KOSPI Market Rises to 16th in Market Cap... Other Bio Stocks Lag Behind

IPO Market Investor Sentiment Revives... Large Funds Flow into Public Offering Funds

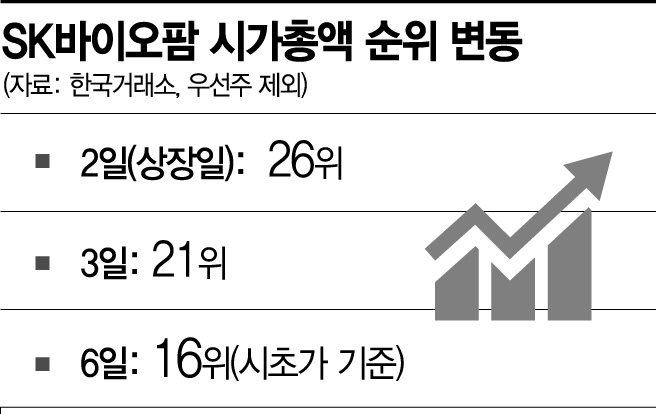

[Asia Economy Reporters Koh Hyung-kwang and Geum Bo-ryeong] SK Biopharm is creating an 'SK Biopharm Syndrome' by hitting the daily upper price limit for three consecutive days after its listing. Its market capitalization rose to 16th place on the KOSPI market (excluding preferred shares), surpassing POSCO. The huge success of SK Biopharm's public offering has also sparked strong interest in the IPO market for the second half of the year.

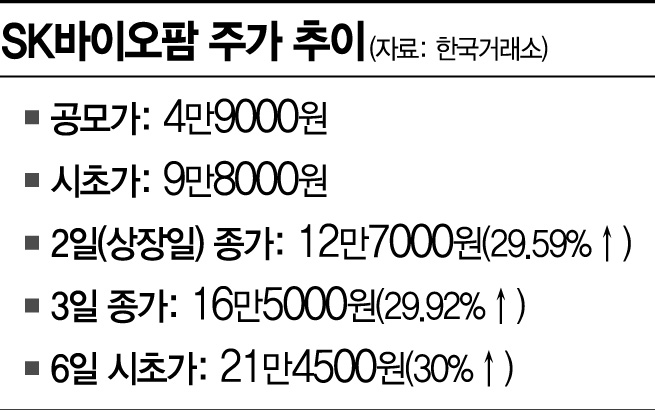

According to the Korea Exchange on the 6th, as of 10:20 a.m., SK Biopharm recorded 214,500 KRW, up 30% (49,500 KRW) from the previous trading day. Compared to the public offering price of 49,000 KRW, this is 4.4 times higher.

On this day, the market capitalization exceeded 16.7 trillion KRW. Rising to 16th place in the KOSPI market, it surpassed POSCO, KB Financial Group, and Shinhan Financial Group. Just above it are SK Telecom (15th) and SK (14th). Considering that the market capitalization was about 9.9 trillion KRW on the first day of listing, the 2nd, the company’s size grew by about 7 trillion KRW in just three trading days.

Right after the market opened that day, profit-taking sell orders for SK Biopharm poured out, causing stock price fluctuations. As of 10 a.m., the intraday low was 193,500 KRW. Trading volume also exploded, with SK Biopharm’s volume exceeding 6.16 million shares and trading value surpassing 1.3 trillion KRW as of 10:26 a.m. SK Biopharm is the first in the KOSPI market to record the so-called 'ttasang' and hit the daily upper price limit for three consecutive trading days after listing. 'Ttasang' means forming the opening price at twice the public offering price and then hitting the daily upper price limit. In the KOSDAQ market, Hyundai Feed in 2018 and Peptron in 2015 achieved the same record.

As a significant portion of market funds flowed into SK Biopharm, other bio stocks relatively declined. Samsung Biologics’ closing price fell from 810,000 KRW on the 26th of last month to 771,000 KRW on the 3rd, a 4.81% drop in a week. Celltrion also declined 0.96% from 312,500 KRW to 309,500 KRW during the same period. Seo Geun-hee, a researcher at Samsung Securities, analyzed, "From a supply and demand perspective, the KOSPI market had only large healthcare stocks like Celltrion and Samsung Biologics, so from the institutional investors’ standpoint, the ability to diversify their investment portfolio is positive."

The financial investment industry is highly optimistic about SK Biopharm’s early inclusion in the KOSPI 200 index. The KOSPI 200 index calculates the average market capitalization over 15 trading days from the listing date, and if the stock ranks within the top 50 in the KOSPI market based on common shares, early inclusion is possible. Passive funds are also expected to flow in through this. However, caution is advised against overconfidence in early passive demand. Kang Song-cheol, a researcher at Shinhan Financial Investment, explained, "In the past, large IPO stocks like Celltrion Healthcare, Netmarble, and Samsung Biologics saw stock price increases until their inclusion in MSCI, KOSPI 200, and KOSDAQ 150, but SK Biopharm already exceeded the returns of those stocks by rising 160% compared to the public offering price on the first day of listing."

With SK Biopharm’s spectacular debut on the stock market, investors are turning their attention to IPOs scheduled for the second half of the year. Big Hit Entertainment, the agency of the global idol BTS (Bangtan Sonyeondan), and Kakao Games, a game-specialized subsidiary of Kakao, are planning public offerings.

The IPO market in the first half of this year suffered severe sluggishness due to the impact of COVID-19. According to the Korea Exchange, only four companies filed for preliminary review for listing in March, when COVID-19 was at its peak. Even those were withdrawn or postponed. However, last month, a total of 19 companies, including SPAC mergers and REITs, filed for preliminary review for listing. As investment sentiment improves, the IPO market is also recovering.

The company attracting the most attention in the second half is Big Hit. Big Hit submitted its preliminary review application for listing on the KOSPI market in May. Its operating profit last year was 98.7 billion KRW. This exceeds the combined operating profits of the three major domestic entertainment companies?SM (40.4 billion KRW), JYP (43.5 billion KRW), and YG (2 billion KRW)?from last year. This is why it is expected that Big Hit will become the leading entertainment stock upon listing.

Kakao Games submitted its preliminary review application for listing on the KOSDAQ market on the 11th of last month. This is a reattempt two years after withdrawing its IPO plan in 2018. At that time, the company’s valuation was in the low 10 trillion KRW range. Given the recent rapid growth of the gaming industry, Kakao Games’ valuation is expected to reach 20 trillion KRW. Considering that it usually takes about four months from the preliminary review application to the new listing, Big Hit and Kakao Games are expected to be listed around September to October.

Gyochon F&B, the first franchise company to pursue an IPO, is also attracting attention. Gyochon F&B, which operates Gyochon Chicken, recorded sales of 369.2 billion KRW and operating profit of 31.9 billion KRW last year. Since it filed for preliminary review in April, it is highly likely to be listed in the second half of this year.

Funds are also flowing into public offering stock funds. According to financial information provider FnGuide, the total funds flowing into 110 domestic public offering stock funds over the past month reached 553 billion KRW. This is the largest amount among the 43 themes classified by FnGuide. A financial investment industry official explained, "Due to the high interest from individual investors but the limited number of shares actually allocated, many investors are turning to funds."

However, experts commonly agree that one should not blindly invest just by looking at successful cases. There are many cases where public offering stocks do not perform well in the long term. Samsung Life Insurance, which was listed in 2014 with a public offering price of 110,000 KRW, currently trades at less than half of that price. Hwang Se-woon, a researcher at the Capital Market Institute, said, "It is natural for funds to flow into IPOs of companies with growth potential, but it is advisable to carefully evaluate the company’s value and invest from a long-term perspective."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.