 2X to prepare for a downturn reversal.

It is expected that individuals will likely continue this trading behavior for the time being. Currently, as the market is in a volatility phase without a clear direction, they take short buy and sell positions to realize profits as they come. Sangyoung Seo, a researcher at Kiwoom Securities, said, "Early this week, the increase in COVID-19 cases and China's import-export statistics, midweek the US Q2 earnings announcements, and late week the European Union (EU) summit are scheduled, which will increase volatility," adding, "It will be a week with many changing factors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)