[Asia Economy Reporter Park Hyungsoo] Netmarble has failed to deliver solid results despite many game companies showing performance improvement trends amid COVID-19. In the first quarter, Netmarble posted operating profits below market expectations, increasing calls to improve its chronic high-cost structure.

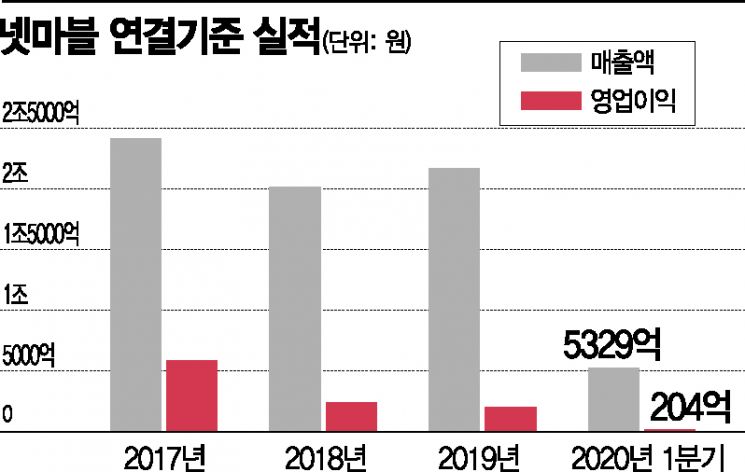

Netmarble recorded sales of 532.9 billion KRW and operating profit of 20.4 billion KRW in the first quarter. Sales increased by 11.6% compared to the same period last year, but operating profit decreased by 39.8%. Although the new releases were expected to push first-quarter operating profit beyond 49 billion KRW, higher-than-expected marketing expenses prevented meeting expectations.

In the first quarter of this year, Netmarble launched new games "Ilgopgaeui Daejae" (The Seven Deadly Sins) and "Steel Alive (A3: STILL ALIVE)." There was high anticipation for performance normalization due to the new releases. Although the new games were released in March and thus accounted for a small portion of first-quarter sales, marketing expenses increased compared to the previous quarter due to pre-release promotions.

Lee Jinman, a researcher at SK Securities, said, "Marketing expenses increased significantly compared to the previous quarter due to A3's pre-marketing and Kabam, Netmarble's North American subsidiary, preparing to launch the new game 'Shop Titans' in China. We expect performance improvement in the second quarter as new game results will reflect three months and marketing expenses will decrease compared to the first quarter."

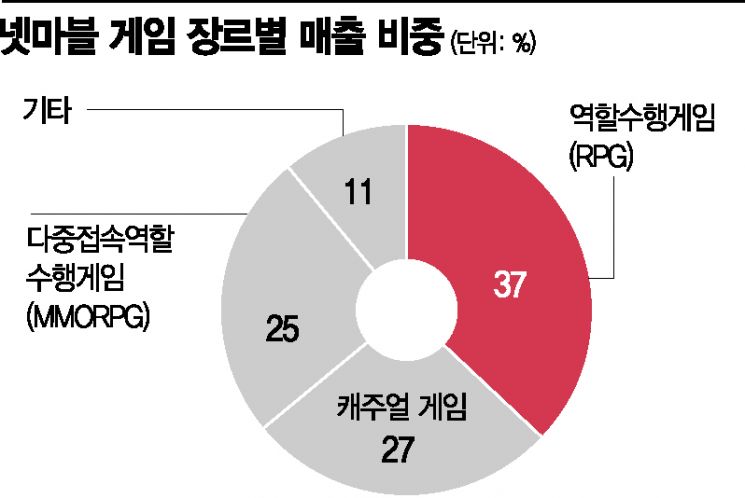

One difference from other leading domestic game companies is that a high proportion of major new releases are based on external intellectual property (IP). As a global game publisher, Netmarble continues to invest to secure a diverse and stable game portfolio and IPs. The IPs applied to games, such as characters, are balanced between owned IP and third-party IP. Compared to competitors relying on limited IPs, this provides higher sales stability but entails considerable expenses for diverse game marketing and distribution. Even if new releases become popular, royalty fees for IP usage may occur. This inevitably differs from NCSoft, which has expanded its proprietary IP "Lineage" to mobile games and enjoys high profitability.

While Netmarble delivers disappointing results in its core gaming business, it is achieving favorable outcomes in its investment sector. Netmarble holds a 25% stake in Big Hit Entertainment, the agency of BTS, and an 8.9% stake in NCSoft. The value of these investment assets alone reaches 3 trillion KRW. Since Big Hit is preparing for a domestic stock market listing, the value of its holdings may further increase.

Including the stake in Coway, whose management rights Netmarble secured, the value of holdings accounts for half of Netmarble's market capitalization. Netmarble acquired Coway in February this year. Coway is the leading company in the physical subscription economy, providing rental services for water purifiers, air purifiers, mattresses, and more. While conducting its gaming business, Netmarble has acquired user big data analysis and operational know-how using artificial intelligence (AI). It plans to apply IT technology and service expertise to Coway's products, developing them into smart home devices to create synergy effects.

Netmarble is a leading domestic game company that consistently generates profits, although it has not met investor expectations. It holds cash and cash equivalents amounting to 540 billion KRW. As of the end of the first quarter, its debt ratio stands at 26.3%.

Kim Donghee, a researcher at Meritz Securities, said, "We expect the game business division to regain growth by releasing new mobile games on various domestic and international platforms this year. We estimate sales of 2.4 trillion KRW and operating profit of 241.6 billion KRW for this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.