Bank of Korea '2020 Q1 Financial Flow (Provisional)'

[Asia Economy Reporter Kim Eunbyeol] As companies focused on securing liquidity due to the impact of the novel coronavirus infection (COVID-19), the net fund-raising scale of companies in the first quarter reached the largest level since the financial crisis, more than doubling compared to the first quarter of last year. With increased government consumption, the government's net fund-raising scale also surged to an all-time high.

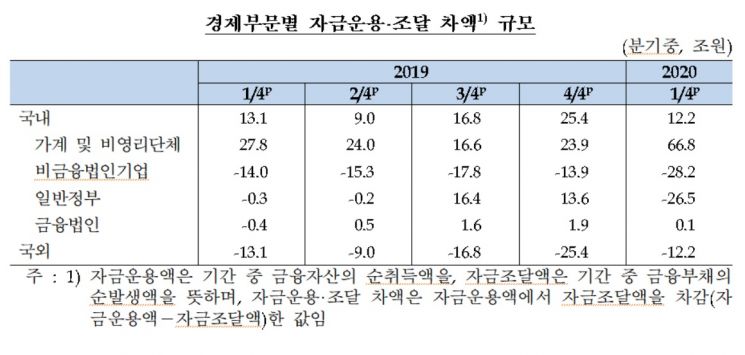

According to the "2020 Q1 Fund Circulation (Provisional)" announced by the Bank of Korea on the 9th, the net fund-raising scale of non-financial corporations in the first quarter was 28.2 trillion won, more than twice the 14 trillion won of the same period last year. The net fund-raising scale of companies is the largest since January 2009 (34.8 trillion won), right after the financial crisis.

Jung Kyu-chae, head of the Fund Circulation Team at the Economic Statistics Bureau of the Bank of Korea, stated, "The net fund-raising scale of companies increased due to factors such as profitability decline and securing liquidity in response to COVID-19." According to the Bank of Korea's corporate management analysis, the operating profit margin of externally audited companies fell from 5.3% in the first quarter of last year to 4.1%, reflecting the impact of COVID-19.

With increased government consumption and investment, the government's net fund-raising scale also expanded to 26.5 trillion won compared to the same period last year. This is the largest scale ever, likely due to the government's active fiscal spending in response to COVID-19 and increased expenditures such as government consumption and investment. Considering that the government's net fund-raising was 300 billion won during the same period last year, this represents a sharp increase.

Net fund-raising is the value obtained by subtracting fund usage from fund procurement. Generally, companies use funds supplied by households and others, so they are in a net fund-raising state (usage < procurement). Net fund usage is the amount obtained by subtracting financial institution loans (fund procurement) from money managed by households in deposits, bonds, insurance, and pension reserves (fund usage), and it is considered surplus funds. Since households supply funds to other sectors through deposits, etc., they are net fund usage entities (usage > procurement).

Households and non-profit organizations expanded their surplus funds further in the first quarter. This was the result of spending less due to increased uncertainty caused by COVID-19. With consumption shrinking and new housing investment decreasing, the net fund usage scale of households and non-profit organizations recorded 66.8 trillion won, an increase compared to the same period last year. This is about three times the 27.8 trillion won recorded in the first quarter of last year.

Previously, household surplus funds had been decreasing due to increased housing investment and private consumption. In 2018, it even recorded the lowest level ever.

Additionally, total financial assets in the first quarter increased by 306 trillion won from the end of the previous quarter to 1,890.71 trillion won. Total financial assets represent the sum of financial assets held by all economic sectors shown in the fund circulation statistics, including both domestic sectors and foreign sectors (non-residents).

Looking at the composition of financial assets, the proportions of cash and deposits (+0.6 percentage points) and bonds (+0.3 percentage points) increased compared to the end of the previous quarter, while the proportion of equity securities and investment funds (-2.2 percentage points) decreased.

At the end of March, the financial asset to financial liability ratio of households and non-profit organizations was 2.10, slightly down from 2.12 at the end of the previous quarter.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.