March Price Index Hits Lowest in 10 Years

'Big 2' Companies Also See Sharp Decline in Q1 Net Profit

Loss of Regular Customers and Production Cuts

Supply Chain Collapse Across All Areas Including Production, Processing, and Distribution

Prices Likely to Fall Further if Producers Are Pushed Out

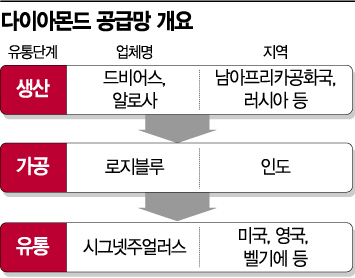

[Asia Economy Reporter Kwon Jaehee] The "Emperor of Gems," diamonds, continues to struggle with humiliation. Amid global economic downturn, the US-China trade dispute, and the outbreak of COVID-19, diamond prices have remained weak, and the supply chain is on the verge of collapse.

The crisis signals in the $80 billion (approximately 96 trillion KRW) global diamond industry can be found in the performance of related companies. According to foreign media on the 30th, Alrosa, one of the world's two major diamond producers based in Russia, saw its net profit plunge by 90% in the first quarter of this year. It also announced plans to reduce production at the Lomonosov mine in Russia. Recently, Alrosa reportedly cut ties with five long-term customers, including one of its major clients, Diacore.

De Beers, famous for the advertising slogan "A Diamond is Forever," announced a 5% price cut on rough diamonds from South Africa and plans to reduce diamond production by up to 26% this year. It is considered unusual for De Beers, which has controlled global diamond production to regulate prices, to initiate a price reduction. Richard Hatch, an analyst at investment bank Berenberg, said, "This is an unprecedented situation in the industry."

According to Index Online, an international diamond price index provider, the diamond price index in March was 116, marking the lowest level in 10 years. Although it slightly rose to 118 in June this year, the general consensus is that it has barely rebounded compared to the downward trend.

The diamond industry's crisis deepened due to a combination of decreased demand and the pandemic. Diamonds have been highly preferred among the wealthy for gifting or inheritance purposes. However, as the global economy entered a recession, their appeal significantly diminished. Compared to safe assets like gold or the US dollar, diamonds have higher price volatility and complicated transactions, resulting in lower liquidity. Particularly, the US-China trade dispute, the first and second largest diamond-consuming countries, affected the sharp decline in diamond demand. The political situation in Hong Kong, which accounts for 40% of global diamond trade, also contracted the diamond industry. Additionally, China's anti-corruption campaign, the global trend of avoiding marriage, and the rapid growth of the synthetic diamond market are cited as major factors contributing to the diamond market contraction.

COVID-19 dealt a decisive blow not only to demand but also to the supply chain. As the world entered shutdowns, the logistics system from mines to processing companies and retailers came to a complete halt. Above all, disruptions in India, which accounts for 90% of the global diamond cutting and processing market, exacerbated the crisis. India acts as an intermediary, importing large quantities of diamonds from De Beers, Alrosa, and others, processing them, and supplying them to Hong Kong, China, and the US. The diamond-related industry in Gujarat, India, where many processing companies are concentrated, reportedly suffered losses of about 80 billion rupees (approximately 1.33 trillion KRW) due to the COVID-19 situation. Gujarat accounts for about 8% of India's domestic GDP. It is assessed that the COVID-19 impact on the diamond industry affects not only the region but also the national economy.

The suspension of processing companies' operations led to the closure of jewelry retailers. Signet Jewelers, the world's largest diamond distributor, announced it would close more than 10% of its stores in the US and UK. According to Bloomberg, Signet Jewelers' stock price has dropped 51% since the beginning of the year.

Amid pessimistic forecasts, the world's largest luxury group, Louis Vuitton Mo?t Hennessy (LVMH), is reportedly reconsidering its acquisition of the US jewelry company Tiffany. LVMH announced in November last year that it would acquire Tiffany for $16.2 billion (approximately 19 trillion KRW), the largest in the group's history. However, due to the direct hit to diamond demand from COVID-19, rumors of renegotiation are gaining traction.

The industry generally expects the downward trend in diamond prices to continue for the time being. Bruce Cleaver, CEO of De Beers, stated, "We will invest $180 million (approximately 216.8 billion KRW) in marketing this year, the largest amount in 10 years," but it remains uncertain whether this can defend against the rapidly falling diamond prices.

Paul Zimnisky, a diamond industry expert, said, "Diamond rough prices have dropped about 20% just this year," and predicted, "If large companies like De Beers and Alrosa start pushing out inventory, prices could fall further."

Meanwhile, competition is intensifying as small-scale companies in major diamond hubs like Antwerp, Belgium, are distributing diamonds at a 25% discount. According to Bloomberg, diamond inventory recently reached $3.5 billion (approximately 4.2 trillion KRW) and is expected to reach $4.5 billion (approximately 5.4 trillion KRW) by the end of the year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.