Strong Semiconductor Performance Amid Growing Non-Face-to-Face Demand, One-Time Display Revenue Included

Set Businesses Like Smartphones and TVs Perform Better Than Expected

Samsung Electronics announced on the 7th that its consolidated operating profit for the second quarter reached 8.1 trillion won. On the same day, employees were seen walking at the Samsung Electronics Seocho Building in Seocho-gu. Photo by Mun Honam munonam@

Samsung Electronics announced on the 7th that its consolidated operating profit for the second quarter reached 8.1 trillion won. On the same day, employees were seen walking at the Samsung Electronics Seocho Building in Seocho-gu. Photo by Mun Honam munonam@

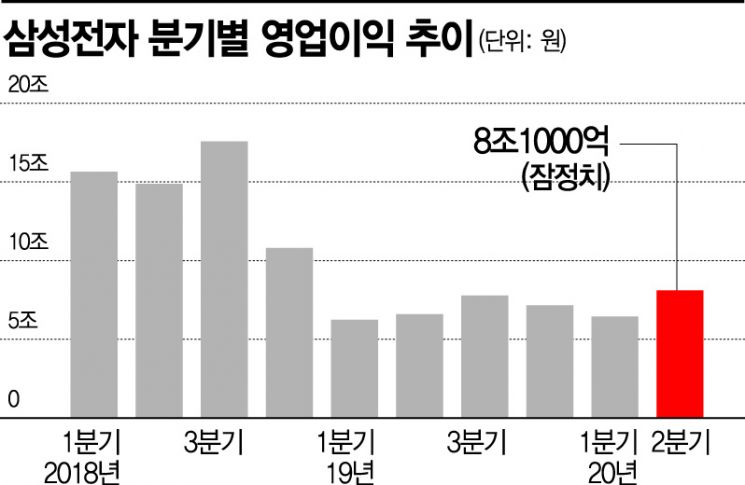

[Asia Economy Reporter Changhwan Lee] Samsung Electronics' second-quarter earnings significantly exceeded market expectations due to strong performance in its semiconductor business driven by the growth of the non-face-to-face market amid the spread of COVID-19. Semiconductor prices rose in the second quarter as non-face-to-face demand increased, leading to higher profits.

Additionally, the smartphone and display divisions, which were expected to perform poorly, posted unexpectedly strong results, offsetting the impact of COVID-19. In the display division, one-time gains from compensation payments related to delays in Apple's panel deliveries contributed to the strong performance.

However, with signs of a global resurgence of COVID-19 and semiconductor prices recently stagnating, uncertainty remains regarding second-half earnings.

◆ Semiconductor Division Operating Profit Surpasses 5 Trillion Won in Q2, Highest Since Late 2018 = The semiconductor division's operating profit in the second quarter is estimated to be around 5.4 trillion won, a roughly 60% increase compared to the same period last year. This marks the highest level in six quarters since about 7.8 trillion won was recorded in Q4 2018.

The improvement in the semiconductor division's performance was driven by rising prices of memory semiconductors such as DRAM and NAND flash in the second quarter. According to market research firm DRAMeXchange, the fixed transaction price of DDR4 8Gb DRAM products, mainly used in PCs, rose from $2.84 in January to $3.29 in April and $3.31 in June.

The spread of COVID-19 in the second quarter increased non-face-to-face demand such as remote work and online classes, leading server and PC companies to build up semiconductor inventories. With limited supply and increased demand, product prices rose.

NAND flash prices also increased, helping improve earnings. The price of 128Gb MLC (Multi-Level Cell) NAND flash, used in solid-state drives (SSD) and USB drives, rose from $4.42 at the end of last year to $4.68 at the end of last month.

No Geun-chang, head of the Research Center at Hyundai Motor Securities, said, "In Q2, memory semiconductor prices such as server DRAM and PC DRAM rose due to COVID-19. Thanks to the higher-than-expected increase in memory semiconductor prices, Samsung Electronics' Q2 operating profit exceeded previous estimates."

The display division's results were also influenced by significant one-time gains. Samsung Electronics disclosed that its earnings included one-time income related to the display business.

Apple had a contract with Samsung Electronics guaranteeing a minimum quantity of display panels. During the process of diversifying suppliers, the allocated quantity fell short of the minimum, resulting in subsidy payments.

Industry sources estimate the subsidy to be between 900 billion and 1 trillion won. With up to 1 trillion won in earnings reflected in Q2, the display division's profit margin was likely larger than expected.

The Consumer Electronics (CE) division, responsible for TVs, washing machines, refrigerators, and the IT & Mobile (IM) division handling smartphones, also posted better-than-expected results.

◆ Uncertainty Remains for the Second Half Due to COVID-19 Spread = Although Samsung Electronics recorded better-than-expected results in Q2, uncertainties remain for the second half due to external factors such as COVID-19 and the US-China trade dispute. In particular, the recent stagnation in semiconductor price increases raises concerns about the semiconductor division's earnings improvement.

According to DRAMeXchange, the spot price of DDR4 8Gb DRAM was $2.71 as of the previous day, down from a peak of $3.60 in early April, marking a decline for three consecutive months. This is attributed to customers reducing orders after building up semiconductor inventories.

The decline in spot prices may lead to a drop in fixed prices in the future. DRAMeXchange expects fixed prices for DRAM and NAND to turn downward in the third quarter. For server DRAM, which has high inventory, the fixed transaction price is expected to fall by more than 5% compared to the previous quarter, and PC DRAM is also expected to see a decline of about 5%.

However, since the price drop is not expected to be significant, it is likely that Samsung Electronics' semiconductor business performance will not deteriorate drastically compared to the first half. With offline sales resuming, set businesses such as smartphones and TVs are expected to improve in Q3 compared to Q2, and profits from other divisions are likely to rise, continuing the overall earnings improvement trend.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.