Housing Prices 'Soar', Subscription is 'Lotto'

With Reconstruction Blocked by the June 17 Measures

Redevelopment Heats Up... Even Areas Not Yet Zoned See Price Increases

Experts Warn "Early Redevelopment Carries High Risks, Caution Against Blind Investment"

#On the 22nd of last month, at the auction hall of the Seoul Eastern District Court in Munjeong-dong, Songpa-gu, Seoul, 18 bidders competed for a 23.1㎡ house in Geumho-dong, Seongdong-gu (hereinafter exclusive area), built in 1986 and now 34 years old. Ultimately, this property, appraised at 182.89 million KRW, was sold for 285.4 million KRW, which is 56% higher than the appraisal price. Considering that redevelopment is being promoted but the area has not even been designated yet, making the feasibility of the project uncertain at this early stage, industry experts analyze this as an unusually high winning bid.

According to industry sources on the 2nd, investors are flocking to early-stage redevelopment sites within Seoul. While housing prices are soaring and the chances of winning housing subscription lotteries are extremely low, coupled with strengthened reconstruction regulations, demand is shifting toward redevelopment, especially among younger generations. In particular, demand is spreading even to early redevelopment projects, which are relatively low-priced but carry high investment risks, such as those before area designation or at the promotion committee stage.

Transactions in early redevelopment stages are active not only in court auctions but also in the general market. A house with a land share of 28.7㎡ in Ahyeon-dong, Mapo-gu, Seoul, where redevelopment is being promoted as Ahyeon 1 District, was traded for 665 million KRW last month. Considering that a similar share house in the area was sold for 510 million KRW in July last year, the price has risen by more than 150 million KRW in about a year.

However, Ahyeon 1 District, famous as the 'Pig Supermarket' in the movie Parasite, has not yet been designated as a redevelopment area. It is currently at the stage of collecting consent forms from landowners and others. As of the end of last month, the consent rate in this district was 67.4%, reportedly surpassing the area designation requirement of two-thirds. A Mapo-gu Office official explained, "Once designated as a maintenance area, a promotion committee can be formed to actively proceed with the project."

The asking prices of old houses in areas where redevelopment projects are being re-promoted after being deregulated, such as Sindang 10 District in Sindang-dong, Jung-gu, and Jeonnong 9 District in Jeonnong-dong, Dongdaemun-gu, are also rising. A representative from A Real Estate in Jeonnong-dong said, "With new apartments moving in around Cheongnyangni and Jeonnong-dong and growing expectations for Cheongnyangni Station development, the number of investors is increasing," adding, "It is so hard to find listings."

As a result, asking prices in redevelopment districts where the association establishment has been approved are soaring. In the case of Machon 3 District in Machon-dong, Songpa-gu, which recently received approval for association establishment, a townhouse with a land share of 29.37㎡ was traded for 700 million KRW. A representative from B Real Estate in the area explained, "Until last year, it was possible to trade with an actual investment amount around 500 million KRW if a jeonse (long-term deposit lease) was involved, but now only listings priced in the mid-500 million to 600 million KRW range remain."

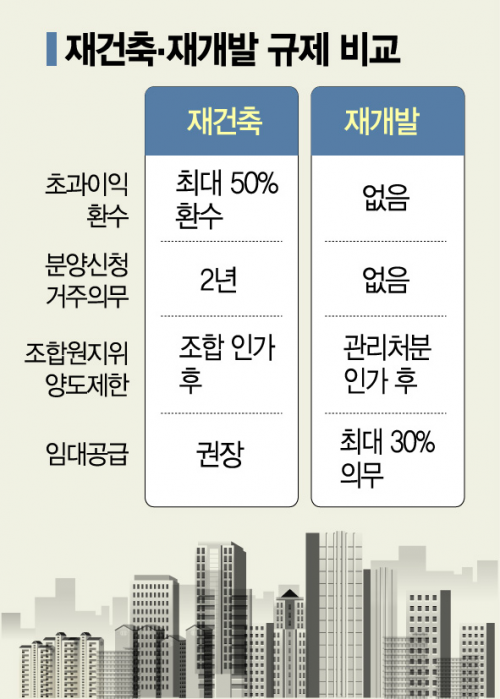

Early-stage redevelopment carries high risks. There is a possibility of prolonged project duration or even project failure. In areas with many subdivided shares, the project feasibility is low, and additional burden charges may be imposed. Nevertheless, the reason investors are flocking seems to be that small investments are possible and regulations are less strict compared to reconstruction.

In particular, recent government regulations on reconstruction, such as the excess profit recovery system and a two-year mandatory residence period, are also cited as causes for increased redevelopment investment demand. Most redevelopment properties are multi-family or townhouse-type houses, allowing avoidance of jeonse loan restrictions imposed by the June 17 measures. For general houses, not apartments, even if a property priced over 300 million KRW is purchased with an existing jeonse loan, the loan is not recalled.

However, experts advise caution against reckless blind investments. Jang Jae-hyun, head of Real Today, said, "Early redevelopment has relatively high uncertainty," adding, "Since project feasibility can vary dramatically depending on location and promotion speed, investors should be careful."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.