High-Interest Loan 'Proxy Deposit Transactions' Targeting Youth... Disguised as Money Lending Between Acquaintances

Youth Increasingly Doing Proxy Deposits for Pocket Money... Secondary Harm Like School Violence Occurs

Proxy Deposits for Others Violate Laws... May Lead to Criminal Charges

[Asia Economy Reporter Kangwook Cho] #. Mr. A borrowed 100,000 won for 3 days and repaid 140,000 won. However, he was additionally charged a late fee of 50,000 won (1,500 won per hour) for a 36-hour delay and is even suffering from illegal debt collection such as threatening calls at night.

#. Ms. B wanted to buy merchandise of her favorite idol but had no funds, so she used proxy payments from several people via SNS, borrowing amounts ranging from 20,000 to 100,000 won. However, unable to repay, she kept rolling over the debt and eventually repaid 4 million won including interest.

Recently, advertisements for proxy payments targeting financially and legally vulnerable youth have been rampant, and as cases of damage have occurred, financial authorities have issued a warning.

According to the Financial Supervisory Service on the 9th, the number of reports on proxy payment advertisements received by the FSS from June last year to May this year totaled 2,100 cases.

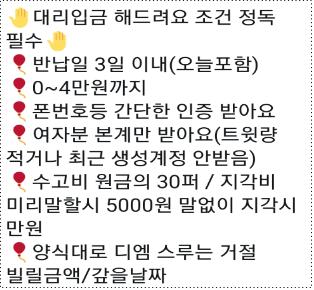

Proxy payment operators mainly posted proxy payment ads on SNS, luring youths who needed concert tickets, celebrity merchandise, game fees, etc., and lent small amounts around 100,000 won for a short term (2 to 7 days).

Although the loan amounts are small and not easily felt, the short-term interest rates range from 20% to 50%, which, when annualized, reach over 1,000%. Especially, if repayment is late, a late fee (delinquency charge) of 1,000 to 10,000 won per hour is imposed.

Also, proxy payments disguised themselves as financial transactions between acquaintances by using terms like 'service fee' and 'late fee' and posting idol photos. Moreover, they demanded contact information of family and friends under the pretext of identity verification and often targeted only youths (especially girls).

There are even youths who do proxy payments as a way to earn pocket money, which has been investigated to sometimes evolve into a form of school violence where friends’ money is extorted in the form of high-interest loans.

Among the reported damage cases, a high school student, Mr. C, who fell into gambling, raised gambling funds through proxy payments with a weekly interest rate of 50% (annual interest rate of 2,600%), and eventually his gambling debt grew to 37 million won over 4 years.

The FSS explained that proxy payments are high-interest private loans with an annualized interest rate exceeding 1,000%, far surpassing the legal interest rate (24%). It also warned that the act of making proxy payments for others is subject to criminal punishment. Posting ads on SNS and repeatedly making proxy payments to multiple people may violate the Loan Business Act and Interest Limitation Act and could lead to criminal penalties. Therefore, if you are threatened with phone numbers, addresses, schools attended, etc., being spread on SNS after using proxy payments and failing to repay, you should seek help from school police officers, teachers, parents, or those around you.

The FSS plans to strengthen financial education by cooperating with related agencies, such as requesting police investigations upon receiving reports of proxy payment transaction damages, and through repeated guidance and education to help youths naturally learn about the risks of illegal finance and how to respond, thereby preventing related damages.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.