[Asia Economy Reporter Ki-min Lee] As the novel coronavirus disease (COVID-19) struck the world this year, there is a forecast that South Korea's economic growth rate will record the lowest level since the International Monetary Fund (IMF) foreign exchange crisis.

The Korea Economic Research Institute (KERI) announced on the 12th in its report "KERI Economic Trends and Outlook Q2 2020" that South Korea's economic growth rate this year is projected to be -2.3%, marking the lowest growth rate since the IMF foreign exchange crisis.

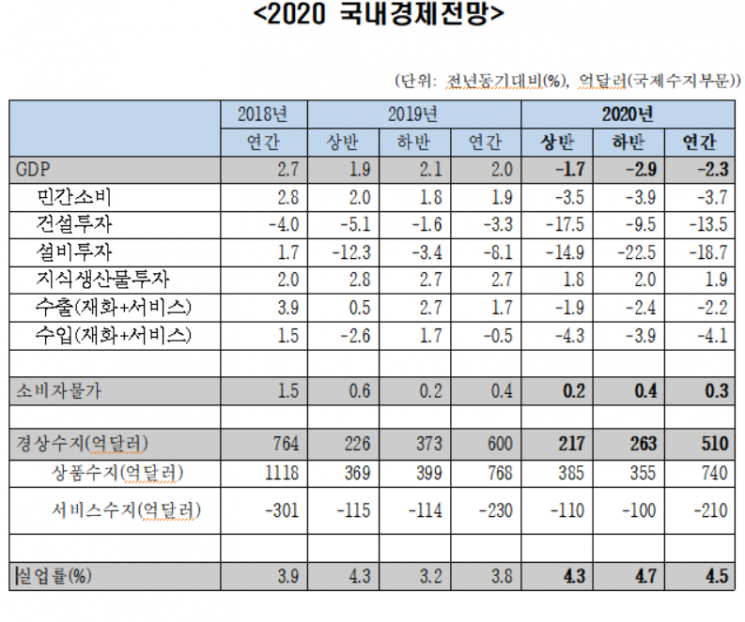

KERI predicted that it will be difficult for the Korean economy, which is experiencing severe stagnation at a level equivalent to an economic crisis, to achieve a rebound within this year. KERI analyzed that the growth rate for the first half of the year will be -1.7%, and the second half will see an even lower negative growth rate of -2.9%.

It pointed out that due to prolonged economic deterioration, the prolonged COVID-19 pandemic, and economic slowdowns in major countries such as the United States and China, efforts to reverse the trend are insufficient.

Private consumption, which has played a supporting role in domestic demand, is expected to shrink by -3.7% this year, according to KERI. The effects of government consumption stimulus measures such as emergency disaster relief funds are insufficient to offset downward pressures caused by factors such as ▲declining nominal wage growth due to poor corporate performance ▲physical restrictions on consumption activities ▲consumer sentiment hitting bottom due to anxiety about the epidemic. Structural causes such as the burden of household debt principal and interest repayments and rising unemployment are also expected to accelerate the decline in private consumption.

Facility investment, which had continued negative growth, is analyzed by KERI to record a -18.7% growth rate due to domestic demand stagnation and economic contraction in major export target countries. Construction investment is also expected to decrease by -13.5% due to construction delays and government real estate suppression policies. Real exports are analyzed to shrink by -2.2% due to global economic contraction and signs of trade conflicts.

KERI pointed out that domestically, ▲the resurgence of COVID-19 infections ▲the possibility of mass unemployment due to worsening corporate performance, and externally, ▲severe poor performance and delayed economic recovery in major countries ▲limited increase in semiconductor prices ▲weakening of the global supply chain (GVC, Global Value Chain) could act as downside risks to growth.

The consumer price inflation rate is projected to record around 0.3%, which is 0.1 percentage points lower than the previous year. KERI also stated that the current account balance will be around $51 billion (approximately 61.25 trillion KRW), down by $9 billion (about 10.8 trillion KRW) from the previous year, as the surplus in the goods balance shrinks significantly due to global economic contraction and the deficit trend in the services balance continues.

KERI emphasized that the COVID-19 shock makes severe economic contraction inevitable not only for the Korean economy but also for the global economy, and suggested that future economic policies should prepare for the possibility of entering a long-term recession rather than exhausting national finances at once by focusing on short-term economic rebound effects. It also stressed the need to flexibly prepare for changes in the economic environment in the post-COVID era.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.