Increase in Payment and Settlement Incidents Due to Regulatory Relaxation in Fintech

Policy Changes Expected to Focus on Strengthening Regulations After Financial Incidents

Strengthening Payment and Settlement Regulations Will Contribute to Normalization of the Banking Industry

[Asia Economy Reporter Kangwook Cho] Recently, the personal information leakage controversy triggered by Toss has escalated into a security issue affecting the entire fintech industry. Consequently, following P2P, a series of digital financial incidents such as fraudulent card payments by fintech companies have raised growing concerns about the side effects of fintech industry promotion policies. Some even predict that policies may shift towards stricter regulations.

According to the financial sector on the 20th, a recent incident occurred on the mobile financial platform 'Toss', which has 17 million subscribers, where users' personal information was stolen and unauthorized payments were made. Viva Republica (Toss), the operator of Toss, clarified that the incident was due to personal information theft rather than a leak from Toss's servers.

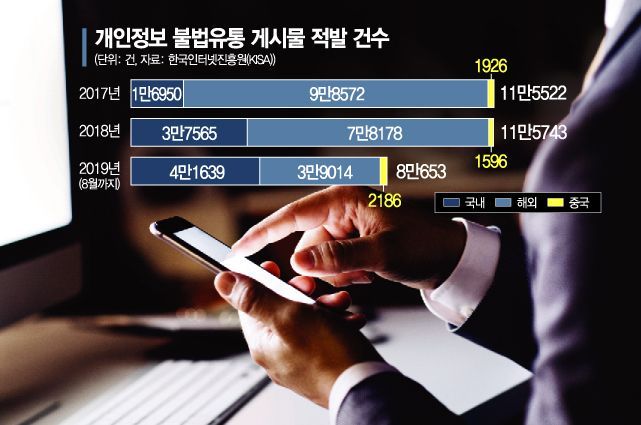

It was also revealed that customer information from card companies was hacked through POS terminals and other means, resulting in the illegal distribution of 900,000 customer records.

Such payment incidents are pointed out as consequences of increasingly sophisticated intelligent crimes, combined with real-time fund transfer environments adopted only by some countries like Australia, and government regulations focused more on efficiency and convenience rather than stability.

Kiwoom Securities explained that financial consumers, especially vulnerable groups, are already paying nearly 1 trillion won annually in costs related to voice phishing and remittance errors during financial transactions (444 billion won for voice phishing and 239.2 billion won for remittance errors in 2018).

Therefore, it is anticipated that payment-related incidents will increase further as IT companies like Naver and Kakao accelerate their entry into payment services in the form of electronic payment operators, influenced by the government's regulatory relaxation under such a loose regulatory framework.

In fact, the P2P industry, which the government had focused on fostering, is leading to investor losses due to a chain of insolvencies, and the introduction of open banking has been criticized for only lowering bank transfer fees without significant changes.

Researcher Youngsoo Seo of Kiwoom Securities stated, "It is time to reconsider whether we should focus more on minor consumer convenience rather than the enormous consumer damages incurred during financial transactions," adding, "Unlike the U.S., which not only prohibits real-time fund transfers but also compensates most damages when payment incidents occur and imposes heavy fines for undermining payment stability and causing consumer harm, Korea's approach is quite different."

However, recently, Korean financial authorities have shown signs of change. As the side effects of fintech industry promotion policies have gradually expanded, differential regulations against electronic financial operators (fintech companies) are being reduced, such as allowing MyData businesses to card companies. Additionally, electronic financial operators are now held responsible for damages caused by forgery, transaction non-fulfillment, hacking, etc., just like banks and securities firms. Furthermore, MyData operators are required to subscribe to liability insurance to cover various financial accidents. This implies that electronic financial operators must also comply with capital and soundness regulations commensurate with the risks faced by banks.

Researcher Seo said, "Although it is difficult to measure losses at this stage, the card information leakage incident is negative news for banks and card companies considering financial damages and trust degradation," but added, "However, since this issue stems from structural problems in the payment system, it can serve as an opportunity to strengthen regulations related to payment systems alongside financial consumer protection, so it should not be viewed solely negatively."

He explained, "Enhancing payment stability and strengthening consumer protection are core government responsibilities and can act as a turning point for the normalization of the banking industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)