[Asia Economy Reporter Jeong Hyunjin] As the novel coronavirus infection (COVID-19) crisis prolongs, the global commercial real estate market, including department stores, is faltering. Department stores, hotels, and restaurants, which have struggled with sales declines due to lockdown measures making operations difficult, have pushed commercial real estate investment firms?whose main revenue source is leasing?toward bankruptcy. With the spread of remote work triggered by this crisis, forecasts that demand for stores and offices will sharply decrease in the long term are gaining credibility.

According to Real Capital Analytics (RCA), a commercial real estate market research firm, from January this year to June 18, the number of commercial real estate transactions worldwide, including the U.S. and Europe, decreased by about 30-40% compared to the previous year. Transaction amounts also dropped significantly. The transaction volume in the U.S. fell by about 30% year-on-year, and Europe, the Middle East, Africa, and the Asia-Pacific region showed similar trends. The biggest reason for the decline in transactions is the uncertainty caused by the spread of COVID-19. As the outlook for generating profits becomes unclear, real estate transactions are being hesitated.

Operations of hotels, department stores, and large supermarkets have also been sluggish, making it burdensome even to pay rent, which has led to a simultaneous decrease in real estate companies' profits. As a result, on May 26, UK real estate investment trust company and shopping center management and development firm Intu Properties entered administration after failing to resolve debt issues exceeding 4.5 billion pounds (approximately 6.7 trillion won). According to CNN in the U.S., Intu Properties, which operates 17 shopping malls across the UK, received rent payments in the second quarter amounting to only 29% of the scheduled amount, significantly lower than 77% in the same period last year.

Simon Property Group, the largest retail real estate investment trust company in the U.S., also canceled its previously planned merger and acquisition (M&A) deal on June 10. In February, it had planned to acquire competitor Taubman for $3.6 billion, but due to the extreme uncertainty caused by COVID-19, it became difficult to use large-scale funds.

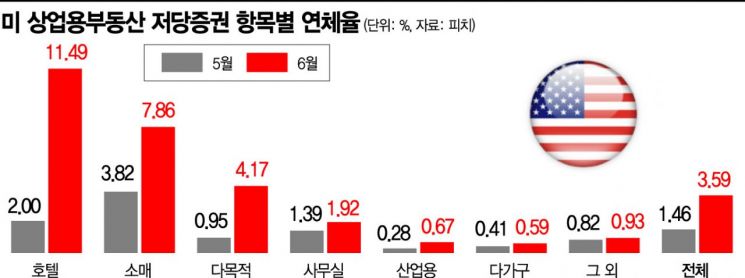

The slump in the commercial real estate industry shows signs of spreading to the financial sector. Delinquency rates on financial products related to commercial real estate are rising. Credit rating agency Fitch announced that the delinquency rate for U.S. commercial mortgage-backed securities (CMBS) last month reached 3.59%, a sharp increase from 1.46% the previous month. This is the largest monthly increase in 16 years. CMBS are securities based on loan bonds that financial institutions lend using commercial real estate such as office buildings, shopping centers, and hotels as collateral.

By category, the delinquency rate for hotels rose more than fivefold from 2.00% in May to 11.49% in June, and retail also saw an increase from 3.82% to 7.86% during the same period. Especially, a large number of regional shopping mall loans became delinquent, pushing up the retail delinquency rate. As the COVID-19 crisis prolongs, online and mobile shopping have expanded, and following department stores that declared bankruptcy one after another, shopping malls are also facing a crisis. Fitch forecasts that the delinquency rate for all U.S. CMBS will peak at 8.25-8.75% by the end of the third quarter this year.

The outlook for the commercial real estate market is bleak. Since a global "experiment" on remote work has been conducted due to COVID-19, it is expected that changes in work patterns will reduce office demand. Ben Carson, U.S. Secretary of Housing and Urban Development, stated at the end of last month that he is considering converting commercial real estate, which is in an oversupply state due to COVID-19, into appropriately priced housing. Additionally, analyses continue that as offline shopping malls transition online, the necessity of commercial real estate will decline.

The International Finance Center emphasized, "Domestic institutional investors have significantly increased investments in European commercial real estate over the past 3-4 years," and added, "There is a possibility that liquidity risks in real estate funds will increase if asset values plummet and rental income sharply decreases, so caution is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.