Jung Visits SK Innovation Seosan Plant

To Meet SK Group Chairman Chey Tae-won Tomorrow

Discussing the 'Big Picture' of Future Mobility Business

Electric Vehicle Market Dominated by Tesla

Battery Supply Is the Key Competitive Advantage

Synergy from 'Big Four Group Battery Alliance'

Lays Foundation for Leading Electric Vehicle Market Share

[Asia Economy Reporters Park So-yeon and Woo Soo-yeon] Chung Eui-sun, Vice Chairman of Hyundai Motor Group, is concretizing the blueprint to catch up with Tesla, the world's largest electric vehicle manufacturer. Starting with a meeting with Samsung Electronics Vice Chairman Lee Jae-yong in May, he has continued a wide-ranging series of meetings with the heads of the four major conglomerates, including LG Group Vice Chairman Koo Kwang-mo in June and finally SK Group Chairman Chey Tae-won this month, in an effort to seize leadership in the rapidly growing electric vehicle market.

According to industry sources on the 6th, Vice Chairman Chung and Chairman Chey are expected to meet as early as the 7th at SK Innovation's Seosan plant. The Seosan plant houses SK Innovation's electric vehicle battery production line, and it is known that the next-generation electric vehicle NE, which Hyundai will launch next year, will be equipped with batteries produced by SK Innovation.

Since Chairman Chey and Vice Chairman Chung have been close like brothers since childhood as heirs of chaebols, there are voices expecting meaningful outcomes from this meeting. There is anticipation that the two heads may explore cooperation plans for electric vehicle batteries and simultaneously draw a 'big picture' at the national level beyond individual companies in the future mobility business sector.

◆ Next-generation electric vehicle envisioned by Chung Eui-sun= The next-generation electric vehicle NE, equipped with SK Innovation batteries, is the first mass-produced car utilizing Hyundai-Kia's dedicated electric vehicle platform (e-GMP). The 73kWh battery long-range model offers a driving range of 450 km, and charging time is only 15 minutes when using ultra-fast charging stations. This solves the issue of charging time, which has been considered the biggest drawback of electric vehicles.

SK Innovation supplies the first batch of next-generation electric vehicle batteries for Hyundai-Kia, while LG Chem secured the second batch. The first batch alone requires a massive supply volume worth 10 trillion won over five years, and Hyundai-Kia's position as a customer in the electric vehicle battery market is expected to strengthen accordingly.

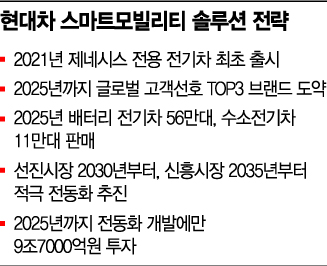

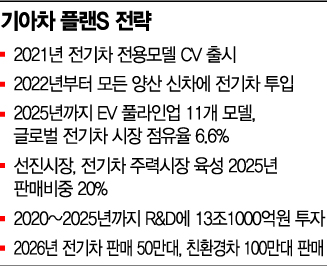

Hyundai-Kia plans to introduce a total of 44 eco-friendly vehicles by 2025, with more than half, 23 models, being pure electric vehicles. Hyundai aims to sell 560,000 electric vehicles and 110,000 hydrogen electric vehicles by 2025, aspiring to become a top 3 global electric vehicle brand. During the same period, Kia plans to establish a full lineup of 11 electric vehicle models and achieve a global market share of 6.6%.

To achieve the '2025 Electrification Plan,' Hyundai will first launch the NE, the first electric vehicle applying the dedicated electric vehicle platform, in 2021 and introduce a Genesis-exclusive electric vehicle in the domestic market. Kia will release the electric vehicle-exclusive model CV next year, developed in collaboration with autonomous driving startup Code42, and from 2022, will include electric vehicle lineups in all new models.

Especially, the overseas market Hyundai-Kia focuses on is Europe, where the eco-friendly vehicle market is rapidly growing due to strengthened environmental regulations. Hyundai targets the European market with eco-friendly and high-performance vehicles, while Kia plans to increase the share of pure electric vehicle sales to 20% in advanced markets including Europe by 2025. If these plans proceed as expected, a vast demand for export and domestic batteries will arise, and the selection of Hyundai-Kia's suppliers will determine the market share rankings of global battery companies.

◆ Attention on the role of the four major conglomerates to check Tesla's dominance= Attention is also focused on the roles of the heads of the four major conglomerates in securing leadership in the global electric vehicle market. It is forecasted that the will and cooperation of these leaders during this period of upheaval will determine the future car and global electric vehicle battery market landscape.

In the past, when the iPhone first attempted to enter the domestic market in 2009, SK Telecom, which held a majority share in the domestic telecommunications market, delayed the iPhone's domestic launch by about two years to support Samsung Electronics. Subsequently, Samsung Electronics accelerated the development and commercialization of smartphone technology and quickly became the strongest player in the global smartphone market. The industry views that close cooperation among domestic companies could similarly determine the future electric vehicle market landscape.

As the global automobile market paradigm rapidly shifts from internal combustion engines to eco-friendly vehicles, battery supply is expected to become the greatest competitive advantage for automakers. There is ongoing optimism that if the heads of the four major conglomerates unite, they can seize leadership in the rapidly changing mobility market centered on the Hyundai platform. Given that Korean battery companies possess uniquely advanced technology and production capacity worldwide, if the four conglomerates unite, it is expected that they will surpass traditional internal combustion engine vehicles within the next three years and rise to become a global top-tier mobility powerhouse.

However, whether this hope will translate into actual cooperation between battery companies and automakers remains uncertain. A battery industry official said, "It is true that if Korea's four major conglomerates unite, there is hope to rise as a global top-tier player by leveraging battery technology and supply capacity in the Tesla-dominated electric vehicle era, overtaking German luxury carmakers. However, realistically, it is difficult for competing battery companies to unite, so whether this will lead to practical cooperation and results remains to be seen."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.