[Asia Economy Reporter Kim Hyewon] There is a claim that the ASEAN region should be noted as a stable production base to replace China after the outbreak of the novel coronavirus infection (COVID-19).

The Korea International Trade Association's International Trade and Commerce Research Institute stated in its report titled 'Post-COVID Era, Review of ASEAN Investment Environment for Global Supply Chain Diversification,' released on the 12th, "As wage increases and the US-China trade dispute intensify de-Chinafication, the outbreak of COVID-19 has focused the attention of global companies seeking stable supply chains on ASEAN."

In the report, the institute classified the investment environments of the five ASEAN countries?Malaysia, Vietnam, Indonesia, Thailand, and the Philippines?and China into economic, policy, and social aspects to evaluate comparative advantages.

As a result, in the economic aspect evaluating market attractiveness, market stability, and production efficiency, Vietnam was found to be close to China.

Vietnam received the highest scores in both industrial production index growth rate and manufacturing wage levels, leading production efficiency among the five ASEAN countries.

China was analyzed to have excellent market attractiveness in terms of market size and purchasing power but faced difficulties securing competitiveness in production costs due to steep wage increases.

In the policy aspect, which evaluates government policies and investment and trade systems, Malaysia was the most outstanding. Malaysia showed favorable results across evaluation indicators such as total tax rate relative to operating profit, weighted average tariff rate, and protectionist trade measures. In contrast, China’s trade barriers were higher compared to the five ASEAN countries.

In the social aspect, Malaysia and Thailand, which have strengths in industrial infrastructure and startup environments, were evaluated to be on par with China.

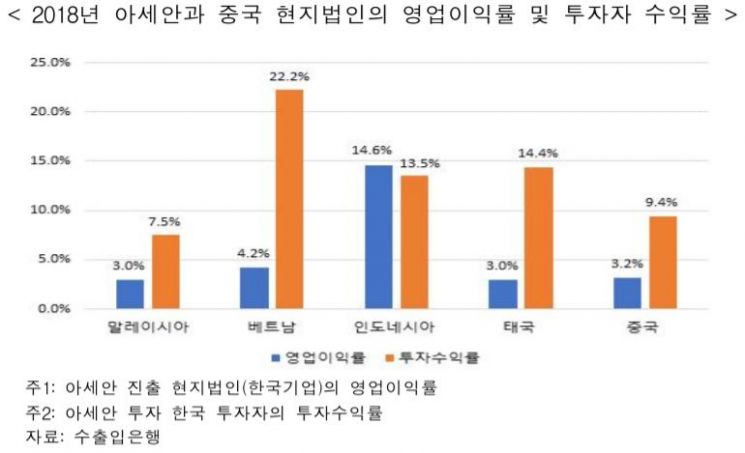

The report viewed that the excellent investment environment in ASEAN can be confirmed based on the business performance of local companies.

The return on investment for Korean companies in ASEAN was only one-third of China’s (24.6%) at 8.5% in 2014, but by 2018, ASEAN (12.4%) had significantly surpassed China (9.4%).

Jo Euyoon, a researcher at the Strategic Market Research Office of the Korea International Trade Association’s International Trade and Commerce Research Institute, said, "Companies seeking low-wage overseas expansion need to consider overseas production strategies that include ASEAN investments, moving away from China-centric investment."

He added, "The phenomenon of rising wages in China will similarly appear within ASEAN. Japanese companies operating in ASEAN are further strengthening production automation to reduce labor costs as a solution to wage increase risks, so our companies should also take note."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.