COVID-19 Shock Mitigation and Recovery Uncertain

Increases in China, US, Vietnam; Decreases in Japan, etc.

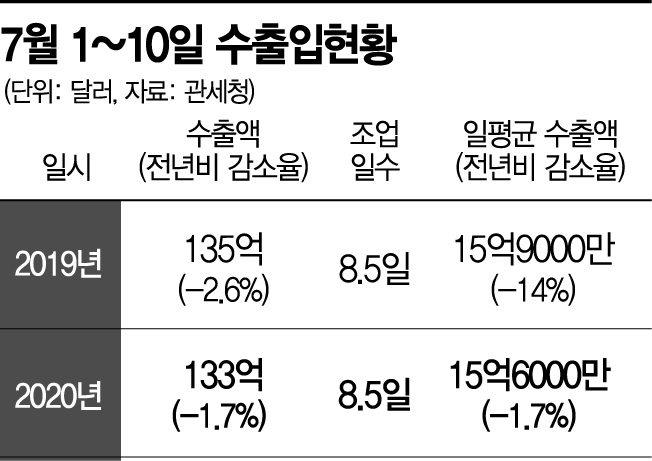

[Asia Economy Reporter Moon Chaeseok] Due to the impact of the novel coronavirus infection (COVID-19), exports in the third quarter also started in the negative. Export value from the 1st to the 10th of this month was $13.3 billion, down 1.7% compared to the same period last year. Although the shock caused by COVID-19 appears to be somewhat easing, it remains uncertain whether exports will successfully rebound this month.

According to the export-import status announced by the Korea Customs Service on the 13th, export value from the 1st to the 10th of this month was $13.3 billion, down 1.7% compared to the same period last year.

Looking at the performance of major export items, semiconductors (7.7%), passenger cars (7.3%), and ships (307%) increased, while petroleum products (-42.2%), wireless communication devices (-9.7%), and automobile parts (-34%) decreased. By country, exports to China (9.4%), the United States (7.3%), and Vietnam (4.1%) increased, whereas exports to Japan (-20.8%), Hong Kong (-6.9%), and the Middle East (-32%) decreased.

The number of working days was 8.5, the same as the same period last year. Considering the number of working days, the average daily export value also decreased by 1.7% compared to the previous year, totaling $1.56 billion from July 1 to 10. However, the rate of decrease in average daily exports has narrowed. It showed an improving trend with -18.6% in April 1-10, -30.2% in May, -9.8% in June, and -1.7% in July.

An official from the Ministry of Trade, Industry and Energy explained, "The performance of semiconductors and ships had a significant impact on export results in early this month," adding, "Since the impact of COVID-19 has not been completely resolved, it is difficult to predict whether exports will show a recovery trend this month or in the third quarter."

Professor Choi Nam-seok of the Department of Trade at Jeonbuk National University said, "Due to restrictions on businesspeople's movement between countries, decision-making by multinational corporations is not smooth, and global production division networking has not recovered due to concerns about a second COVID-19 pandemic," adding, "It is difficult to judge that the recovery trends in China and the United States are truly reflecting a base effect."

The fact that automobile parts exports remained at -34% is also analyzed as evidence that the government's global value chain (GVC) restructuring and the Materials, Parts, and Equipment 2.0 strategy have not yet led to increased export performance.

Professor Kang In-soo of the Department of Economics at Sookmyung Women's University said, "The fact that automobile parts remained in the minus 30% range should be seen as the government's GVC restructuring and materials-parts-equipment policy effects not yet being reflected in export performance," adding, "Initially, it was expected that exports would hit bottom by the second quarter this year and rebound in the third quarter, but whether a second COVID-19 pandemic occurs is the biggest variable related to third-quarter export performance."

Meanwhile, import value from the 1st to the 10th of this month was $14.1 billion, down 9.1% ($1.42 billion) compared to the same period last year. By item, semiconductors (6.9%), semiconductor manufacturing equipment (85.1%), and wireless communication devices (29.9%) increased, while crude oil (-32.6%), machinery (-12.9%), and gas (-3.2%) decreased.

By country, imports from Taiwan (22.4%) and Vietnam (0.7%) increased, while imports from China (-1.3%), the United States (-12.9%), the European Union (EU, -11.9%), and the Middle East (-18.5%) decreased.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)