[Asia Economy Reporter Oh Hyung-gil] Won Jong-gyu, CEO of Korean Re, has recently been strengthening his management rights by continuously purchasing treasury shares. This decision has drawn attention as it was made at a time when financial authorities are separating the reinsurance business from the non-life insurance business and preparing to introduce a joint reinsurance system.

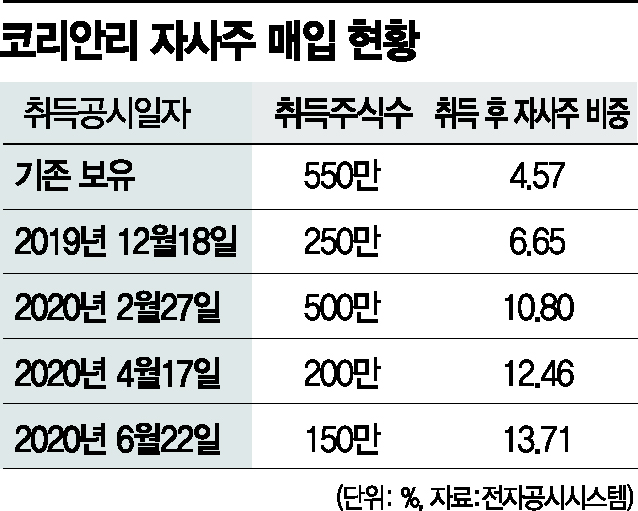

According to the insurance industry on the 25th, Korean Re decided to purchase 1.5 million treasury shares worth 11 billion KRW from the 23rd until September 22. After acquisition, the proportion of treasury shares held will increase to 13.71%.

Korean Re started purchasing 2.5 million shares in December last year, followed by acquiring 5 million shares in February and 2 million shares in April. The total acquisition amount reaches approximately 75 billion KRW. The proportion of treasury shares, which was only 4.6% in early December last year, has increased more than threefold.

The treasury share purchases were made when Korean Re’s stock price experienced a sharp decline due to the COVID-19 pandemic. The stock price, which was in the 9,000 KRW range at the end of last year, fell to the 5,200 KRW range, the 52-week low, in March. Since then, it has recovered and is currently trading in the 7,400 KRW range as of this date.

Currently, the largest shareholder of Korean Re is Jang In-soon (5.72%), the wife of the late Chairman Won Hyuk-hee, and CEO Won Jong-gyu holds a 4.35% stake. Including shares held by relatives and other special relations, the total reaches 23.01% of all issued shares.

Korean Re, the only specialized reinsurance company in Korea, is recording strong performance unlike insurers suffering from sluggish business. Last year’s net profit was 188.7 billion KRW, an 83.3% increase compared to the previous year.

Reinsurance business is expected to continue smoothly this year as well. With the joint reinsurance system set to be implemented next month, a new market is expected to emerge immediately.

While existing reinsurance prepared for risks such as unexpected large-scale accidents and insurance payouts, joint reinsurance is a system where insurers and reinsurers jointly share risks by diversifying insurers’ interest rate risks. From the reinsurer’s perspective, the contract size will increase, enabling the securing of new premium income.

A Korean Re official explained, "Internally, we believe that our treasury shares are undervalued in the market," adding, "Continuously purchasing treasury shares is a measure to strengthen management rights, stabilize the price of treasury shares, and enhance shareholder value."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.