[Asia Economy Reporter Kangwook Cho] The number of users borrowing small amounts of cash at high interest rates based solely on credit has fallen below 2 million for the first time in about nine years.

According to the "2019 Second Half Loan Business Survey Results" announced by the Financial Services Commission and the Financial Supervisory Service on the 30th, the number of loan business users as of the end of last year was 1,777,000, down 230,000 from the end of June last year. The number of loan business users fell below 2 million for the first time in over nine years since the end of June 2010.

The financial authorities analyzed that the main reasons for the contraction of the loan business market were that the large Japanese loan company Sanwa Money stopped new operations from March last year, other major loan companies switched their operations to savings banks, and loan screening was strengthened.

Additionally, the number of low-credit users who mainly use loan businesses decreased, and the expansion of alternative markets such as private mid-interest loans and policy-based financial services for low-income earners also had an impact.

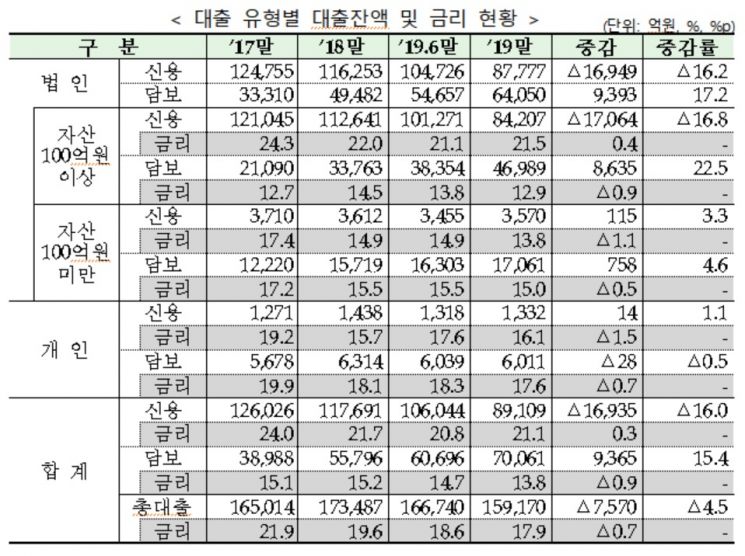

As the number of users decreased, the loan volume also declined. The outstanding loan balance of loan businesses was 15.9 trillion won as of the end of last year, down 800 billion won from six months earlier. The outstanding loan balance of small and medium-sized loan companies increased by 100 billion won to 2.8 trillion won, but the balance of large companies decreased by 900 billion won to 13.1 trillion won.

By type, unsecured loans decreased by 1.7 trillion won, while secured loans increased by 900 billion won. The proportion of secured loans in total loan business loans increased from 32.2% at the end of 2018 to 44% at the end of last year.

Also, in the case of loan businesses linked to peer-to-peer (P2P) loans, the outstanding loan balance increased by 400 billion won (24.1%) to 2.2 trillion won at the end of last year.

The average loan interest rate as of the end of last year was 17.9%. The interest rate on unsecured loans (21.1%) rose slightly, but the interest rate on secured loans (13.8%) fell by 0.9 percentage points compared to the end of June last year.

This is attributed to the reduction of the legal maximum interest rate from 27.9% to 24% in February 2018 and the continued low-interest rate trend. The average loan interest rate for loan businesses has been steadily declining from 21.9% at the end of 2017.

However, despite the decrease in loan interest rates, the delinquency rate as of the end of last year rose by 1 percentage point to 9.3% compared to six months earlier.

The total number of registered loan businesses was 8,354, an increase of 60 during the same period. The number of loan brokerage businesses and P2P loan-linked loan businesses increased by 65 and 17 respectively, while the number of money lending businesses mainly responsible for funding supply and recovery and loan claim purchase and collection businesses decreased by 22 and 70 respectively.

The financial authorities stated, "We will carefully analyze the impact of institutional changes such as the reduction of the maximum interest rate on the loan business operating environment and credit supply to low-credit borrowers, and improve the supply conditions of policy-based financial services to ensure that low-credit borrowers do not face difficulties in using funds."

They added, "To protect loan users, we will continuously monitor unhealthy business practices by loan businesses such as violations of the maximum interest rate and illegal debt collection, and promptly complete legal measures to restrict illegal profits of illegal private lenders and strengthen penalties."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![A Woman with 50 Million Won Debt Clutches a Stolen Dior Bag and Jumps... A Monster Is Born [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)