Industrial Bank Board Meeting Activated Following Bank of Korea Monetary Policy Committee Session

[Asia Economy Reporter Kim Eun-byeol] A special purpose vehicle (SPV) that will purchase non-investment grade corporate bonds and commercial papers (CP) is expected to be operational as early as next week, and no later than within two weeks. This is anticipated to provide relief to the non-investment grade corporate bond and CP market, which has been constricted due to the impact of the novel coronavirus disease (COVID-19).

According to the Bank of Korea on the 7th, the Financial Services Commission plans to approve the establishment of a subsidiary of KDB Industrial Bank on the 8th. After the Financial Services Commission's approval, the Industrial Bank will hold a board meeting to resolve the SPV investment and proceed with the corporate establishment procedures.

Regarding the establishment of the corporation, procedures such as the inaugural general meeting of founding members, corporate registration, and document notarization remain, so even if expedited, it is expected to take at least three business days. Once the corporation is established, the Bank of Korea plans to hold a Monetary Policy Committee meeting to execute the loan. The earliest scheduled Monetary Policy Committee meeting is on the 16th. A Bank of Korea official stated, "The establishment will be completed within two weeks at the latest."

The government, the Bank of Korea, and the Industrial Bank decided to establish the SPV to enable companies struggling due to the COVID-19 shock to smoothly raise funds in the market. However, the launch was delayed due to the postponement of the passage of the third supplementary budget.

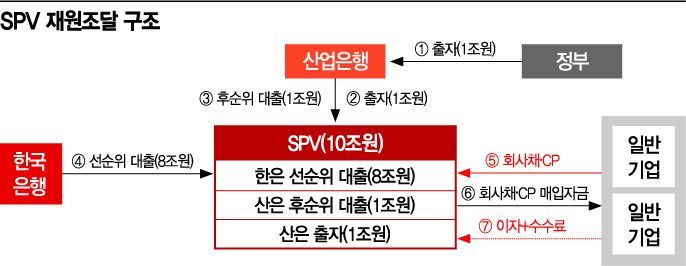

First, the government plans to invest 1 trillion won in the Industrial Bank to establish the SPV. Based on the government’s investment, the Industrial Bank will invest 1 trillion won to establish the SPV. The Industrial Bank and the Bank of Korea will then respectively execute loans of 1 trillion won (subordinated) and 8 trillion won (senior), creating a fund of 10 trillion won.

The government, the Industrial Bank, and the Bank of Korea will jointly form an investment management committee within the Industrial Bank to decide on specific matters necessary for the operation of the SPV. The exact members and size of the committee have not yet been finalized.

The purchase targets are corporate bonds with credit ratings from AA to BB, and CP and short-term bonds rated A1 to A3. Purchases will focus mainly on investment-grade and A-rated bonds, but bonds rated BBB and below will also be purchased. However, BB-rated bonds are limited to those whose credit ratings have fallen from investment grade to speculative grade due to the COVID-19 shock (fallen angels). Maturities must be within three years. Companies with an interest coverage ratio below 100% for two consecutive years are excluded from the purchase targets.

Meanwhile, the Industrial Bank has already purchased low-credit corporate bonds and CPs first, considering the policy gap caused by the delay in the supplementary budget passage. After the SPV is launched, the investment management committee will decide whether to accept the corporate bonds pre-purchased by the Industrial Bank into the SPV.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)