Strengthened to Common Stock Level Starting This October

Expansion of Permanent Single-Price Trading Application

Photo by Getty Images Bank

Photo by Getty Images Bank

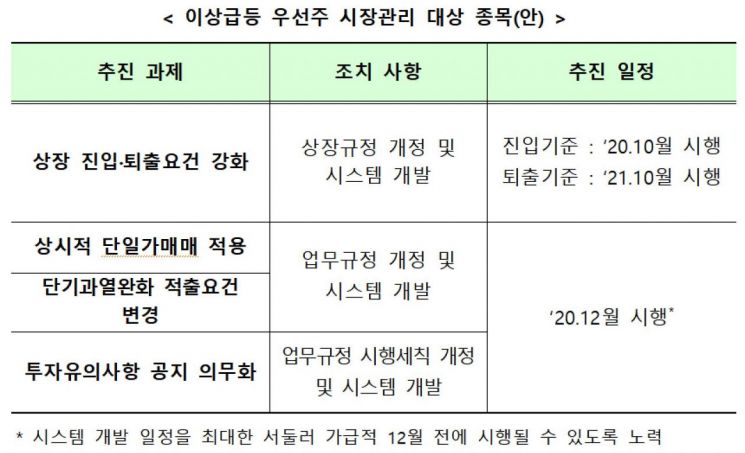

[Asia Economy Reporter Minwoo Lee] Measures are being promoted to intensively manage preferred stocks that show excessive price fluctuations, such as price differences exceeding 10,000% compared to common stocks. The plan includes strengthening listing and delisting requirements, applying continuous single-price trading, and enhancing market surveillance.

On the 9th, the Korea Exchange announced that it will revise exchange regulations and develop systems within this month to implement these preferred stock management measures within the year. First, the entry condition for preferred stocks will be raised from a minimum of 500,000 listed shares to 1,000,000 shares, the same as common stocks. The market capitalization requirement will also be increased from 2 billion KRW to 5 billion KRW. These standards are scheduled to take effect from October. Delisting conditions will also be strengthened, raised from the current 50,000 shares and 500 million KRW to 200,000 shares and 2 billion KRW. This reflects concerns that the lower listing entry standards compared to common stocks cause higher price volatility and vulnerability to unfair trading. Based on the closing price on the day, Samsung Heavy Industries common stock was 5,750 KRW, while the preferred stock was 620,000 KRW, resulting in a price difference rate (disparity rate) of 16,826%.

The criteria for applying single-price trading will also be lowered. Preferred stocks with fewer than 500,000 shares will be subject to continuous single-price trading at 30-minute intervals. Additionally, if the price disparity rate of preferred stocks compared to common stocks exceeds 50%, they will be designated as short-term overheated stocks and single-price trading will be conducted for three trading days.

Furthermore, for preferred stocks designated as short-term overheated stocks, market warning stocks (investment caution/warning/risk), or management stocks that have experienced abnormal price surges, when purchase orders are placed through the Home Trading System (HTS) or Mobile Trading System (MTS), warning pop-ups and purchase intention reconfirmation windows will be mandatorily displayed. Market surveillance will also be strengthened through planned monitoring of rapidly rising preferred stocks.

These measures are expected to be applied as soon as possible starting this year. The adjusted listing criteria will be applied from October, and the delisting criteria from October next year. The application of single-price trading and market surveillance will be implemented within the year.

Recently, there have been concerns about investor damage due to the sharp fluctuations of preferred stocks. Samsung Heavy Industries preferred stock is a representative case. After closing at 54,500 KRW on the 1st, it recorded the upper price limit for 10 consecutive trading days starting the next day, soaring to 960,000 KRW intraday on the 19th of last month. Subsequently, it plummeted to 301,000 KRW over 10 of 11 trading days until the 3rd of this month. This shows a pattern of rising 17 times in one month and then collapsing to one-third of its value.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)