Popularity Diversifies from Ultra-Compact to Small and Medium Sizes

"Increasing Demand for Alternatives to Apartments"

[Asia Economy Reporter Im On-yu] As government real estate regulations have focused on apartments, officetels have attracted attention as a balloon effect.

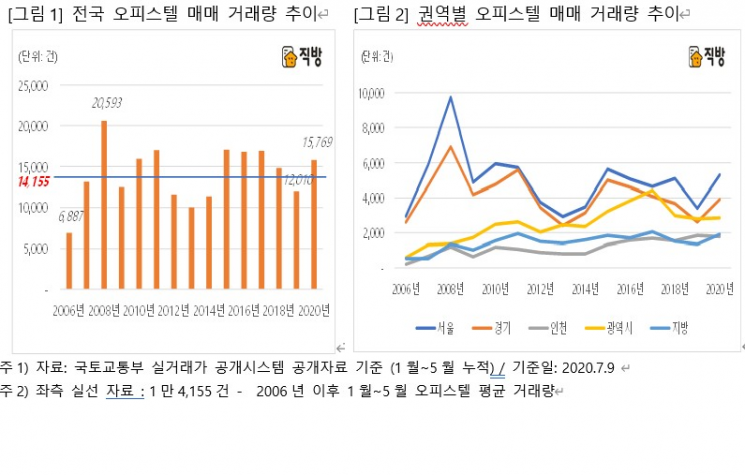

According to Zigbang on the 13th, 15,769 officetel transactions were made nationwide from January to May this year. This is an 11.4% increase compared to the average for the same period since the first disclosure of actual transaction prices in 2006 (14,155 cases), and a 31.3% increase compared to the same period last year (12,010 cases).

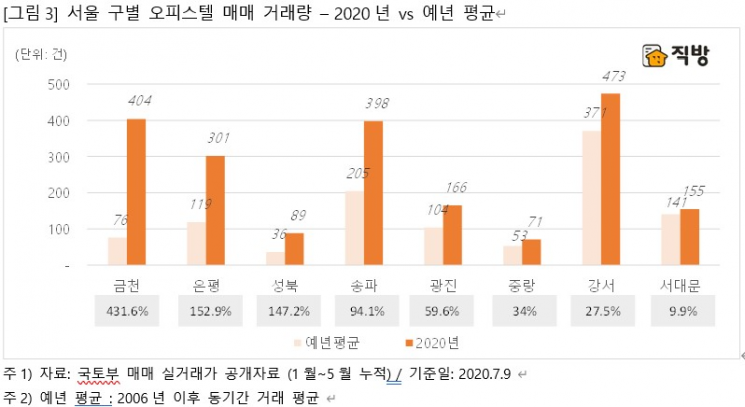

In particular, officetel transactions in Seoul increased noticeably. From January to May, the number of officetel sales transactions in Seoul was 5,312, up 56.3% compared to the same period last year. The districts with the most officetel transactions in Seoul were Gangseo-gu and Yeongdeungpo, with 473 cases each. Geumcheon-gu recorded 404 transactions. Transactions centered on newly built officetels that moved in last year and this year resulted in more than five times the average number of transactions for the same period in previous years (since 2006). Eunpyeong-gu also saw 301 transactions, more than twice the average of previous years.

Zigbang explained, "Gangnam and Yeouido areas have high commuting demand, so transactions have been steadily made around subway stations or near Magok District, where many companies have settled."

Gyeonggi-do recorded 3,907 transactions, a 49.2% increase compared to the same period last year. Icheon had 55 transactions, nearly four times the average of previous years. Transactions increased mainly around newly built officetels that moved in last year. Suwon Yeongtong-gu saw nearly three times the average transactions of previous years. As apartment prices rose, buying demand extended to nearby officetels, leading to active transactions in areas such as Gwanggyo.

Metropolitan cities and provinces recorded 2,854 and 1,911 transactions respectively, both increasing compared to the average of previous years and the same period last year. While transaction volumes were concentrated in the metropolitan area as in previous years, this year there were many officetel transactions in some metropolitan cities and provinces. Daegu (227 cases), Gangwon (133 cases), Gyeongbuk (230 cases), Chungnam (500 cases), and Chungbuk (210 cases) recorded the highest transaction volumes since the disclosure of actual transactions in 2006, drawing attention.

By price range, officetel transactions under 300 million KRW were the most numerous. From January to May nationwide, 13,637 transactions under 300 million KRW were made, accounting for about 86% of the total. By exclusive area, units under 40㎡ accounted for more than half of total transactions with 9,392 cases. However, the proportion of transactions under 40㎡ is gradually decreasing, while transactions for units over 40㎡ up to 60㎡ and over 60㎡ up to 85㎡ are increasing. This year, transactions for units over 40㎡ up to 60㎡ and over 60㎡ up to 85㎡ were 2,672 and 2,919 cases respectively.

Ham Young-jin, head of Zigbang Big Data Lab, analyzed, "Officetel transactions are diversifying from ultra-small units to small and medium-sized units," adding, "Investors may have chosen officetels as an alternative product because they are relatively less regulated and have lower entry barriers than apartments." He further explained, "This can be interpreted as reflecting the characteristic of 1-2 person households, who value quality of life, expanding their living space from ultra-small to small and medium-sized units."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.