In 2016, China unofficially imposed a ban on the Korean Wave (Hallyu) in response to the deployment of the Terminal High Altitude Area Defense (THAAD) system on the Korean Peninsula. Many domestic companies that had entered the Chinese market suffered significant losses as their access was blocked. However, with recent improvements in the atmosphere between South Korea and China, expectations for the lifting of the ban have increased. China, with a population of 1.4393 billion, is one of the largest markets in the world. For export-driven South Korea, it is an essential market. South Korea's media and entertainment industries are considered key drivers of the Korean Wave. Re-entering the Chinese market is expected to bring significant growth in these sectors. Asia Economy evaluates the potential for a resurgence of Studio Dragon and JYP Entertainment, two companies in the media and entertainment sectors expected to benefit the most from the lifting of the ban.

[Asia Economy Reporter Yoo Hyun-seok] JYP Entertainment (JYP Entertainment) recorded high growth every year after the debut of the girl group 'TWICE,' but this year, growth was hindered by the novel coronavirus disease (COVID-19). This was because it became difficult to hold concerts, which account for a large portion of their revenue. However, the success of a new girl group and the lifting of the ban are expected to prevent further deterioration.

◆ JYP Entertainment Leapt After TWICE's Debut... "Will It Happen Again?"

Compared to boy groups, girl groups find it relatively difficult to form fandoms. As a result, their concert drawing power is weaker. This is one reason why girl groups are considered less profitable than boy groups. However, TWICE, a girl group under JYP Entertainment, is an exception. As of the 3rd (based on Gaon Chart shipments), TWICE's total domestic album sales have exceeded 5.26 million copies, from their debut album 'THE STORY BEGINS' released in October 2015 to their recent work 'MORE & MORE.' In Japan, the total shipment volume of their nine albums released so far is 3.57 million copies. The cumulative sales in Korea and Japan reach 8.8 million copies. 'MORE & MORE' also set a record for the highest sales by a girl group, surpassing 563,000 copies in cumulative sales.

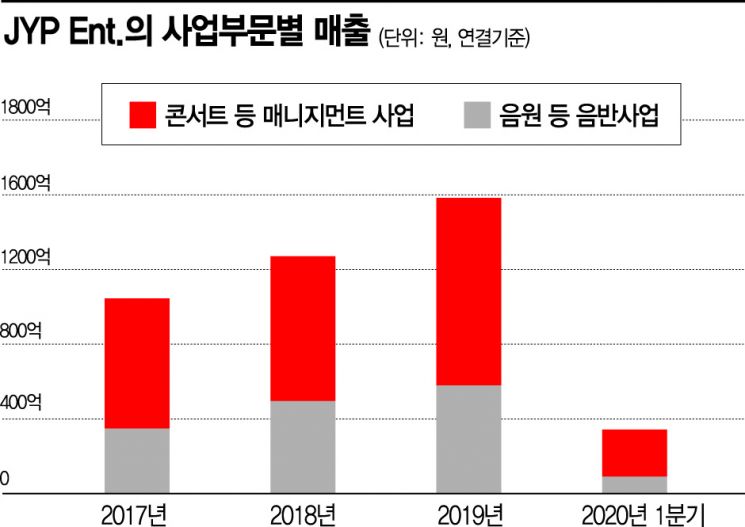

The improvement in performance was also remarkable. TWICE debuted in October 2015. That year, JYP Entertainment's sales were 50.6 billion KRW, with an operating profit of 4.2 billion KRW. However, in 2016, sales reached 73.6 billion KRW, and operating profit rose to 13.8 billion KRW. Sales increased by 45.7%, and operating profit surged by 228.9% compared to the previous year. In 2017, sales surpassed 100 billion KRW, and last year, sales reached 155.4 billion KRW with an operating profit of 43.5 billion KRW, showing rapid growth every year. Along with strong performance, the financial structure is stable. The debt ratio, which was 45.1% in 2017, steadily maintained mid-20% levels at 24.5% in 2018 and 28% in 2019. Additionally, the reliance on short-term borrowings is below 1%.

The first quarter of this year recorded strong results. Sales were 34 billion KRW, and operating profit was 13.4 billion KRW, increasing by 28.9% and 132.3%, respectively, compared to the same period last year. Specifically, sales from concerts and appearance fees in the management business decreased, but other revenues such as image rights increased by about 10 billion KRW. Securities analysts interpret this as high sales related to the Japanese fan club.

Expectations for JYP Entertainment are rising with the emergence of a new girl group. The rookie girl group 'NiziU' is the protagonist. NiziU was created through the 'Nizi Project,' a collaboration between JYP Entertainment and Sony Music, Japan's largest record company. Their pre-debut digital mini-album 'Make you happy,' released on the 30th of last month, ranked first on Japan's Oricon weekly chart. The explosive initial response has raised expectations, with comparisons to TWICE. Lee Ki-hoon, a researcher at Hana Financial Investment, explained, "Various news and indicators related to NiziU, expected to debut in the fall, are pouring in, and it feels familiar, just like when we saw TWICE three years ago."

◆ Outlook Gloomy Due to COVID-19... But What If the Ban Is Lifted?

Although the first quarter recorded strong results, the outlook for this year is not bright. According to FnGuide, securities firms forecast consolidated sales of 144 billion KRW and operating profit of 40.7 billion KRW for this year. This represents a decrease of 7.3% in sales and 6.4% in operating profit compared to the previous year. These figures also represent a sharp decline from the forecasts six months ago, which were 176.9 billion KRW in sales and 47.3 billion KRW in operating profit. This is because activities such as concerts, which constitute a large part of a singer agency's business, cannot be held due to COVID-19. Especially for JYP Entertainment, this is disappointing as it was a time when global digital content sales were increasing, and monetization of rookie singers like the girl group 'ITZY' and new idol projects were becoming visible.

Meanwhile, expectations for the lifting of the ban remain high. Some domestic celebrities have been selected as models for Chinese local companies, and Chinese travel companies have been selling Korean tourism products. Also, in May, President Moon Jae-in had a phone call with Chinese President Xi Jinping and agreed to promote Xi's visit to Korea within the year. The industry interprets Xi's visit as the point when the lifting of the ban will be officially announced. Hana Financial Investment also projected that if tours such as concerts resume, JYP Entertainment's annual operating profit could easily exceed 60 billion KRW with the easing of the ban, compared to 50 billion KRW currently.

Researcher Lee Ki-hoon said, "In the case of JYP Entertainment, GOT7 had high recognition in 2016, but TWICE was only in its second year after debut, so it is safe to say that there was almost no revenue from China. Therefore, it is difficult to estimate the potential for sales growth if the ban is eased," adding, "However, they plan to debut a Chinese boy group in 2021, so the growth potential depending on the success variable is quite high."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.